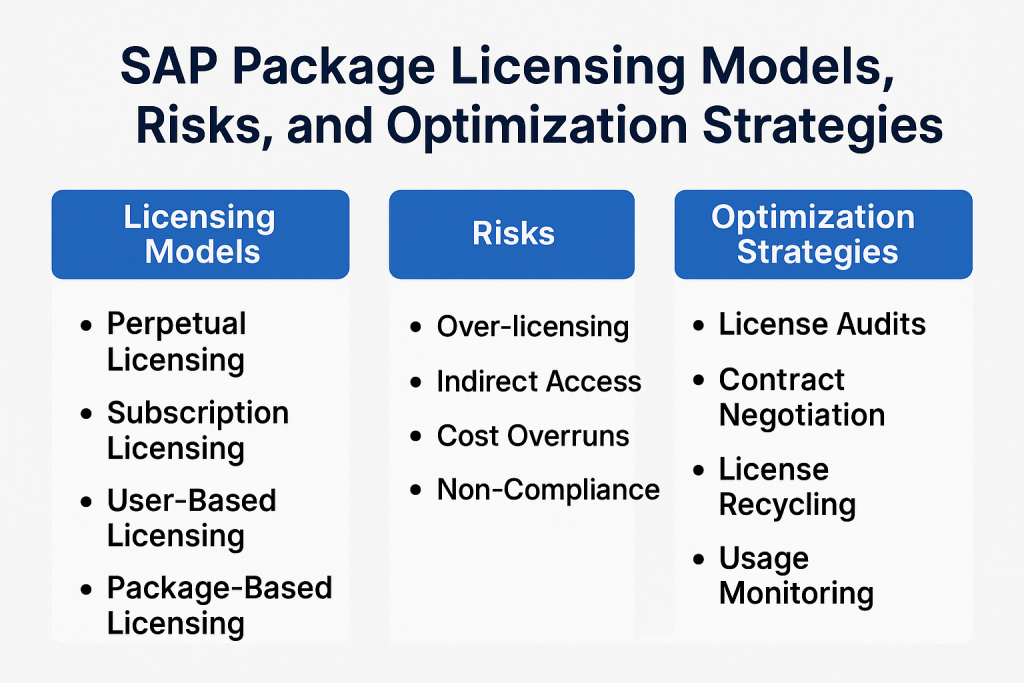

SAP Package Licensing Models, Risks, and Optimization Strategies

SAP package licensing is a model in which SAP software modules (engines) are licensed based on business metrics rather than per-user fees.

This usage-based approach can lead to complex cost structures and compliance challenges.

IT leaders must understand how these package licenses work, track their usage closely and negotiate terms carefully to control costs and avoid unplanned fees.

SAP Package Licensing

SAP’s enterprise software licensing comes in two forms: named user licenses (per individual user access) and package (engine) licenses (for specific modules or functionality measured by a usage metric).

Every SAP environment requires a base ERP license plus sufficient named users to access the system. Additionally, optional modules (e.g., advanced logistics, industry solutions, analytics engines) require separate package licenses, which are tied to the amount of usage of that component.

In essence, user licenses cover who is using SAP, while package licenses cover how much you are using certain SAP features.

- Named User License: Assigned to each person logging into SAP, usually categorized by role (e.g., Employee Self-Service, Professional, Developer). This is a fixed count of users and typically forms the foundation of SAP contracts.

- Package (Engine) License: Covers a specific SAP module or add-on and is measured by a business metric (not a user count). You agree to an allowed quantity of that metric (e.g., transactions per year, number of employees, database size) and must purchase more licenses if you exceed it. There are hundreds of such engines across SAP’s portfolio, each with its metric definition.

IT leaders should ensure they inventory all SAP components in use and identify the licensing model for each, specifically which parts are covered by named users versus those that require separate package licenses. Both types must be managed in tandem to ensure compliance and cost-effectiveness.

Read SAP Industry-Specific License Types.

SAP License Metrics and Module Examples

Many SAP packages are aligned to key business drivers, meaning the license metric often reflects the scale of business operations. For example, instead of paying per user for a payroll system, you pay based on the number of employees processed.

Below are a few examples of SAP engines and their licensing metrics:

| SAP Module / Engine | Usage Metric | Licensing Basis (Example) |

|---|---|---|

| SAP HCM (Payroll) | Number of Employees | Licensed per employee record (e.g. 5,000 employees require 5,000 units licensed). |

| SAP Transportation Mgmt (TM) | Freight Orders per Year | Licensed by annual document volume (e.g. up to 100,000 freight orders/year per license package). |

| SAP HANA Database (Runtime) | Memory Size (GB) | Licensed in blocks of memory or % of system value (e.g. in 64 GB increments, or ~15% of application value). |

| SAP Digital Access | Number of Documents | Licensed by documents created indirectly (e.g. pack of 100,000 digital documents/year for external systems). |

| SAP Extended Warehouse Mgmt | Warehouse Objects | Licensed by scope of warehouse data (e.g. number of storage bins or product items managed). |

Table: Examples of SAP package licenses and their metrics. Each engine’s license is tied to a business quantity, rather than a user count, requiring careful tracking of this metric.

Each package’s contract will define exactly what counts toward the metric.

For instance, “employee” might refer to active employees in the system (possibly including contractors if not specified), or “sales order” might refer to a specific document type within the last 12 months. It’s critical to understand these definitions upfront.

If your business grows or changes (e.g., adding more employees, increasing orders, or expanding the database), the allowed metric usage can be quickly exceeded.

This is why monitoring is so important: you need processes to measure these metrics internally (via SAP’s tools or custom reports) to ensure you stay within licensed bounds or know when to purchase additional capacity.

Read SAP Licenses for Third-Party Applications.

Pricing and Cost Considerations

SAP package licenses can represent a significant investment, and their cost structure differs from simple user licenses. SAP maintains a price list for all engines, but in practice, pricing is highly negotiable in enterprise deals.

List prices are often very high, expecting that customers will negotiate discounts based on volume and strategic importance.

Large enterprises have reported negotiating discounts of anywhere from 30% to 80% off list prices for package licenses by bundling them into larger agreements.

For example, if a particular engine is listed at $100 per unit and you need 5,000 units, the raw cost would be $500,000; however, with a 50% discount, the purchase would be $250,000.

Another cost factor is annual maintenance fees. Traditional on-premise SAP licenses are perpetual, but you pay yearly support and maintenance (typically around 20% of the net license cost) for upgrades and support.

Using the example above, a $250,000 engine license would add roughly $50,000 per year in support fees. Over a decade, maintenance can sometimes cost more than the initial license price. I

T leaders should budget not just for the one-time license spend but also for the ongoing maintenance of those licenses, which rises as your license portfolio grows.

Key cost considerations for package licenses include:

- Metric Growth = Cost Growth: Because engines are tied to business metrics, if your usage metric increases (e.g., your customer orders or employee count grows), you may incur additional license costs. Unlike fixed user counts, these metrics can spike with business success or acquisitions. Plan for license expansion in your budget forecasts whenever you project business growth.

- Shelfware and Overbuying: There is a risk of over-licensing “just in case.” SAP sales might encourage buying extra capacity upfront (and paying maintenance on it) to cover future growth. If you overestimate and don’t use that capacity, you waste your budget on idle licenses and their maintenance. For instance, purchasing a license for 10,000 employees when you only have 5,000 means you’re paying support on 5,000 unused units. It’s often wiser to buy for current needs and short-term growth, then true-up later if needed, rather than pay years of maintenance on excess.

- High-Value Engines: Some SAP engines carry very high price tags. The HANA database license (for running SAP on HANA) is one example – it is often priced as a percentage of the value of other software, which can be hundreds of thousands or millions of dollars in large environments. Niche industry solutions (e.g., SAP IS-Oil for oil and gas or advanced Treasury and Risk Management modules) can also be expensive per unit. Understand which of your desired modules are big-ticket items and prioritize those in negotiations for better discounts.

- Discount Dynamics: How you structure the deal impacts cost. Bundling engine licenses with large purchases of user licenses or new SAP products can lead to improved discounts. SAP might be more willing to deeply discount a costly engine if you are also committing to a broad S/4HANA or cloud deal at the same time. Always look at the total cost of your SAP contract: a concession on one component can often be achieved by bundling it with another. Use that leverage to achieve a pricing balance that benefits your needs (e.g., focus higher discounts on the most expensive items).

Compliance Challenges and Risks

Managing package licenses isn’t just about budgeting – it’s also a compliance tightrope. Unlike named user counts (which SAP tools can count automatically), many engine metrics are not tracked by default in SAP.

Organizations often face limited visibility into how close they are to their usage limits. This can lead to two major risks: non-compliance (using more than you paid for) or over-compliance (paying for far more than you use).

Below are common pitfalls IT leaders should watch out for:

- Unanticipated Usage Growth: Business changes, such as mergers, new product lines, or spikes in transactions, can quickly exceed your licensed metrics. For example, if you licensed SAP Transportation Management for up to 50,000 orders/year and a new e-commerce channel doubles your order volume, you would become under-licensed overnight. Such growth can trigger costly true-up fees or compliance penalties if not addressed proactively. Always revisit license needs when business metrics surge.

- Indirect Access (Licensing “Hidden” Usage): SAP has infamously audited customers for indirect use – scenarios where non-SAP systems or external users interact with SAP data without logging in directly. Classic cases include an e-commerce website creating SAP orders behind the scenes or a CRM system updating SAP records. Historically, SAP argued that each of those external users or transactions still required an SAP license, leading to multi-million dollar claims (as seen in the Diageo and AB InBev cases). To address this, SAP introduced the Digital Access model, which licenses indirect usage by document count rather than requiring named users for external systems. IT leaders need to identify any interfaces to SAP and ensure they are properly licensed (either via traditional packages or the digital access license). Indirect usage remains a compliance hotspot – ignorance is no defense in an audit.

- Ambiguous Metrics Definitions: The definition of a metric in your contract can be surprisingly fuzzy if not clarified. Terms like “user”, “employee”, or “order” might have broader scope than assumed. Does the term “employee” encompass contractors and part-time workers? Does “annual revenue” include internal transfers or just sales? Any ambiguity can be exploited in an audit. One company’s “user” metric was interpreted to count unique logins across all systems (meaning the same person in a test system and production counted twice). To avoid this risk, clearly define each metric in the contract or an addendum.

- Difficulty in Tracking Usage: Since each engine requires a unique method for measuring usage (such as a custom report, an SAP transaction like USMM/LAW, or manual data collection), companies struggle to continuously monitor everything. It is easy to fall into a false sense of security until an official SAP audit reveals an overage. Siloed data across multiple SAP instances (production, development, regional systems) adds to the challenge. If usage tracking is not centralized, you might be out of compliance in one system while underutilized in another. Instituting regular internal license audits and using tools (or scripts) to gather metrics can mitigate this.

- All-or-nothing Compliance: Notably, SAP engines typically don’t allow any “burst” or grace overage. Even 1% over the licensed metric is technically non-compliant. There’s usually no automatic tolerance band. This means you must be vigilant—if you’re approaching 100% of your licensed metric (e.g., 90% of licensed orders used), it’s time to talk to SAP about increasing that limit before you cross it. Otherwise, you risk hefty charges for even a small excess during an audit.

To manage these risks, organizations should treat license usage data with the same rigor as financial data. Regular internal reviews (quarterly or at least biannually) can catch compliance issues early.

It’s far cheaper to purchase an extra license proactively than to face audit penalties or legal disputes.

On the flip side, if you discover you’re consistently using far less than you’ve licensed, that’s an opportunity to optimize (for example, by reducing maintenance coverage on unused licenses or negotiating give-backs in the next renewal).

Monitoring SAP package license usage is critical. IT leaders need clear visibility into metrics like transactions, employees, or revenue tied to each engine. The illustration above shows how complex usage data can leave managers concerned – without proper tracking, companies risk non-compliance or wasted spending.

Negotiation and Optimization Strategies

Negotiating an SAP contract involving package licenses is a high-stakes endeavor. SAP’s contracts are flexible to an extent – many terms can be adjusted if you know to ask.

Here are strategies and best practices for optimizing your SAP package licensing agreements:

- Bundle and Leverage: Coordinate your purchases to negotiate user licenses and engine licenses together as a package. If SAP knows you’re investing broadly (for example, buying a large number of S/4HANA user licenses, database, and some add-ons in one deal), you have more leverage. You may be able to secure a deeper discount on an expensive engine by bundling it with other software. Review your total SAP spend and identify where you need the largest price breaks, then negotiate to allocate discounts accordingly.

- Contract Clarity on Metrics: Insist on transparent metric definitions and audit terms in the contract. Every engine should have its unit of measure and how it’s counted explicitly documented in your agreement or an attached SAP product document. Also, negotiate audit-friendly terms: for instance, if you do exceed usage, agree that you can purchase the extra licenses at your standard discount rate (not the full list price) to avoid punitive true-up costs. Having a clause for a grace period or threshold (if possible) for certain metrics can provide breathing room for small overages or seasonal peaks.

- Plan for Growth – but Don’t Overpay Early: It’s wise to anticipate future needs but avoid the trap of over-committing years in advance just for a bulk deal. If SAP suggests licensing 2x your current usage “to be safe,” carefully calculate the cost of doing that now versus later. Often, it’s more economical to buy what you need for the next year or two and then expand if required, even if that future purchase might cost slightly more per unit. This saves paying maintenance on software you aren’t using. You can also negotiate tiered pricing upfront – e.g., if you outgrow 10,000 employees, the next 2,000 are at a pre-agreed unit price. That way, you have price certainty without paying the full $ 12,000 from day one.

- License Mobility and Swap Rights: Over the lifespan of your SAP investment, you may retire certain modules or replace them with newer SAP solutions. Try to negotiate flexibility, such as conversion credits or swap rights. For example, if you move from SAP CRM on-premise to a cloud CRM, ask SAP to credit some value of the old CRM engine license toward new licenses or subscriptions. Similarly, if you have an engine you no longer use, see if it can be terminated or swapped out at renewal. SAP may allow you to drop an unused license (and its maintenance fees) if you’re making a new purchase elsewhere – but you must raise this during negotiations; it won’t be offered by default.

- Consider Third-Party Support: SAP’s standard maintenance is costly, and not every engine requires continuous updates. If you have stable, mature systems that you don’t plan to upgrade, third-party support providers (like Rimini Street) can support certain SAP software at roughly 50% of SAP’s maintenance fee. Switching support will save money, though it means you cannot apply new SAP patches or upgrades for that component. This tactic isn’t for everyone, but simply having it as an option can strengthen your hand when negotiating maintenance terms with SAP.

- Co-Term and Centralize Negotiations: If possible, align the end dates of your major SAP contracts. Having all licenses come up for renewal together creates a significant negotiation opportunity where you can address underutilized engines, required new licenses, and better terms in one go. SAP’s sales teams often have more flexibility when a large amount of business is on the line at once. Use that moment to clean up your entitlements—drop what you don’t need, optimize metrics, and perhaps re-bundle under newer models (such as moving some components to cloud subscriptions if advantageous).

Finally, approach SAP licensing as an ongoing discipline, not a set-and-forget purchase. Assign ownership for license management within your team or bring in licensing experts, especially for large or complicated contracts.

The money at stake is significant: a well-negotiated SAP package deal can save millions, while a poorly managed one can cost the same in unexpected fees.

SAP is often open to creative solutions if you come to the table informed, so do your homework on usage data and industry benchmarks before every negotiation.

Recommendations

- Maintain Real-Time License Visibility: Establish a dashboard or regular report that tracks each package metric (e.g., current employees vs. licensed employees, orders processed vs. license limit). Update it quarterly and review it with IT and finance leaders to catch any metrics that are trending toward their limit.

- Tie Licenses to Business Plans: Integrate licensing checks into business growth planning. If Sales forecast a 20% increase in orders next year, verify that your SAP Sales/Distribution or digital access licenses can accommodate this increase. Proactively budget for any necessary license top-ups instead of reacting after an audit.

- Enforce Internal Compliance Audits: Don’t wait for SAP’s auditors to arrive. Conduct your mini-audits at least once a year. Have each module owner verify the usage metrics against entitlements. For self-declared metrics (such as the number of employees), ensure an internal sign-off process to ensure data accuracy and documentation.

- Negotiate Audit Protections: When renewing or signing new contracts, include provisions that favor the customer in the event of audits. For example, ensure you can purchase any shortfall at your negotiated discount rates and get reasonable notice periods for audits. Clear audit rules prevent surprise “sticker shock” bills due to technicalities.

- Optimize and Reduce Shelfware: Regularly review all your SAP engines and identify any that are not fully utilized or not in use at all. If certain licenses are unused, consider dropping their maintenance to save cost (you can always re-license them later if needed). If usage is far below entitlement, use that as leverage at renewal to reduce costs or exchange for licenses you do need.

- Educate and Communicate: Make SAP licensing a cross-functional conversation. Train procurement and relevant business units on how SAP package metrics work. When everyone (HR, Sales, operations, etc.) understands that their data (headcount, order volume, etc.) drives license costs, they are more likely to flag significant changes ahead of time.

- Leverage Transitions (S/4HANA, Cloud) Wisely: Big changes like migrating to SAP S/4HANA or adopting RISE with SAP (SAP’s cloud subscription bundle) are prime opportunities to renegotiate licensing. Use these inflection points to simplify your licensing landscape – retire outdated engines, move to newer pricing models if they offer better value, and ensure SAP provides credit for past investments where possible.

- Consult Experts for Complex Deals: If your SAP environment is large or highly customized, consider bringing in independent licensing experts or legal advisors before major negotiations. Their insights on recent SAP policies, common pitfalls, and benchmark discounts can pay for themselves many times over in the savings or protections you secure.

FAQ

Q1: How is a package (engine) license different from a regular SAP user license?

A: A named user license is tied to a person and grants them access to the SAP system (with different levels such as Professional, Limited, Employee Self-Service, etc.). In contrast, a package (engine) license covers a specific SAP module or functionality and is measured by usage. Instead of “one license per user,” it might be “one license per X amount of business metric.” For example, you don’t buy SAP Payroll by user – you buy it for a specific number of employees to be processed. Many SAP implementations require both types: user licenses for each person and package licenses for add-on modules, based on the intensity of use for those modules.

Q2: How do we track our usage against these package license metrics?

A: SAP provides some tools like the System Measurement Program (USMM) and License Administration Workbench (LAW), which can measure certain license metrics (especially user counts and some technical engines). However, not all metrics are automatically captured. You often need to run specific reports or queries – sometimes provided by SAP notes or your own custom ABAP programs – to get the numbers. For instance, to measure documents for Digital Access, SAP has a Digital Access Evaluation Tool. For other metrics (such as “number of active employee records” or “total database size in GB”), you can retrieve this information from SAP tables or admin consoles. It’s a good practice to assign an owner to each metric (e.g., HR owns the employee count metric, and Finance might own a revenue metric) and have them regularly report the figures. By consolidating these into an internal dashboard and comparing them to your entitlements, you can ensure you’re within limits. If something isn’t clear (say, how exactly SAP counts a “purchase order” document), ask SAP for the measurement standards or documentation well before any audit.

Q3: What happens if our usage exceeds the licensed amount?

A: If you exceed your licensed metric, you are technically out of compliance and need to address it. The ideal approach is to proactively purchase additional licenses as soon as you notice usage will surpass entitlement. Contact your SAP account manager, explain the growth, and negotiate the additional licenses (preferably at your normal discount rates). If an official SAP audit finds the overuse first, they will issue an audit report showing the shortfall – for example, “Licensed for 10,000 employees, actually using 11,000.” In that case, you’ll be asked to purchase the 1,000 extra units, potentially with back-dated maintenance fees for the period you were over. Audits conducted after the fact can be more expensive and leave less room for negotiating prices. It’s much better to catch it yourself and true it up via a planned purchase. In some cases, if the overage is small and near the end of a period, you may be able to negotiate a grace period or a deferred payment until renewal; however, don’t count on it. The key is to avoid knowingly operating beyond your licenses – address it with SAP before it becomes a compliance violation.

Q4: Can we reduce our package licenses if our usage drops or if we no longer need a module?

A: You cannot typically “return” a perpetual license for a refund once purchased, but you do have ways to optimize in case of reduced usage. If you own licenses that you aren’t using fully, you can choose not to renew their maintenance on the unused portion. For example, you purchased 10 engine licenses but now only use 5; at the next maintenance renewal, you might renew support for five and let maintenance lapse for the other 5. You still hold the rights to use those five lapsed ones (up to the software version available at lapse), but you won’t pay annual fees for them. This effectively shelves them. Another angle is to negotiate with SAP during a new purchase or renewal. Sometimes, they will allow a reduction or trade-in of licenses as part of a larger deal (especially if you’re adding other products). If you have completely stopped using an SAP module (replaced it with something else), formally communicate this and ensure that no usage is occurring. You can then safely drop its support and possibly get SAP to acknowledge the termination so it doesn’t appear in future audits. In subscription models (cloud), you can usually reduce quantities at the next renewal term with sufficient notice.

Q5: What is “SAP Digital Access,” and do we need it?

A: Digital Access is SAP’s newer licensing model to handle indirect usage. Instead of requiring a named user license for each external user or system that indirectly interacts with SAP, Digital Access uses a document-count approach. It defines specific document types (such as sales orders, invoices, and purchase orders) and counts the number of those created indirectly by non-SAP systems or users. You purchase an annual quota of these documents (for example, 100,000 documents per year). Suppose you have a large number of third-party systems or customer portals that feed data into SAP. In that case, Digital Access can simplify licensing by covering that activity with a metric that often makes more sense than counting external users. Whether you need it depends on your integration landscape: if all significant access to SAP is by named employees directly, you might not. But if you have, say, an e-commerce site creating SAP orders or a supplier portal feeding SAP, then without Digital Access, you’d be on shaky ground license-wise. SAP has been encouraging customers to adopt Digital Access (sometimes offering conversion programs) to mitigate the risk of indirect access compliance. It’s worth evaluating: calculate the documents your external systems generate and see if a document license is more cost-effective than traditional named users or engine licenses for those scenarios.

Q6: Are SAP package licenses one-time purchases, or are they subscriptions?

A: In the classic on-premise model, package/engine licenses are generally one-time perpetual purchases. You pay a lump sum for the license, which gives you usage rights indefinitely (up to the licensed metric amount), and then you pay annual maintenance for support. However, SAP’s offerings are evolving. Many newer products and cloud offerings are sold as subscriptions – essentially, you pay annually for a specific metric or capacity. For example, suppose you use SAP cloud services (like SuccessFactors, Ariba, or the newer Business Technology Platform engines). In that case, those are typically subscription-based (you pay annually based on user count or transactions). Even some traditional engines can be sold as subscriptions if you go with SAP’s RISE (cloud bundle) model. Always clarify with SAP what type of licensing you are getting. If you are staying on-premises, you will likely have perpetual licenses. If you are moving to cloud or SaaS versions, expect a subscription (which includes the infrastructure and support in one fee). The trend is that SAP is increasingly pushing subscription models, but it still offers perpetual licensing for many core products, allowing users to prefer capital expenditure over ongoing operating expenses.

Q7: Which SAP engines tend to be the most expensive or tricky to license?

A: A few stand out as particularly costly or complex. SAP HANA database licensing can be expensive – if you run SAP’s software on HANA (rather than a third-party database), the license for HANA is often calculated as a percentage of your SAP application value or by memory size, which can amount to a large sum in big environments. This is one to watch, especially when upgrading hardware (more memory or CPU could mean a need to expand your HANA license). Industry-specific engines, such as SAP IS-Oil, Utilities, or SAP Treasury and Risk Management modules, also carry high price tags per unit because they deliver specialized value. SAP BusinessObjects BI (if still used on-premises) historically had engine metrics (such as CPU cores for analysis processing) that could become expensive as you scale servers. And, of course, the Digital Access documents license can become costly if you have extremely high volumes of documents, though SAP often negotiates in bulk for large customers. The key is to identify which engines in your SAP portfolio are “cost drivers” (usually those tied to core business volumes or technical resources) and give those extra attention to monitoring and negotiating. Even a small percentage change in the usage of a high-cost engine can have a significant impact on your budget.

Q8: How should we prepare for an SAP license audit regarding package licenses?

A: Preparation for an SAP audit primarily involves organizing and having your facts and figures ready. First, ensure you have documentation of your usage for each package license – this could be in the form of system reports, spreadsheets, or exports that show, for example, the number of employees in SAP each quarter or the number of orders processed. Maintaining an audit trail over time helps identify trends and support your positions. Next, review your contracts so you understand the official definitions and the scope of your licenses (which systems and affiliates are covered). During an audit, SAP will typically ask you to run their measurement tools (LAW, USMM) and possibly additional scripts for specific engines. It’s wise to run these internally beforehand so you know what the results will show. If you find any discrepancies (such as a count that seems unexpectedly high), investigate them. Sometimes, data may require cleanup (e.g., old user accounts that inflate numbers or test system data being mixed with production counts). Designate a point person or team to serve as the primary interface with SAP auditors. All communication should go through them and only provide the data requested, nothing more. If the audit report identifies a shortfall, engage in a discussion rather than accepting the first bill. Often, there is room to negotiate a resolution, especially if you plan to purchase additional licenses or if there were misunderstandings. Finally, many companies conduct an internal “mock audit” or a review with a third-party expert beforehand, making the official audit a formality. Being organized and informed is your best defense; it turns an audit from a frantic scramble into a straightforward validation exercise.

Read more about our SAP Licensing Services.