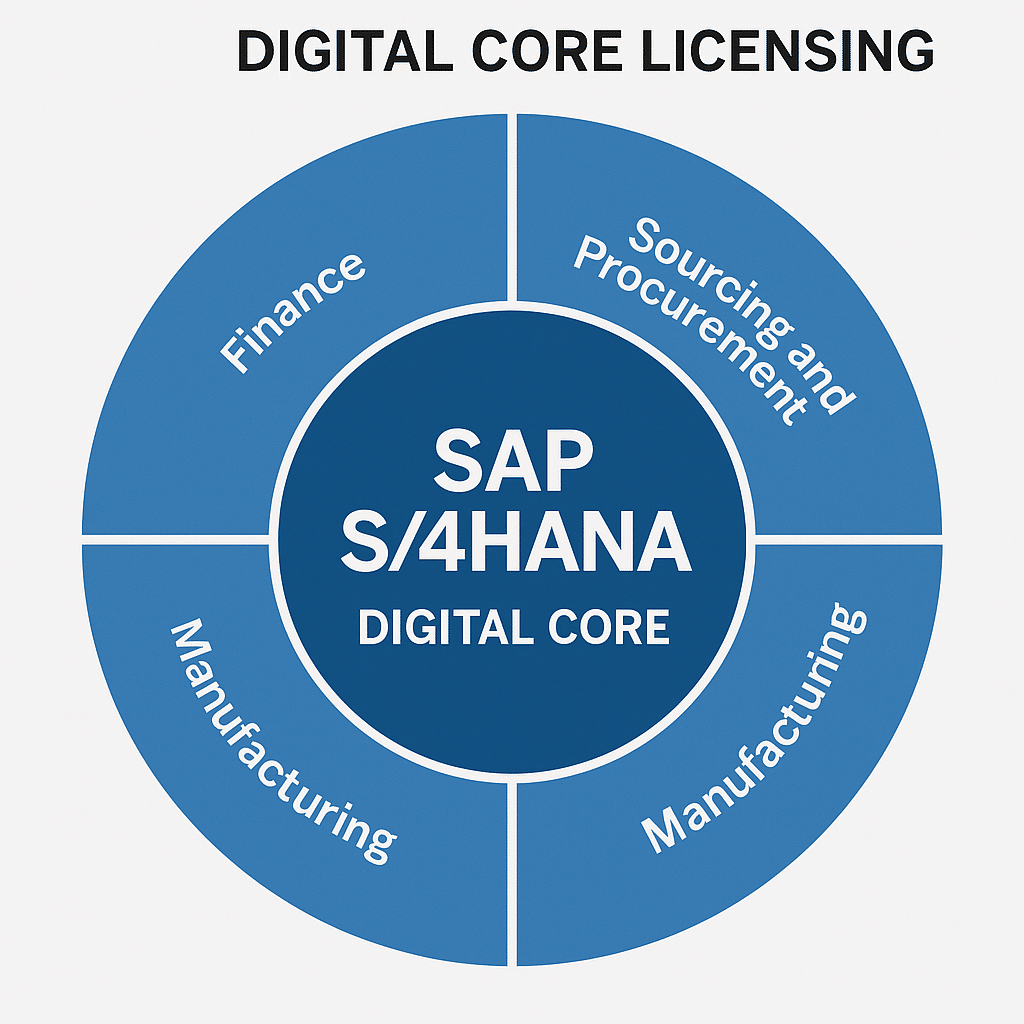

SAP S/4HANA Digital Core Licensing

SAP S/4HANA’s Digital Core, the base ERP suite covering finance, sales, procurement, manufacturing, and more, comes with a complex licensing model.

Enterprises must understand how user-based licenses work across on-premises and cloud (RISE) offerings, and plan carefully to optimize cost and avoid compliance pitfalls.

A proactive licensing strategy enables organizations to pay only for what they need, adapt as they grow, and avoid surprises in audits or renewals.

The S/4HANA Digital Core

SAP S/4HANA’s Digital Core encompasses the fundamental ERP modules (finance, supply chain, sales, etc.) in one integrated solution.

This Enterprise Management license is the cornerstone of any S/4HANA contract.

It grants access to a broad set of core business processes under a single umbrella.

Unlike legacy SAP ERP (ECC), where modules were often licensed separately, the S/4HANA Digital Core is purchased as a package sized mainly by the number of users.

In practice, you pay for users (or user capacity) to use all the included core functions, rather than paying for each module individually.

The result is a simpler core scope. Once you’ve licensed the digital core for your users, they can access any standard module their role requires without separate module fees. This core license is required as the foundation before adding any extra optional modules or industry solutions.

Why “Digital Core” matters:

It’s essentially your main SAP ERP system – the central engine running your finance, logistics, HR, and other primary processes.

SAP positions S/4HANA as the “digital core” of the intelligent enterprise, meaning it serves as the transactional backbone that other cloud services and extensions connect to.

Licensing this core correctly is crucial: it determines how many people (or systems) can use the ERP and at what level of functionality. Because the digital core encompasses a wide range of functionality, its license typically represents a substantial portion of your SAP investment.

Organizations should map which business processes and users will be in S/4HANA’s core to size this license properly and avoid overpaying for unused capacity.

Read Differences Between SAP ERP and SAP S/4HANA Licensing.

On-Premises vs. Cloud Licensing Models

SAP offers S/4HANA in two primary deployment models: traditional on-premises (where you run it in your data center or cloud of choice) and S/4HANA Cloud (subscription-based, often via RISE with SAP).

The licensing approach differs substantially between these models, affecting cost structure and flexibility.

Below is a comparison of key factors in on-prem vs. cloud licensing for the digital core:

| Aspect | On-Premises S/4HANA (Perpetual License) | S/4HANA Cloud (Subscription via RISE/SaaS) |

|---|---|---|

| License Term | Perpetual – buy once and own the software indefinitely (with optional support). You can use the licensed software version forever. | Subscription – right to use the software only for the contracted term. Must renew to continue using (no perpetual rights). |

| Payment Model | Large one-time license fee (CapEx) + annual maintenance (~22% of license cost) for support and updates. Example: pay $1M upfront, then $220k per year for support. | Ongoing periodic fees (OpEx) that bundle software, support, and infrastructure. Example: $X per year, with possible 3-5% annual price escalations. No big upfront cost, but continuous payments. |

| Unit of Measure | Named Users by type (each individual user license is purchased and assigned a category like Professional, etc.). Additional engines/modules may use business metrics. | Users or Full User Equivalents (FUE) – a pooled metric that weights users by type. You contract for a total FUE count covering all users. (E.g. 1 Professional = 1.0 FUE, 1 Limited user = 0.1 FUE.) |

| Infrastructure | Customer-managed. You provide the hardware or cloud hosting, and handle system installation, backups, DR, etc. Infrastructure costs are separate from license fees. | SAP-managed. Hosting and technical infrastructure are included in the subscription (SAP runs the system in their cloud or a hyperscaler). This shifts infrastructure burden and cost to SAP. |

| Upgrades & Control | You control upgrade timing. You decide when to apply new releases or fixes (support gives access to updates, but you schedule projects). More flexibility to postpone changes. | SAP controls the environment’s updates (especially in public cloud edition). Upgrades are applied on a regular schedule (e.g. quarterly), delivering new features automatically. Less ability to delay updates, so you must adapt continuously. |

In summary, on-premises licensing is a capital expense with a higher upfront cost but more control (and you retain the software rights even if you stop maintenance).

Cloud licensing is similar to leasing – it spreads costs over time and offloads infrastructure to SAP, but you’re locked into renewing to continue using the software.

Over a 5-10 year horizon, the total cost of ownership can be similar, but it’s structured differently.

Key insight: If you expect to use S/4HANA for many years, on-premises may become cheaper after the breakeven point (since you pay once and then only for maintenance).

However, if flexibility, faster time-to-value, or avoiding infrastructure management is a priority, the cloud model (RISE) might be attractive despite potentially higher long-term cost. Always run multi-year cost projections to compare scenarios.

Read SAP S/4HANA On-Premise vs Cloud Licensing.

User License Types and Metrics

Licensing the digital core is driven primarily by user licenses. SAP has defined standard user categories in S/4HANA, each with different levels of access (and cost).

It’s crucial to assign the right type to each user to control spending.

The main S/4HANA user license types include:

- Professional User: Full access to all standard modules and functionality in the digital core. These are for power users and business roles that perform a wide range of tasks (for example, an accountant who posts entries, runs reports, and configures finance settings would need Professional access). Professional licenses are the most expensive per user, but they provide unrestricted access to the core ERP.

- Functional User: Also called a Functional or Limited Professional user (depending on context). This is a mid-tier license for users who work in a specific area or perform tasks that are more limited than those of a Professional. For instance, a procurement manager using only procurement and inventory modules, or a plant supervisor focusing on manufacturing execution, might fall under this category. They have broad access in their domain but not across all modules. Priced lower than Professional, roughly half the cost in many cases.

- Productivity (Limited) User: A low-level license for occasional or self-service users. These users perform basic tasks such as time entry, expense filing, approvals, and report viewing. An employee who just logs hours or a shop-floor worker recording job status could be a Productivity user. This category has the lowest cost per user and limited system privileges.

Each user who directly logs into S/4HANA needs one of these named user licenses (in an on-prem model) or counts toward your subscription total (in the cloud). In on-prem environments, you purchase a number of each type of user license.

For example, you might license 50 Professional, 150 Functional, and 300 Productivity users to cover your workforce’s needs. Each category has a different price – Professional licenses might list at several thousand dollars each, whereas Productivity users might be only a few hundred dollars.

In one real-world scenario, Professional users were priced at around $4,000 each (one-time) and limited users at under $1,000 each; your negotiated discount will heavily influence the actual spend. An annual support (maintenance) fee of ~22% applies to those license prices, so optimizing the mix saves money year after year.

In cloud subscriptions (RISE or S/4HANA Cloud): you typically don’t buy individual user licenses outright.

Instead, SAP uses Full User Equivalents (FUEs) as a measure of consumption. Think of FUEs as a points system – each user type “costs” a certain number of points.

For instance, SAP might assign 1.0 FUE for a Professional user, 0.5 for a Functional user, and 0.1 for a Productivity user.

If you plan for 100 Professional, 200 Functional, and 200 Productivity users, that would translate to roughly 1001.0 + 2000.5 + 200*0.1 = 100 + 100 + 20 = 220 FUEs. You would then subscribe to S/4HANA Cloud for 220 FUEs (or a slightly higher amount as a buffer).

The beauty of FUEs is their flexibility: as long as you stay within your total FUE entitlement, you can adjust the number of users of each type without amending the contract.

SAP will bill the subscription based on the total FUEs, typically quoted as an annual or monthly rate per FUE or user.

For example, a Professional user might effectively cost around $2,000-$3,000 per year in the cloud (once converted to an annual price), whereas a light user might be only a few hundred dollars per year. These rates again depend on negotiations and volume.

License compliance tip:

Carefully manage user assignments. Every user in the system should be assigned the correct license type in SAP’s user management.

If someone is left unassigned or misassigned, SAP’s audit tools may default them to the highest category (Professional) by assumption, which can inflate your compliance risk.

Regularly review your user list to ensure nobody has a more expensive license than necessary, or worse, is using the system without a proper license. This governance will pay off during annual true-ups or audits.

Indirect Access and Digital Access Licensing

Not all activity in SAP is driven by a human user clicking in the interface. Often, other systems or automated processes interact with S/4HANA, for example, an e-commerce website creating a sales order in SAP, or a third-party reporting tool querying data.

This is known as indirect access (when SAP is used by external applications or devices rather than direct human login).

Historically, indirect usage was a grey area that led to some surprise audits. SAP sometimes argued that if a non-SAP system generated SAP transactions, the company required additional licenses (leading to high-profile disputes in the past).

To bring clarity, SAP introduced the Digital Access model for S/4HANA.

Instead of requiring a named user license for each non-human access, Digital Access licenses the outcomes of those external interactions, specifically the creation of certain business documents in SAP (such as Sales Order, Invoice, and Purchase Order) by any external system.

In practical terms, you estimate how many such documents your external applications will generate in a year and purchase a document license bundle accordingly.

For example, if your e-commerce site is expected to generate 50,000 sales orders in S/4HANA per year, you might purchase a package that covers at least 50,000 documents annually.

SAP sells these in blocks (often 1,000 documents as a unit, priced with volume discounts as you buy more).

Cost impact: The pricing for Digital Access can range widely.

At low volumes, the effective cost per document may be a few dollars; at very high volumes, it can drop to a few cents per document.

SAP has run promotional programs (like a one-time Digital Access Adoption Program) offering steep discounts to encourage customers to adopt this model.

It’s essential to assess your indirect usage early: count the documents or transactions that external systems create in SAP to determine whether the Digital Access model or the traditional model (licensing those external users via named user licenses) is more economical for you.

New S/4HANA contracts typically highlight Digital Access, and SAP prefers customers to use it. However, suppose you have very minimal third-party integrations.

In that case, you might opt to license a handful of named users for those interfaces instead, or negotiate a clause that covers certain interfaces at no extra charge.

Don’t leave indirect usage ambiguous.

From a contract negotiation standpoint, make sure your S/4HANA agreement explicitly addresses how indirect access is covered.

Either purchase the necessary Digital Access document licenses or ensure that your current integration scenarios are permitted under your existing user licenses.

The worst outcome is to ignore this and face an audit later with a hefty bill for unlicensed indirect usage.

Many enterprises negotiate a cap on indirect usage fees or pre-negotiate unit prices for documents to avoid open-ended exposure. Clarity here will protect you from future compliance surprises.

Beyond the Core: Add-Ons and Industry Solutions

The S/4HANA Digital Core encompasses a broad range of standard ERP functions, but SAP also provides add-on modules and engines to address specialized needs.

These could be Line-of-Business extensions (like advanced procurement, supply chain, or HR capabilities) or industry-specific solutions (for retail, utilities, aerospace, etc.).

Such products are licensed separately, in addition to the digital core.

Notable examples include:

- SAP Extended Warehouse Management (EWM) – advanced warehousing functionality beyond the basic inventory features in the core. This might be licensed by the number of warehouse sites, by warehouse workers, or by inventory volume.

- SAP Transportation Management (TM) – for complex logistics and freight management, sometimes licensed by the number of shipments or freight orders processed.

- Industry Packages – e.g., a Retail industry package might be licensed by the number of stores or POS terminals; a Utilities package might use the number of customers or meter points as a metric.

- Advanced Financials or Analytics – for instance, Central Finance (to centralize financial reporting across systems) might charge based on the total revenue managed or the number of entities consolidated.

Each add-on has its metric tied to what SAP deems the “business value driver” of that solution.

This is different from the core (which is user-based). The good news is that many essential functions are now included in the S/4HANA core license out-of-the-box, whereas in ECC, some of those required extra licensing.

For example, basic warehouse management and basic transportation management are included in the core, as well as features such as the Fiori user interface and embedded analytics.

You license EWM or TM separately only if you need the advanced capabilities or higher throughput that the core does not provide.

This means that when moving to S/4, review what licenses you needed in the past; you might find that some are no longer separate (saving costs), but also identify new functions you want that do cost extra.

Licensing add-ons vs. the core:

A user who has a core license can generally use any add-on modules you’ve purchased (assuming their role needs it) without needing a separate user license for that module. You’ve already paid for that user’s access to the system.

The add-on license covers the additional software usage (often measured by transactions or other metrics, not per user).

If, however, you have users who only use a standalone engine and not the core ERP at all, you might be able to license just that engine for them.

For example, suppose an external warehouse workforce only logs into an SAP EWM system (and doesn’t use any other core function).

In that case, you might license EWM for a specific number of users or by workload, and not have to purchase full S/4HANA user licenses for those individuals.

These scenarios are nuanced and need to be documented in the contract. It’s often a point of negotiation – you may negotiate that an engine license covers certain limited users without requiring a core license.

Always double-check these terms, because misassumptions can lead to compliance gaps (e.g., using an add-on heavily but not realizing that some of those users also needed core licenses).

In summary, license the digital core for broad functionality first, then add engines as needed for specific processes. Start with what you truly require at go-live; you can usually expand later.

SAP often will propose a large bundle of products in the initial sale – resist the temptation to buy modules you’re not sure you’ll use immediately.

It’s often wiser (and more cost-effective) to license add-ons in phases once there’s a clear business need and user base for them.

Pricing and Contract Considerations

SAP S/4HANA licensing costs can be significant, but they are also negotiable. Knowing the components of cost and typical negotiation levers can save millions.

Elements that drive your S/4HANA licensing cost include the number of users (and their types), the edition (on-prem vs cloud), any add-on products, and indirect usage.

Here’s what to keep in mind:

- License fees vs. maintenance vs. subscription: In an on-premises deal, you pay a one-time license fee upfront for the software, followed by an annual maintenance fee (typically 20-22% of the license value) for support and updates. For example, if your initial license purchase is $1 million, the annual support will be approximately $ 200,000. Over five years, you’ll pay $1M + $1M (maintenance over 5 years) = $2 $2 $2 $2M total. In a cloud subscription, there is no separate maintenance line item; support and upgrades are bundled into the yearly subscription price. So, a cloud deal might be, say, $400,000 per year for five years, totaling approximately $2 million over the five years. Both models ultimately end up in the same ballpark in this hypothetical scenario, but their cash flow and accounting approaches differ. Important: Maintenance fees compound; SAP often adds small annual increases (e.g., 3% per year) to support costs. Over a decade, maintenance can exceed the original license price, so factor that into the long-term cost of ownership.

- Discounts and price negotiations: SAP’s list prices are typically high, but almost nobody pays the list price. Large enterprises regularly negotiate 50% or more off the original price. The discount you secure will directly affect your TCO (since maintenance is a percentage of the discounted price). Always negotiate aggressively on the initial license price or subscription rate – it not only saves upfront dollars but also sets a lower base for future maintenance or renewal increases. Use benchmarks from similar companies if available, and don’t be afraid to solicit quotes from SAP competitors during your negotiation – SAP sales reps have significant flexibility when they sense competition or hesitation. Additionally, if you are expanding user counts or adding products, consider negotiating volume breaks (e.g., a lower per-user price at specific thresholds).

- Contract structure (ECC conversion and RISE trade-in): If you’re an existing SAP ERP (ECC) customer migrating to S/4HANA, you’ll likely either undergo a contract conversion or sign a net-new contract (especially for RISE cloud). SAP offers conversion programs that provide credits for your existing licenses. For example, you may receive credit for the remaining value of your ECC licenses, which can be applied towards the S/4HANA purchase. Make sure to capture those credits – you paid for those ECC licenses and should not pay twice for equivalent functionality. However, be aware: moving to a RISE subscription usually means giving up your perpetual licenses in exchange for subscription credits. That’s not inherently bad if S/4HANA Cloud is your target, but it means if you ever leave RISE, you’d have to purchase licenses again to run on-prem. Weigh the trade-offs of trading a perpetual asset for a subscription. Ensure that any conversion offer from SAP is documented, clearly stating the credit you receive and the items you surrender.

- Future growth and flexibility: Consider your 3-5 year growth projections when signing the contract. If you know you will add users or expand to new modules in a year or two, negotiate those terms now. For instance, you can seek a price protection clause: e.g., “We can buy up to 20% more users at the same per-unit price as the initial purchase.” In a cloud contract, try to cap the rate of subscription increase at renewal (SAP might propose something like a 5-7% uplift after the initial term; you could negotiate a lower cap or tie it to an index). Additionally, if your business is cyclical or uncertain, consider discussing the ability to adjust user counts. Cloud contracts typically don’t allow reductions mid-term, but you may be able to negotiate some flexibility or favorable terms at renewal. The goal is to avoid being stuck overpaying for unused capacity or facing a budget shock if you need more later.

- Real-world cost example: Consider a manufacturing firm with 500 users. An on-premises S/4HANA deal might break down as $1.0 million for licenses upfront, plus $ 220,000 per year in maintenance. Over five years, that’s approximately $2.1 million (excluding hardware and infrastructure costs). The equivalent cloud subscription might be approximately $ 400,000 per year (including infrastructure and support), totaling $2.0 million over five years. The costs are in the same range, but the cloud spend is evenly spread and includes hosting, whereas the on-prem deal had a big upfront spike and separate IT infrastructure costs. This example underscores why it’s critical to evaluate total costs over several years – don’t just compare year 1 costs, look at the long run. Depending on your negotiated discounts and the internal cost of capital, one model may clearly be more cost-effective.

- Infrastructure and hidden costs: If you opt for on-premises deployment, remember to budget for the HANA database and hardware. S/4HANA only runs on SAP’s HANA database. SAP includes a restricted-use HANA license for S/4HANA (at no additional cost) if you only use it for the ERP’s data. However, if you plan to use the HANA database for other applications or analytics beyond S/4 (full use), a separate license is required, which can be expensive. In the cloud (RISE), the HANA database is part of the service – you don’t license it separately.Additionally, on-premises, you’ll incur costs for servers (or cloud IaaS), storage, backups, disaster recovery, and the staff to manage these services. In a subscription, those costs are bundled in. So, when comparing prices, allocate a value to those infrastructure and admin costs. The decision isn’t purely about license fees – it’s also about your IT operating model preferences.

- Shelfware and timing: One common mistake is over-licensing upfront “just in case.” It’s better to start with what you realistically need in the first year or two. You can always buy more licenses later, preferably with a pre-negotiated discount. Many S/4HANA adopters roll out in phases (by region, module, or division). If only 300 of your 500 users will use the system in Year 1, consider licensing 300 initially and include contractual options to add the remaining users at the same discount. SAP sales may push for an enterprise-wide deal on Day 1, but you have the leverage to phase it in. Just be mindful of any conversion credit expirations (SAP sometimes says your old license credit is only 100% if you convert now, and less if later – balance that in your plan). Overall, align licensing with deployment to avoid paying for idle licenses sitting on the shelf.

By handling these considerations, you’ll be in a stronger position to control costs. SAP licensing is notoriously complicated, but with careful planning and negotiation, you can turn it into a manageable, predictable part of your IT budget rather than a nasty surprise.

Recommendations

- Right-Size Before Purchase: Inventory your users and usage before committing to S/4HANA licenses. If you’re an existing SAP customer, run tools (like SAP’s LAW audit report) to see current active users and eliminate dormant accounts. This analysis prevents overestimation of required licenses. New to SAP? Still take a hard look at business roles – don’t simply accept SAP’s or an integrator’s user count estimates without validation.

- Start with Core Needs, Expand Later: License only what you need for go-live. It’s tempting to buy the full “digital transformation” bundle upfront, but that often leads to shelfware. Begin with the minimal number of core user licenses and necessary add-ons. Negotiate the right to add more users or modules later at the same discount. This way, you avoid overpaying for capacity you won’t use initially.

- Leverage Existing Investments: If migrating from ECC, negotiate credit for your current licenses. Don’t let legacy value go to waste. Be cautious with RISE trade-in deals – understand that moving to subscription means relinquishing perpetual licenses. Ensure the financial trade-off makes sense and that you’re not paying twice for similar functionality. If you’re keeping on-premises, consider a straightforward conversion of licenses. If you’re moving to the cloud, obtain a clear valuation of your traded licenses.

- Clarify Indirect Usage Upfront: Nail down how Indirect/Digital Access will be handled in your contract. If you expect significant third-party system integration, consider purchasing Digital Access document licenses now (perhaps at a discounted rate). Alternatively, negotiate contract terms that cover specific interfaces or set a fee cap if indirect usage is found. Never leave this area open-ended – it’s a common source of surprise fees. Put in writing exactly what is allowed and any charges for overages, so you have no ambiguities later.

- Negotiate Future Flexibility: Anticipate growth and lock in terms. If you know you’ll need more users in the future, negotiate price locks or tiered pricing for those additions now. Include renewal rate caps – for instance, limit annual cloud price increases to inflation or a small percentage of the current price. In on-prem deals, try to secure conditions for license expansion (or even returns if downsizing, though SAP typically doesn’t allow reducing counts). The more predictability you can build into the contract, the better you can budget and avoid nasty shocks at renewal.

- Optimize License Mix Continuously: Once live, regularly review user license assignments to ensure optimal allocation. People’s roles can change – someone who needs a Professional license might switch to a lighter role, and you could downgrade them to a less expensive license type (in on-premises, that means reallocating the expensive license to someone else or reducing it at the next true-up). Keep an eye on usage: are there users with Professional licenses who only log in once a month for basic tasks? If so, reclassify them to Productivity if possible. Over time, this governance keeps your recurring costs in check.

- Plan for Audits and Stay Compliant: Conduct a self-audit annually (or quarterly). Treat SAP license compliance as an active process. Use SAP’s measurement tools or third-party software asset management solutions to check your license deployment versus entitlements. This helps catch any shortfalls (so you can purchase what you need proactively) or overages (so you can potentially re-harvest licenses) before SAP’s official audit. Maintaining clear documentation and an internal audit trail can also give you leverage to negotiate less frequent formal audits or more favorable terms, since you can demonstrate control. And if SAP does audit, engage early and thoroughly review their findings, and resolve any discrepancies collaboratively.

- Consider Database and Support Options: For on-premise deployments, decide upfront if SAP’s HANA runtime license is sufficient or if you need a full-use HANA license. The runtime (included) saves money, but restricts you to using HANA only with SAP applications. If you plan to use heavy custom analytics or third-party apps on the HANA database, budget for the full-use license; otherwise, consider an alternate analytics platform to avoid this cost. Also, remember that you’re not forced to stick with SAP for support forever. If your S/4HANA system stabilizes and you’re not keen on continuous updates, third-party support firms (like Rimini Street) can support SAP at ~50% of the maintenance fee. This is a controversial route (SAP won’t provide upgrades in that case), but it’s an option to consider in cost-saving strategies for mature systems.

FAQ

Q1: What exactly is the “Digital Core” in SAP S/4HANA licensing?

A: The Digital Core refers to SAP S/4HANA’s base ERP package (officially called S/4HANA Enterprise Management). It includes the essential modules for running your business – finance, accounting, sales, procurement, manufacturing, supply chain, and more – all under one integrated license. When you license S/4HANA, the digital core is the primary component you’re buying access to. It means your users can transact in all these fundamental areas. Think of it as the foundational software layer that covers standard enterprise processes. You don’t usually license each core module separately (as was sometimes done in the past); instead, you license users to access the entire core system. Add-ons and industry solutions come on top of this, but every S/4HANA customer needs the digital core license as the starting point.

Q2: How is S/4HANA’s licensing model different from the old SAP ECC model?

A: There are a few notable differences. First, S/4HANA has revamped user categories with clear definitions (Professional, Functional, Productivity), replacing the more custom user types in ECC. This means during migration, your old users will be mapped to these new types, and you need to ensure you have the right mix. Second, S/4 introduced digital access (document-based) licensing for indirect use. In contrast, ECC typically just required named users for any access (and many customers were unaware of indirect usage issues until audits). Now, SAP provides a formal way to license third-party interface usage by counting documents, which is a new dimension in S/4HANA. Third, the technical underpinnings have changed: S/4HANA requires the HANA database, so for on-premises use, you either use the included HANA runtime or purchase a full HANA license (ECC can run on various databases). Also, many functionalities that were optional in ECC are built into S/4’s core, and conversel,y S/4 has new optional extensions (some of which didn’t exist in ECC). Lastly, if you move to S/4HANA Cloud or RISE, you’re switching from ECC’s perpetual license model to a subscription SaaS model – a fundamental change in how you pay (own vs. rent). In summary, expect a license reset: you will likely sign a new agreement for S/4, with new metrics and terms, rather than a simple 1:1 carryover of your ECC licenses.

Q3: What’s the difference between licensing S/4HANA on-premises and via RISE with SAP (cloud)?

A: On-premises S/4HANA licensing means you purchase perpetual software licenses and run the system yourself (or in a hosted environment you control). You pay a large upfront fee for licenses, followed by yearly support fees. You also handle infrastructure, hardware, and upgrades on your schedule. In contrast, RISE with SAP (SAP’s subscription offering for S/4HANA Cloud) is more akin to leasing – you pay an annual subscription that includes the software license, SAP handling of the cloud infrastructure, and standard support. You don’t own the software outright; if you stop subscribing, your access ends. The cloud model uses FUE (Full User Equivalent) counts instead of fixed named-user counts. SAP manages the technical operations and updates the system periodically (so you get new features continuously, but with less control over timing). Financially, on-premises is CapEx-heavy and can be cost-effective over a long period if utilized fully, whereas RISE is OpEx-oriented, with a lower upfront cost but potentially higher cumulative cost if used indefinitely. Many companies choose RISE for its agility and reduced IT burden. In contrast, others opt for on-premises solutions for control and the comfort of a one-time investment – it depends on your strategy. Importantly, RISE bundles can include more than just S/4 (e.g., platform services), so ensure you understand everything included and how that compares to licensing components à la carte on-prem.

Q4: How does SAP’s “Digital Access” (indirect use) license work, and do we need it?

A: Digital Access is SAP’s approach to licensing indirect usage of S/4HANA. If non-SAP applications (or devices, bots, etc.) are creating business transactions in S/4HANA (like an order or an invoice), SAP wants those accounted for. With Digital Access, you purchase a license for a specified number of documents (across 9 document types defined by SAP, including Sales Order, Invoice, Purchase Order, etc.) that external systems generate annually. For example, if your e-commerce site creates 10,000 sales orders in SAP per year, you’d get a package to cover at least that many. If you exceed your licensed documents, you’d need to true-up with additional blocks. Whether you “need” it depends on your integration landscape. If you have significant third-party systems that feed into SAP, it’s wise to evaluate Digital Access. SAP will likely raise it during S/4HANA negotiations. Some customers with very limited external interfaces opt not to purchase it and instead ensure that any external users are covered by a named user license (an older approach). But many are moving to the document model for clarity and to avoid per-user licensing workarounds for integrations. One tip: if you opt for Digital Access, closely estimate volumes and negotiate a favorable discount tier (SAP has been known to offer incentives on these, especially if you’re an early adopter or if you agree during an S/4 deal). And include it in your compliance monitoring – track how many documents your interfaces are creating so you stay within your allotment, or know when to request an extension.

Q5: What are some effective ways to optimize and reduce S/4HANA licensing costs for an enterprise?

A: Start with thorough planning and assessment. Know your user counts and what type of access each role truly needs – this prevents over-licensing with too many high-level users. During negotiations, push for high discounts on licenses or subscriptions and consider competitive bids (even if you won’t switch vendors, it gives leverage). Ensure you receive credit for any existing SAP investments when migrating. Optimize your license mix by aligning users to the lowest appropriate license tier and revisiting that mix regularly after go-live. Avoid buying software you’re not sure about; it’s better to phase in additional modules over time than to purchase a large bundle and have half of it sitting idle. If on-prem, evaluate if you need to pay maintenance on all licenses – some companies drop maintenance on unused licenses or use third-party support for stable environments to save cost (bearing in mind you lose upgrade rights on those). Also, negotiate contract clauses that give you flexibility – for example, the ability to swap license types (convert some Professional to lower-tier users if needs change) or to adjust volumes at renewal without hefty penalties. Finally, keep up with SAP’s licensing programs – sometimes they introduce new offerings or amnesty programs (for instance, a new bundle or a limited-time discount on digital access) that you can take advantage of. In short, treat SAP licensing as an ongoing optimization exercise, not a one-and-done purchase, and you’ll find savings and efficiencies over the life of your S/4HANA system.

Read more about SAP Licensing Services.