SAP Licensing Overview

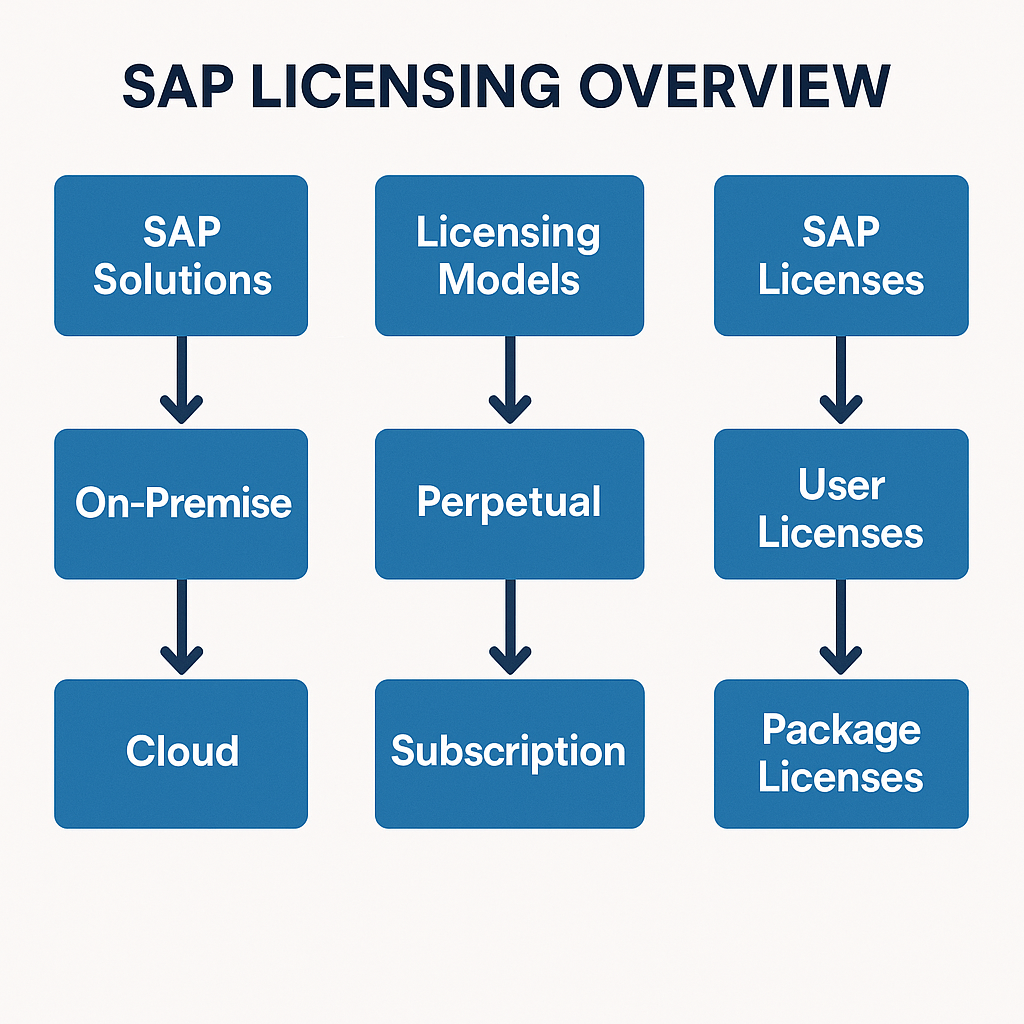

SAP’s software licensing is complex and ever-evolving, moving from traditional on-premise models to new cloud subscription offerings in recent years.

CIOs and CTOs must navigate a myriad of user license types, metrics, and compliance rules.

This overview provides IT leaders with a clear understanding of SAP licensing models, key terminology, 2024 updates, and strategies to optimize costs and reduce compliance risk.

What is SAP Licensing?

SAP licensing refers to the commercial agreements and rules that determine how customers purchase and use SAP software.

In essence, an SAP license is a contract granting specific usage rights for SAP’s enterprise software.

Understanding what you’re entitled to use (and under what conditions) is crucial, as non-compliance can lead to audits and unbudgeted fees.

SAP licensing is not a one-size-fits-all scheme. It’s a collection of user-based licenses (for individuals accessing the system) and usage-based licenses (for software components measured by metrics such as revenue or transactions).

Ultimately, SAP licensing governs how you pay for SAP software and ensures compliance with SAP’s terms.

History of SAP Licensing Models

Over the past several decades, SAP’s licensing models have undergone significant evolution.

In the 1990s, SAP R/3 introduced the concept of named-user licenses and module-based pricing, replacing the earlier mainframe-based licensing model.

During the 2000s, SAP bundled products under the “mySAP” licensing model, and perpetual licenses with annual maintenance became the norm for ERP and Business Suite software.

As SAP’s portfolio grew, so did its license metrics – from simple user counts to more complex measures (like payroll employees or order volume for specific modules).

A pivotal change occurred in the mid-2010s with the introduction of SAP S/4HANA: customers were required to migrate their legacy licenses to new S/4HANA license types, often through conversion programs.

Around the same time, high-profile disputes (e.g., the “indirect access” case in 2017, where a customer faced a multi-million dollar claim) prompted SAP to adjust its model. SAP introduced the

Digital Access licensing approach, which charges for system-generated documents instead of requiring named users for every indirect connection.

By the late 2010s and early 2020s, SAP shifted its focus to cloud subscription models, culminating in offerings such as RISE with SAP (a bundled cloud subscription package) and GROW with SAP (for mid-market customers).

In summary, SAP’s licensing history has evolved from straightforward on-premise deals to a mix of perpetual, subscription, and hybrid models, reflecting the changing technology landscape and evolving customer demands.

Key Components of SAP Licensing

SAP’s licensing framework consists of several key components that every IT leader should understand:

- Named User Licenses: Most SAP products require licenses per individual user. Each person accessing SAP (even indirectly) needs an assigned user license of an appropriate type.

- Package (Engine) Licenses: Beyond users, SAP sells licenses for specific functional modules or technical components (often called “engines”). These are usage-based, measured by metrics such as the number of employees, revenue, transactions, and CPU cores (e.g., licensing SAP Payroll by employee count or the SAP HANA database by memory size).

- Perpetual vs. Subscription: On-premise software is typically sold as a perpetual license (one-time purchase) plus annual maintenance fees (usually around 20% of the license cost). Cloud software (like S/4HANA Cloud or SuccessFactors) is sold via subscription – a recurring fee that often includes software, support, and cloud infrastructure.

- Maintenance/Support Agreements: For perpetual licenses, customers pay annual support fees (for updates and support). These fees are subject to periodic increases (SAP imposed a 5% increase in 2024 for standard support). Subscriptions have support built in, but the overall subscription cost may increase upon renewal.

- License Metric Units: Every license has a unit of measure, such as users, cores, GB of data, or documents. Understanding the metric is key to managing usage (for example, an engine license might allow 1000 “orders” per year; a user license might allow one user full access).

These components work together. For instance, to use an SAP module, you might need both user licenses for each person and an engine license for the module itself.

A solid grasp of these building blocks helps in mapping what you’ve purchased to what you deploy.

SAP Licensing Terminology

SAP’s licensing comes with a vocabulary of specialized terms. Here are some important ones:

- Named User: A single named individual with access to SAP. Licenses are tied to users, not shared. Each user is designated a type (e.g., Professional, Functional) based on their usage.

- Indirect Access (Digital Access): Indirect access occurs when users or systems access SAP data through a third-party application or interface rather than directly logging in. SAP’s Digital Access model addresses this by licensing the creation of specific documents (such as sales orders and invoices) rather than requiring a named user for each external party.

- User Types: Categories of users defined in SAP contracts. Common examples include Professional User (full access, highest cost), Limited Professional/Functional User (restricted to specific modules or tasks), Employee Self-Service (ESS), or Employee User (with very limited use, such as timesheets or HR self-service). Each type has different rights and price points.

- Engine/Package: A functional component or product (like SAP CRM, SAP Payroll engine, SAP BI). Licensed based on a metric (users, revenue, etc.), separate from named users.

- SLAW/Law and USMM: SAP’s License Administration Workbench (SLAW) and User Measurement Tools (USMM) help collect usage data for audits. These tools classify users and count engine usage to compare against entitlements.

- Full Use vs. Runtime: Full Use licenses permit the independent use of a product, whereas Runtime licenses restrict usage (often applicable to SAP HANA database or third-party runtime licenses – e.g., SAP HANA Runtime can only be used under SAP applications).

- RISE with SAP: SAP’s all-in-one subscription offering that bundles S/4HANA Cloud, associated components, hosting, and support in a single contract. It’s a newer model (subscription-based) as opposed to traditional licensing.

- Shelfware: Slang for purchased software licenses that go unused. In the SAP context, overbuying licenses “just in case” can lead to shelfware if those users or engines are not utilized.

Understanding these terms is critical when reading SAP contracts or audit reports.

They define what you can do with the software and how usage is counted. This will help businesses make more informed decisions when negotiating licensing contracts or managing SAP environments.

SAP Licensing Strategy

Developing an SAP licensing strategy involves proactively managing your SAP assets to minimize costs and risks.

From a CIO/CTO perspective, this involves a few key areas.

First, align licensing with actual usage by regularly reviewing how many users are actively using SAP and whether their assigned license types match their roles (e.g., don’t pay for a Professional license if the user only needs limited functionality). Rightsizing licenses can yield huge savings.

Second, plan for growth and changes: anticipate project rollouts (like implementing new SAP modules or migrating to S/4HANA) and include licensing needs in your project plan. Early planning avoids last-minute purchases at the list price.

Third, negotiate wisely: SAP licensing has room for negotiation, especially for large enterprises. Volume commitments or strategic projects (like a move to the cloud) can be leveraged for better discounts or contract terms. It’s not uncommon for large customers to negotiate 50% or more off the list price or secure favorable bundles.

Fourth, govern and educate: create internal processes to govern license assignment (for example, a policy that requires every SAP user to be reviewed annually for the correct license type). Train your IT and procurement teams on SAP’s licensing basics so they can spot issues (like an interface that might trigger indirect usage licensing).

Finally, consider expert help: many firms engage independent licensing advisors to benchmark deals and navigate audits. An effective strategy treats SAP licensing as an ongoing discipline, not a one-time procurement task.

In short, manage licenses like an asset portfolio – track usage, optimize continually, and align licensing decisions with your IT roadmap.

Differences Between On-Premise and Cloud SAP Licensing

Cloud licensing introduces subscription models and bundled services, whereas on-premise SAP licensing relies on perpetual licenses plus annual maintenance. CIOs must understand these fundamental differences in cost structure and flexibility.

On-premise and cloud licensing for SAP software differ in several key aspects.

On-premise SAP licensing is typically based on perpetual licenses: you pay an upfront fee for each software component and user and then pay yearly maintenance (support) fees. You (or your hosting provider) manage the infrastructure, and you have control over when to upgrade or modify the system.

Cloud licenses enable SAP (or a cloud partner) to manage the underlying servers and apply updates on a scheduled basis.

| Aspect | On-Premises Licensing | Cloud (Subscription) Licensing |

|---|---|---|

| Ownership | Perpetual – you own the license indefinitely | Subscription – right to use as long as you pay |

| Upfront vs. Ongoing | Large upfront cost; 15–22% annual maintenance fee | Lower upfront; regular recurring fees (includes support) |

| Infrastructure | Managed by customer (own data center or cloud hosting) | Included and managed by SAP (SaaS or cloud service) |

| Customization | Full flexibility to customize (you control the system) | Standardized environment; limited deep customization |

| Upgrades | Controlled by customer (can defer upgrades) | Automatic updates by SAP (on SAP’s schedule) |

| Scalability | Add capacity by purchasing more hardware/licenses | Scale by adjusting subscription (adding users or capacity) |

| Compliance Focus | License audits on users and engines (periodic SAP audits) | Usage monitored continuously; true-ups at renewal |

| Cost Model | CapEx (capital expense) heavy, then ongoing OpEx (support) | Pure OpEx (operational expense), easier to forecast short-term |

From a licensing perspective, on-premise gives more control (and long-term ownership) but requires more responsibility (maintenance, managing growth, utilizing what you bought).

Cloud licensing offers simplicity and agility, but it also relinquishes control over the environment and commits to ongoing subscription costs.

A CIO should weigh the Total Cost of Ownership (TCO) over a 5- to 10-year period. Sometimes, on-premise solutions can be cheaper if a system is heavily used and stable, whereas cloud solutions might be costlier over time but provide quicker innovation and scalability.

Importantly, moving to the cloud doesn’t eliminate licensing compliance issues – it changes them.

Instead of traditional audits, cloud-based compliance may involve ensuring you don’t exceed contracted user counts or consume excessive resources and negotiating renewals carefully to avoid price escalations.

SAP License Types Explained

SAP offers a bewildering variety of license types, which can be broadly categorized into two main types: user licenses and package licenses.

User License Types: These cover the human users of SAP. Each user license type defines the actions a person can perform in SAP.

Some key SAP-named user types include:

- Professional User: This is the highest level, granting full access across SAP modules. It’s intended for power users, administrators, or anyone whose role spans multiple functional areas. Professional users are the most expensive license type (often 2x-3x the cost of limited users) and usually make up the core of SAP user licensing.

- Limited Professional/Functional User: This type is designed for users who require access to only specific modules or have a more limited scope of use. For example, a sales clerk in SAP CRM or a plant supervisor might only use specific transactions. These licenses are offered at a lower price due to their restricted scope. (In newer S/4HANA contracts, SAP might label these as “Functional User” or “Business User” licenses.)

- Employee (ESS) User: Also known as Employee Self-Service, this license is intended for very light usage, typically by employees accessing their data. Examples include entering timesheets, viewing payslips, or submitting travel expense entries. This category enables broad access for a large employee base at a low cost per user. An ESS license cannot perform operational transactions beyond self-service tasks.

- Developer User: A specialized license for technical staff who work on SAP development or customization (e.g., ABAP developers, BASIS engineers). It usually provides deep access to development tools. Interestingly, developer licenses can cost as much as a Professional user license (reflecting the high level of access). Only those who are performing configuration or programming tasks should be assigned this license.

- External Contractor or Partner User: In some contracts, there are user types for external individuals (like consultants or partners) who access your SAP system. These often mirror the above categories (Professional/Functional) but are designated for non-employee use.

Package/Engine License Types: These licenses cover SAP software components or modules, rather than individual users.

Key points include:

- ERP Modules and Add-Ons: For example, licensing SAP Human Capital Management (HCM) may be based on the number of employees, or the SAP Sales & Distribution engine may be based on the number of sales orders per year. Each package has a metric definition.

- Database and Technology: SAP HANA database licenses (if not under a subscription) could be purchased by memory size or number of cores. A named user or CPU might license SAP BusinessObjects (BOBJ). SAP Business Technology Platform services often have their metrics (capacity units).

- Industry Solutions: Some industry-specific products (oil & gas, retail, etc.) have unique metrics (e.g., “barrels of oil processed” or “stores”).

- Cloud Service Metrics: Cloud products have subscription metrics. For instance, SuccessFactors (SAP’s HR cloud) is priced per employee per month; Ariba (a procurement network) might be priced by spend volume or the number of documents; SAP Analytics Cloud is priced by user or capacity. These are effectively package licenses in subscription form.

In summary, a company’s SAP license portfolio might include hundreds or thousands of named user licenses of various types, plus dozens of engine licenses for different modules.

The proper mix depends on the SAP products you use and the number of users. IT leaders need to understand which license types are aligned with specific roles and systems within their organization.

Key Licensing Challenges for SAP Users

SAP licensing presents several challenges that CIOs and CTOs frequently encounter:

- Complexity and Volume: With over 3,000 products and 100+ licensing metrics in SAP’s price list, just figuring out what you need is a challenge. Many companies struggle to interpret contracts and map them to actual usage. This complexity often leads to either over-licensing (buying too much “just in case”) or under-licensing (unknowingly using more than purchased).

- Indirect Access Risks: One of the most significant compliance risks is indirect access. If third-party systems (or customer/partner portals) connect to SAP, you must ensure that either those external users are licensed or you adopt SAP’s digital access documents. Mismanaging this can lead to significant audit findings, as seen in cases where companies were billed tens of millions of dollars for unlicensed indirect use.

- Audit and Compliance Pressure: SAP regularly audits customers. Keeping up with audit requests, running SAP’s measurement programs, and defending your license position can be arduous. The rules can be ambiguous (e.g., how to classify a user or what counts as use of an engine), and SAP’s interpretation may differ from yours. Users often feel the deck is stacked in SAP’s favor during audits.

- Cost Overruns: SAP software is a major investment. License and support costs can consume a large share of the IT budget. Without active management, organizations accumulate shelfware (unused licenses) or pay for higher-tier licenses when a cheaper one would suffice. Additionally, annual maintenance increases and cloud subscription renewals can inflate costs year over year.

- Changing License Models: Transitioning to new SAP offerings (like moving from ECC to S/4HANA or adopting RISE with SAP) can render your existing licenses partially obsolete or in need of conversion. Understanding conversion ratios, trade-in credits, and new metrics is a challenge in itself. There is also a fear of “lock-in” with new cloud models – once you’re on a subscription, switching back or changing providers is difficult.

- Alignment with Business Change: Mergers, acquisitions, or divestitures in a company can create licensing headaches. Combining multiple SAP contracts or carving out part of an SAP deployment to a spun-off company requires navigating SAP’s rules on contract transfers and license entitlements across legal entities.

These challenges mean that SAP licensing is not merely a procurement task but an ongoing operational concern.

SAP Licensing Case Studies

Real-world examples illustrate how SAP licensing can significantly impact organizations:

- Audit Defense Saves Millions: A multinational manufacturing company was hit with an SAP license audit claiming over $15 million in compliance gaps. The audit cited indirect access (interfaces feeding data into SAP) and misclassified users. By engaging in a rigorous defense – validating SAP’s findings, correcting user classifications, and negotiating – the company reduced its exposure by over 90%, settling for around $1.2 million. This case study highlights that initial audit figures can be challenged and significantly reduced with the proper expertise and license optimization.

- Indirect Access Legal Battle: A well-known beverage company in the UK faced a landmark legal case with SAP around 2017. They had connected Salesforce to SAP without additional licenses, and a court ruled they owed SAP about £54 million for indirect access. This sent shockwaves through the SAP community and led SAP to introduce the Digital Access model. The lesson for others: indirect use is a serious matter – address it proactively rather than assuming it goes unnoticed.

- Optimizing License Usage: A Swiss multinational with operations in over 50 countries discovered, through an internal review, that it was over-licensing in certain areas. They had thousands of Professional User licenses assigned, but many users only needed limited functionality. By reclassifying 30% of their users to a lower-cost license type and retiring unused engine licenses, they saved several million dollars in annual support costs. Additionally, they established a central license management function to continuously monitor usage, thereby avoiding both overspending and compliance gaps.

- Cloud Subscription Negotiation: A Fortune 500 company transitioning to RISE with SAP (the cloud subscription for S/4HANA) leveraged competitive benchmarks and a robust business case to secure a more favorable deal. They secured a contract with more flexible terms: the ability to adjust user counts annually without heavy penalties, cloud credits for additional services, and a cap on annual price increases. This case shows that even in subscription models, large customers can negotiate terms to maintain some control over cost and capacity.

Each of these scenarios highlights different aspects of SAP licensing, including audit risks, cost optimization, and contract negotiation.

The common thread is that expertise and proactive management can turn a potentially costly situation into a controlled outcome. Avoid pitfalls by adopting a strategic approach to license allocation and management.

How SAP Licensing Affects Implementation

SAP licensing decisions have a direct influence on how you implement and use the software.

During an SAP project (like a new ERP rollout or adding a CRM module), it’s critical to consider licensing early in the planning phase.

Scope and Module Selection:

The modules you decide to implement must align with what you’re licensed for. For instance, if you plan to deploy SAP Payroll but didn’t license that engine, you’ll need to budget for it in the project. Sometimes, companies limit the scope of an implementation (or phase certain functionality later) to stay within existing license entitlements and control costs.

User Access Design:

How you design user roles in SAP can affect license requirements. If you assign a user a too broad role, they may require a Professional license. Many SAP implementation teams work with licensing teams to ensure roles are designed to fit the intended license type (least privilege principle – only give access needed for the job).

Testing and Project Users:

Even in non-production systems, unlicensed use can be a risk. SAP requires that all users, including testers and contractors, have the appropriate licenses. During implementation, if you bring on a team of consultants or power users for testing and training, you need to have licenses for them (or short-term license arrangements).

Infrastructure and Sizing:

For on-premise projects, sizing the system might trigger engine licensing considerations – e.g., using SAP HANA requires a HANA license and ensures you don’t exceed licensed memory. For cloud implementations, sizing may require a higher subscription tier if high usage is anticipated.

Timeline and Contract Alignment:

If your project is scheduled to go live mid-year with a significant increase in users, consider timing your license purchases or contract true-ups accordingly. It’s often better to negotiate needed licenses as part of the project budget (when you might have more leverage or internal focus) rather than scramble later.

Lastly, data integration plans (which third-party systems connect to SAP) must be reviewed for indirect access licensing requirements.

SAP Licensing Compliance and Best Practices

Staying compliant with SAP’s license terms requires ongoing effort and best practices embedded in IT operations.

Here are several best practices for SAP license compliance:

- Regular License Audits (Internal): Don’t wait for SAP’s official audit. Conduct your own annual internal license audit. Use SAP’s measurement tools (USMM/SLAW) to get usage data, then analyze it to see if you have the right mix of licenses. This proactive approach enables you to address issues on your terms.

- Role-Based Access Control: Implement strict role management in SAP. Ensure that user roles match the minimal license needed. For example, if a user only needs to display reports, give them a display role tied to a lower-tier license. Avoid granting broad roles that would force an upgrade to a Professional license unnecessarily. This may involve designing roles in tandem with license types—a methodology some call “license-aware role design.”

- License Allocation Governance: Establish a governance process for issuing new SAP user licenses. For instance, when a new employee requires SAP access, have a checklist to determine the appropriate license type and require management approval for expensive license types. Keep a centralized record of license assignments and available license capacity.

- Monitor Indirect Usage: Map out all systems that interface with SAP. Ensure compliance for each integration – either by having the external users or devices covered under an existing license or by using digital access documents. Consider using monitoring tools or scripts to track document creation from interfaces, allowing you to accurately assess your digital access consumption at any time.

- Stay Updated on Contracts: Maintain a repository of your SAP contracts, order forms, and terms of use. Know your entitlements – how many of each user type, how much metric volume is licensed for each engine, etc. This may sound basic, but many organizations lose track over time. Also, diaryize critical dates: contract renewal or support renewal dates and any deadlines for license conversion programs (for example, SAP had deadlines for swapping old licenses for digital access credits).

- Education and Awareness: Train your administrators and business users on the impact of licenses. For example, an innocuous configuration change, such as enabling a new SAP module or duplicating a user role, could have licensing implications. If your SAP Basis team and module leads are license-aware, they can flag potential compliance issues before they materialize.

- Periodic Optimization: Treat SAP licenses like a dynamic inventory. Periodically identify unused or underutilized licenses (e.g., a user left the company but their license wasn’t re-harvested or an engine license for a module nobody uses anymore). You may be able to terminate maintenance on unused licenses to save costs or reallocate licenses to meet new needs, rather than purchasing additional ones.

- Audit Response Plan: Despite best efforts, you will likely face SAP audits. Have an audit response plan ready: designate a point person or team to interface with SAP auditors, provide only the required data, and seek clarification on any findings that arise. If SAP presents a non-compliance claim, analyze it critically – do not assume it’s correct. You often can negotiate and clarify to reduce liability.

By following these practices, organizations create a culture of compliance and avoid the last-minute panic of audit fire drills. It’s about embedding license management into the fabric of SAP operations.

How to Calculate SAP Licensing Costs

Calculating SAP licensing costs can feel like crunching numbers for a complex puzzle, but it boils down to a structured approach:

- Inventory Your Licenses: Start by listing all SAP products you use. Break it down into user licenses (by type) and engine licenses (by-product metric). For example, 500 Professional Users, 200 Functional Users, SAP ERP Financials engine for $X revenue, SAP HANA 256GB, etc. Use your contracts or SAP’s License Administration tools to get this info.

- Identify Usage Quantities: Determine the actual quantities of each that you need. This might involve counting active users by role for user licenses and using system metrics for engines (e.g., current employee count for HR, transaction volumes). Also, project future needs when budgeting ahead.

- Apply Unit Prices: For each license type, apply the unit price. SAP’s price list provides a gross list price (e.g., a Professional User might be listed at around $3,000 one-time, a Limited User at around $1,500, or cloud equivalents at $100 per user per month). In reality, most customers have discounts – if you know your discount (say 50% off lthe ist), apply that. Don’t forget engines: each will have a price per metric unit (e.g., $X per 1000 invoices). Multiply out based on your usage.

- Add Maintenance or Subscription Fees: If on-premise, calculate annual support as usually 22% of the net license cost per year (or as stated in your contract). If you are subscribing, the cost you calculated in step 3 may already be annual; however, remember that subscriptions are recurring, so consider including multi-year totals. Real-world example: Suppose you need 100 Professional on-premises licenses and 200 Limited licenses. If list prices are $3,000 and $1,500, respectively, and you have a 50% discount, that’s $150,000 + $150,000 = $300,000 net license outlay. Annual maintenance at 20% would be an additional $60,000 per year. Over 5 years, that’s $300k + (5 * $60k) = $600,000 total cost of ownership for that portion. In a cloud scenario, 100 Pro users at $100 per user per month would be approximately $120,000 per year, with a potential 10% discount for a multi-year term, resulting in around $ 108,000 per year. Over 5 years, this would total $540,000.

- Consider One-Time vs. Recurring: Account for one-time implementation or setup fees (some SAP cloud deals have one-time onboarding fees). Also, include any known price escalators, such as support fees increasing by 5% annually or subscription rate increases after a certain period.

- Model Different Scenarios: It’s wise to model both the best-case and worst-case scenarios. For example, if you anticipate adding 50 more users next year, how does that impact the cost? If an audit requires you to purchase digital access, what is the potential cost? Scenario modeling helps in budgeting and also in negotiating with SAP (you can see the cost impact of various deal structures).

Please note that SAP’s pricing is often opaque and customized for each customer.

The calculated cost serves as a baseline, but large enterprises rarely pay the full price – they often negotiate bundles and discounts.

Also, taxes (if applicable) and local currency considerations can affect costs.

Nonetheless, this systematic approach ensures that you capture all elements, including user licenses, engines, support, and growth, to arrive at a reasonable total cost of ownership for SAP.

Global Trends in SAP Licensing

SAP licensing is being shaped by several global trends in 2025 relevant to CIOs and CTOs:

- Cloud-First Licensing: SAP, like other major vendors, is promoting a cloud-first approach. A growing percentage of new SAP deals globally are subscription-based (Cloud). Traditional perpetual license sales are declining. Many regions are seeing SAP offer incentives or bundle deals to move to SaaS and PaaS (Platform-as-a-Service) models. The trend is clear: future SAP licensing will be predominantly subscription.

- Rise of All-in-One Contracts: In large enterprise deals, SAP is packaging more into comprehensive agreements. For example, RISE with SAP bundles ERP, infrastructure, and support. Similarly, SAP’s enterprise licensing agreements may bundle multiple cloud services under a single contract. While this simplifies procurement, it can obscure individual product pricing and increase vendor lock-in.

- Frequent Policy Changes: SAP has been regularly revising its licensing policies, partly to address customer concerns over issues such as indirect access and partly to capitalize on emerging technologies. For instance, SAP may introduce new license metrics for AI/ML services or IoT usage as these technologies become more mainstream. Staying agile in understanding these changes (through SAP user groups or advisory firms) is becoming necessary worldwide.

- Customer Advocacy and User Groups: A trend is emerging among large SAP customers, who are banding together (via user groups such as ASUG in North America and DSAG in Germany) to influence SAP’s licensing practices. These groups have been vocal about complexities and fairness. In some cases, SAP has responded (the Digital Access model was refined with user group input). Global CIO forums share licensing experiences, which empower buyers with more knowledge.

- Third-Party Support & Alternatives: Another trend, especially for mature SAP environments, is to consider third-party support vendors (like Rimini Street and Support Revolution) once out of mainstream maintenance. While still a niche approach, some global companies are leveraging this to reduce costs on legacy SAP licenses instead of continuing SAP support. Additionally, some are exploring modular alternatives (such as Workday for HR or Salesforce for CRM) and considering how integration with SAP would be licensed – essentially challenging SAP’s all-in-one footprint to gain leverage.

- License Compliance Technology: Globally, more organizations are investing in Software Asset Management (SAM) tools specifically for SAP. These tools, offered by vendors like Snow, Voquz, or USU, help interpret SAP usage and optimize licenses. The trend is shifting away from manual spreadsheet tracking to automated license analytics, particularly in large enterprises with thousands of users across multiple countries.

In summary, SAP licensing is gradually shifting toward subscription-based and cloud models, influenced by a more informed customer base.

Expect continual evolution – today’s rules may change in a year or two, so keeping an eye on global SAP announcements and peer benchmarks is crucial for effective planning.

Make informed decisions about their SAP investments and adapt their licensing strategies accordingly.

Keeping an eye on global licensing trends also allows companies to anticipate changes and remain competitive.

SAP Licensing for Multinational Companies

For multinational enterprises, SAP licensing brings additional layers of complexity and opportunity:

- Global Volume Agreements: Large multinationals often negotiate a single, global licensing agreement with SAP that covers all their subsidiaries. This can yield better discounts due to volume (all usage pooled together) and ensures consistent terms worldwide. However, it requires accurately forecasting global needs. One challenge is allocating costs internally – many companies use license “share” models to distribute expenses to different country units.

- Multiple SAP Instances: It’s common for a multinational to run multiple SAP systems (e.g., regional ERPs, separate instances for acquired companies). Each instance still draws from the same license pool, but tracking usage per instance and ensuring total usage stays under entitlement is a big task. Some companies accidentally double-count or over-provision because different IT teams manage different landscapes – a central license team is crucial.

- Local Compliance Variation: SAP’s audit approach might vary by region. Some countries’ SAP local offices are more aggressive in auditing or upselling. Multinationals should establish a unified approach to handle SAP audits globally – don’t let each subsidiary negotiate in isolation, as that can weaken your overall position. It’s often best to handle audits at a group level with oversight from HQ.

- Currency and Pricing: SAP licenses are sold in various currencies (e.g., EUR, USD) depending on the region. Fluctuations and local price lists can cause costs to be uneven. Some global deals lock pricing in one currency to mitigate foreign exchange risk. Additionally, taxes (such as VAT) on software licenses vary by country. CIOs must factor this into budgeting – the same license could effectively cost more in one country than another after taxes and local conditions.

- Divestitures and M&A: In a multinational context, business changes are frequent. When acquiring a company that already uses SAP, aligning or merging contracts is tricky. SAP typically does not allow transferring licenses between unrelated entities without consent. During mergers, you might end up paying extra if you don’t negotiate contract adjustments. Conversely, if you are selling off a division, you cannot simply give them part of your license entitlement without SAP’s involvement. Early engagement with SAP in these scenarios is advisable to avoid contractual breaches.

- Data Residency and Cloud: For multinationals transitioning to SAP cloud services, data residency can be a significant consideration, as certain countries require data centers to be located within the region. SAP’s cloud licensing may specify where your data is hosted, and sometimes, if you need a separate instance for countries like China or Russia due to regulations, that can require a separate subscription slice. This can complicate what you thought was a unified cloud contract.

- Centralized vs. Decentralized License Management: The trend is for multinationals to centralize SAP license management, as the contracts are typically global. A central team can reallocate licenses (e.g., shifting unused licenses from Europe to a growth project in Asia) rather than each region buying new licenses. This optimizes utilization. However, that team needs visibility into all deployments and good communication with local IT.

Overall, multinational companies benefit from their scale in negotiations; however, they also face increased complexity in administration.

A clear global governance model for SAP licensing is essential, encompassing global policies while allowing for local input to ensure the company remains compliant and cost-effective as a whole.

Counts for these regional differences help multinationals manage compliance and control costs effectively. Understanding the differences in local regulations and their impact on licensing is also crucial.

SAP Partner Licensing Models

SAP partners, including resellers, system integrators, and consultants, hold specific licenses.

SAP’s ecosystem includes partners, consulting firms, software vendors, and outsourcers, who also interact with SAP licensing in distinct ways.

Key partner-related licensing models include:

- SAP PartnerEdge Licenses: SAP offers special licensing for its partners to run demo, development, or education systems. For instance, a certified SAP implementation partner can obtain an SAP Test & Demonstration license (non-production) to showcase SAP solutions to clients. These are typically time-limited or scope-limited and are offered at a reduced cost (or included as part of the partner program fees). Essentially, partners don’t purchase full-production licenses for their internal use if they’re only intended for demoing to clients – they utilize partner licensing arrangements.

- Development Licenses for Build Partners: If a software partner is building an add-on or integration to SAP (through SAP’s APIs or BTP platform), SAP provides them with developer licenses or sandbox environments. SAP aims to encourage extensions on its platform, offering programs that enable partners to develop and test on SAP software without requiring full licenses for each developer. These usually fall under “Non-Commercial” licensing agreements with SAP.

- OEM and Embedded Licensing: Some partners embed SAP technology into their products. For example, an ISV might embed SAP Analytics Cloud or SAP’s database engine in their solution sold to end customers. In such cases, SAP offers OEM licensing, where the partner pays SAP for the runtime license on behalf of the customer, often at a discounted rate, and packages it into their product. The end customer might not even realize that SAP is under the hood and they have no direct license with SAP (they obtain it through their partner).

- Reseller Agreements: Value-added resellers (VARs) and distributors can resell SAP licenses to end customers, usually for the SME market. These partners have certain discount structures from SAP and can bundle services with licenses. For the end customer, the terms are still SAP’s standard, but the commercial transaction is via the partner. SAP has strict rules for partners regarding how they can discount and what they must charge (to avoid undercutting SAP’s direct sales).

- Cloud (MSP) Partner Models: Some partners act as managed service providers for SAP, particularly for hosting services. For example, a cloud hosting partner might provide SAP S/4HANA as a service to a client. They might leverage SAP’s Cloud Choice program or hyperscaler agreements. In such cases, the partner holds certain cloud subscription licenses, and the customer subscribes through the partner. This model is evolving as SAP’s own RISE offering competes with partner-hosted models.

- Partner Compliance and Usage: Partners themselves must be mindful of SAP compliance. SAP audits partners as well, ensuring that their use of SAP software (for demos, training, and internal systems) is by the terms of their partner agreement. A partner can’t use a “demo license” to run their own internal ERP, for example. So, partners have licensing models for internal use as well – often, they receive a steep discount for internal systems if they are a certified partner, but they still need to purchase those licenses (this is sometimes referred to as an NFR – Not For Resale – license, used internally by the partner).

In summary, SAP’s partner licensing models are designed to enable the partner network to sell, build on, and support SAP products while ensuring SAP still controls how licenses are used.

If you’re a customer working with an SAP partner, it’s useful to know that some license offerings might come through the partner (and you should verify the terms).

If you’re a partner, it’s crucial to follow SAP’s rules – non-compliance can risk your partnership status..

Benefits of Proper SAP License Management

Investing time and effort in SAP license management yields significant benefits for an organization:

- Cost Savings: Proper license management helps avoid over-purchasing. By matching license types to actual user needs and eliminating surplus licenses, companies save directly on license and maintenance costs. It’s common to find 10-20% cost reduction opportunities just by cleaning up mismatches (like expensive licenses assigned to low-usage users).

- Audit Risk Mitigation: With good management, you’re continually in compliance, so an SAP audit is far less scary. There’s less scrambling to find a budget for unplanned true-ups. Essentially, you turn a potential audit penalty into a planned expense (or avoid it entirely). This predictability is valuable for financial planning and avoids paying hefty back maintenance or penalties.

- Informed Decision-Making: When you actively track license usage, you gain insights that inform IT decisions. For instance, usage data might show that a certain SAP module isn’t heavily used – perhaps you can replace it or retire it in favor of a cheaper solution. Alternatively, you might discover a department that is heavily utilizing a module, justifying further investment or training. License data becomes usage data, which is strategic.

- Optimal Allocation of Resources: Effective license management ensures that the right people have the right access. This prevents scenarios where critical users are blocked due to a license being unavailable, or projects are delayed because a specific license is exhausted. By forecasting and managing license allocations, IT ensures software availability isn’t a bottleneck for business.

- Negotiation Leverage: If you know your exact license usage and have a clear understanding of your needs, you can negotiate with SAP from a position of strength. You can confidently say, “We don’t need that product or those extra users. Here’s the data,” to resist an upsell. Or conversely, “We will need X more licenses next year; let’s agree on a bulk price now.” SAP sales teams respond better when customers are informed – you’re less likely to overpay or buy unnecessary products if you have factual usage info.

- Better Strategic Planning: Proper license management is closely tied to IT strategy. For example, if you plan to roll out SAP to a new region, you can simulate license costs in advance to ensure accurate planning. If you plan to migrate to S/4HANA, you can analyze your current license assets to see what can be converted. All of this makes large IT initiatives smoother because the licensing piece is under control.

- Compliance Confidence: Finally, there’s an intangible but real benefit: peace of mind. IT leaders and CFOs can sleep easier knowing they won’t get an ugly surprise from SAP. This confidence also strengthens the relationship with business units, as IT isn’t coming back asking for emergency funds to handle compliance issues.

In essence, managing SAP licenses effectively is akin to financial stewardship of a major asset. It pays dividends in cost avoidance, operational readiness, and strategic flexibility.

Investing time and resources into SAP license management, using tools and best practices to maintain efficiency.

Proper license management is not only about compliance but also about ensuring that resources are utilized optimally to drive business success.

SAP Licensing for Large vs. Small Businesses

SAP serves both Fortune 50 giants and small-mid businesses, but licensing approaches can differ by company size:

- Product Choice: Large enterprises typically utilize the flagship SAP S/4HANA or a comprehensive SAP Business Suite, which features a wide range of modules and integrations. Small businesses might opt for products like SAP Business One or the SAP Business ByDesign (for midsize) – these have their licensing models (often simpler and cheaper per user). For instance, SAP Business One offers Professional and Limited user licenses priced in the low thousands of dollars per user (or under $100 per user per month in cloud form), which is more feasible for a small company. In contrast, S/4HANA enterprise licenses can be more costly and complex.

- License Volume and Discounts: A large company might have thousands or tens of thousands of users, which gives them leverage to negotiate volume discounts with SAP. It’s not unusual for large enterprises to negotiate 50-80% off list prices due to scale. Small businesses, buying perhaps 5 or 20 users, often pay closer to the list price with smaller discounts (though SAP sometimes offers SME promotions). Additionally, large businesses can negotiate enterprise license agreements or unlimited usage periods, which small firms cannot.

- Expertise and Management: Big companies often have dedicated software asset management teams or SAP Center of Excellence licensing specialists. They invest in tools to track and optimize licenses. Small businesses likely don’t have that luxury; an IT manager might manage licensing as one of many tasks. Thus, small firms may rely more heavily on their SAP reseller or partner to help maintain compliance. In contrast, large firms typically handle it in-house or with the assistance of specialized consultants.

- Flexibility: Small businesses value simplicity – they might prefer subscription models that bundle everything (and indeed, offerings like GROW with SAP target simplicity for midsize). Large businesses often prefer perpetual licenses for core systems to avoid recurring subscription costs; they have capital budgets for such expenses. However, large organizations also consider the implications of being locked into big contracts, so they carefully evaluate RISE vs. on-prem, possibly using a hybrid approach to maintain some flexibility.

- Audit Frequency: In practice, SAP tends to audit all customers, but a large enterprise with a multi-million SAP contract may get very regular attention (annual audits are common) because the stakes (and potential additional sales) are high. A small company might experience a lighter touch or longer intervals between audits, partly due to resource focus – SAP’s compliance team might prioritize bigger fish. That said, no SAP customer is truly exempt from compliance checks.

- License Types Used: A nuanced point – large businesses often utilize a broad mix of license types (including developer licenses, multiple engine metrics, etc.), making their landscape varied. Small businesses may have only a couple of user types (e.g., Professional and Limited) and fewer or no additional engines (they may use only the core ERP). This narrower scope can make licensing easier to manage for small firms, albeit on a smaller scale.

- Growth and Scaling: For a small but growing business, SAP licensing can be a hurdle – adding a few users is a proportionally significant cost increase. SAP has attempted to address this by offering starter packages and allowing for gradual expansion. Large businesses, on the other hand, plan growth in big chunks (e.g., adding a new division with 500 users) and often negotiate those expansions into their contracts via framework agreements.

In summary, SAP licensing fundamentals are similar for any size (a user is a user, an engine is an engine). Still, large enterprises play a more complex game, with a higher price tag and more resources to manage it.

In contrast, small businesses require simplicity and affordability, often relying on packaged solutions and guidance from partners.

SAP Named User Licenses

Named user licenses are the cornerstone of SAP licensing.

A “named user” is an individual human given access to SAP software, and SAP requires that each such person have an appropriate license.

Let’s break down key points about SAP named user licenses:

- Named Means Named: The license is assigned to a specific person (John Doe, Jane Smith). It’s not a floating or concurrent license that can be shared. Even if John uses SAP in the morning and Jane uses it in the afternoon on the same PC, they each need their licenses. This is a strict rule – no sharing of generic logins allowed.

- Types of Named Users: SAP has numerous classifications of named users. We covered the main ones (Professional, Limited/Functional, ESS, Developer, etc.). Each license type is defined in the contract with the authorizations or activities that the user can perform. For example, a Professional Named User might be defined as someone authorized to perform any operational transaction within SAP. A Warehouse Named User (an example of a more specialized type) might be limited to warehouse management transactions. The definitions can span multiple pages – SAP provides a document called the “SAP Software Use Rights” that enumerates the capabilities of each named user type.

- License Spectrum and Cost: Generally, Professional users have the highest cost and have the broadest use. Other types scale down in cost and permissions. For instance, an Employee User (for self-services) could cost a fraction of a Professional. The reason companies care about this spectrum is obvious: why pay $3,000 for a Professional if a $500 Limited user license suffices for someone? Thus, categorizing users correctly is a major part of license management.

- Enforcement and Measurement: SAP’s audit tools measure named users by examining user master records in the system and their associated roles to determine the appropriate type. Historically, it was somewhat manual – companies would assign license types, and auditors would check if usage matched. Now, with S/4HANA and newer systems, SAP’s authorization-based measurement can automatically classify a user if their roles exceed what a lower license permits (bumping them to a higher category). For example, if a user has authorization that only a Professional should have, the measurement program will flag them as needing a Professional. This puts the onus on customers to regularly review user roles.

- Reassigning and Retiring Users: You can reassign a named user license when someone leaves or changes roles; however, you must update your records and potentially inform SAP at the next audit. Licenses are generally perpetual (if bought outright), so you can reuse them for new hires, etc., as long as you stay within the count you own for each type. If you have 100 Professional licenses purchased, you can have up to 100 individuals assigned as professionals at any time – who those 100 people are can change, of course (people join, leave). In cloud subscriptions, the process is similar, except you pay per user annually – if one user leaves and another joins, you’re still paying for the total count purchased.

- External Named Users: For scenarios where non-employees access SAP (e.g., dealers, suppliers via a portal), SAP historically had separate user types, such as “Supplier User” or “Business Partner User.” Many of these scenarios now fall under either specialized user licenses or the digital access model. But it’s worth noting that named user licenses can extend to external people if they log in to your SAP system.

- Common Mistake – Misclassification: A key challenge is ensuring that each user is classified accurately. A common mistake is leaving everyone as a Professional by default (which some companies did in the past because it was simpler), which means over-licensing. The opposite mistake is assuming everyone is a Limited user and then failing an audit because some were doing more. Regular reviews and using SAP’s user analytics (like the USMM reports) help avoid this. Some organizations associate license types with job roles, for example, designating all finance clerks as Limited and all finance managers as Professional as a starting point.

In summary, SAP-named user licenses require disciplined management. Every person needs the correct type of license before they use the system.

The license type determines what they’re allowed to do and how much you pay.

Getting this right ensures you’re compliant without overspending on overly powerful licenses for users who don’t need them.

SAP Licensing FAQ

- Q: Can SAP licenses be shared among users or transferred to another user?

A: No. SAP uses named user licensing, which means each license is assigned to a specific individual. You cannot have two people sharing one “concurrent” license – even if they work different shifts. Licenses can be reassigned over time (e.g., when an employee leaves, their license is assigned to a new hire), but not shared simultaneously. - Q: What is indirect access, and why is it such a big deal?

A: Indirect access refers to scenarios where SAP is accessed not by a user directly logging in, but via a third-party application or interface. For example, an e-commerce website pulling data from SAP or a middleware updating SAP records. Historically, SAP required a license for these usages (which was confusing). Now, SAP’s “Digital Access” model charges based on documents (like the number of sales orders created through external systems). It’s a big deal because many companies unknowingly had a lot of indirect usage and were audited with huge fees. Therefore, you must either license those indirect scenarios via named users or the digital document approach; otherwise, you will be out of compliance. - Q: How often does SAP audit customers’ licenses?

A: For on-premise licenses, SAP typically has the right to audit annually (the contract usually says you must run their measurement programs once a year). In practice, many customers face an audit every 2-3 years, but it can be more frequent if SAP suspects compliance issues or if a significant negotiation is pending. For cloud subscriptions, usage is continuously monitored, and “true-ups” may occur at renewal or if you exceed the contracted amounts. Always be prepared for an audit by staying compliant and maintaining accurate records – assume SAP can conduct an audit at least once a year. - Q: Is it more cost-effective to opt for SAP cloud subscriptions or maintain on-premises licenses?

A: It depends. On-premise licenses have a big upfront cost but lower ongoing fees (just maintenance). Cloud is pay-as-you-go. If you take a 5-10-year view, sometimes on-premises solutions end up being cheaper for stable environments because you pay once and can use the software indefinitely (maintenance is optional after support ends). Cloud might be more expensive in the long run, but it includes hardware and hosting, and you receive continuous innovation. Also, SAP is giving incentives to move to the cloud (like bundling services in RISE). Many organizations conduct a business case analysis comparing the net present value of both options. The answer varies by situation – there’s no universal cheaper option, it’s about usage patterns and company strategy. - Q: What happens if we’re found to be under-licensed during an audit?

A: If an SAP audit finds you using more licenses than you purchased, the typical outcome is a compliance remediation proposal. That means SAP will ask you to purchase the missing licenses (often at list price, sometimes with back-dated maintenance). There usually isn’t a separate “fine” beyond buying what you should have had – it’s not like a legal penalty; it’s a contract compliance fee. However, the cost can be significant if you’re short on many licenses or high-value engines. The key is that during negotiations, you can often work out a deal. For example, instead of just buying “penalty” licenses, you might negotiate an upgrade or a new enterprise agreement that covers the shortfall more favorably. The worst-case scenario if you refuse to comply would be SAP revoking your license (rare and extreme) or litigation; however, it is almost always resolved commercially by purchasing additional licenses. - Q: Can we negotiate the pricing and terms of our SAP license?

A: Yes, especially if you’re a medium or large customer. Everything, from user license prices to payment terms to special contract clauses, can be negotiated. SAP has standard price lists, but few large customers pay those rates. Negotiation tactics include leveraging end-of-quarter sales push, committing to multi-year plans or broader adoption (to get bundle discounts), and using competitive insight (knowing what discounts peers got). You can also negotiate caps on maintenance increases, flexibility options such as swapping some license types for others, or cancellation rights for unused software. The key is to negotiate upfront because once you sign, SAP is less flexible until the next big renewal or purchase. - Q: What is SAP’s “RISE with SAP,” and does it change licensing?

A: RISE with SAP is a bundled subscription offering that includes SAP S/4HANA (cloud edition), hosting (on SAP or hyperscaler infrastructure), and managed services, such as upgrades and support, all in one package. It essentially changes licensing by consolidating multiple licenses (such as database, application, and users) into a simplified subscription measured in FUEs (Full User Equivalents). Under RISE, you don’t separately license the database or infrastructure – it’s included. You still assign user types (Professional, etc.), but SAP converts everything into a unified metric. For customers, RISE can simplify things (one bill for everything), but it’s a subscription – you don’t “own” licenses in the traditional sense. It often requires a new contract, effectively terminating the old on-prem licenses (with possible credit for their value). Yes, it does change licensing, as it transitions to an all-subscription model and hands more responsibility to SAP for running the system. - Q: How do I know if I have the right number of each SAP user license?

A: The best approach is to conduct an internal user license audit. Generate a user list with their roles and transaction history, and compare it against the definitions of each license type. For example, if a user has access to create sales orders, that likely requires at least a Functional user license. If they also have access to configure the system or cross-module transactions, that might bump them to Professional. SAP’s license measurement tools (LAW/USMM or the newer SAP Tool for Indirect Access and User Evaluation) can provide a baseline classification, but it should be reviewed for accuracy. Another tip: Map job titles or departments to license types as a rough guide (e.g., call center staff = Limited CRM User, warehouse staff = Warehouse User, accountants = Professional, etc.) and then adjust for exceptions. Regularly review these counts; if you find a type that is over-assigned, consider whether some users could be downgraded. Ultimately, maintaining an active roster of licenses versus users in a spreadsheet or SAM tool is the best way to know where you stand at any time.

Recommendations

To effectively manage SAP licensing and avoid pitfalls, CIOs and CTOs should consider the following action items:

- Implement a Licensing Governance Team: Establish a dedicated team or point-person responsible for SAP license management and compliance. This team should regularly review usage, handle audits, and liaise with SAP on contract matters.

- Classify and Monitor Users Proactively: Use role-based templates to assign the minimum necessary license type to each user. Continuously monitor user roles/activities and reclassify licenses if a user’s role changes or if they are given broader access than their current license allows.

- Conduct Annual Internal Audits: Perform your own SAP license audit at least once a year. Identify any shortfalls or surpluses in licenses and address them before SAP’s official auditors do. Internal audits will highlight optimization opportunities and compliance gaps early.

- Negotiate with Data in Hand: Before any SAP contract renewal or new purchase, gather data on your actual usage and license needs. Use this data to negotiate pricing and terms. Leverage benchmarks from similar companies (or advisors) to push for better discounts and clauses (like the flexibility to swap license types or cloud credits).

- Utilize SAP’s Conversion Programs: Stay informed about SAP’s license conversion or exchange programs (for example, moving from old ECC licenses to S/4HANA or trading user licenses for Digital Access documents). These programs often have deadlines or financial incentives that can significantly benefit your organization during times of transition.

- Optimize License Allocation Continually: Treat license management as an ongoing process. Reclaim licenses from departing users immediately and reuse them for new users instead of automatically purchasing more. If certain modules or engines aren’t used, consider terminating their maintenance to save costs (you can often reinstate them later if needed, albeit at a price).

- Train Your Teams on Compliance: Ensure your IT security, BASIS, and functional teams understand the basics of SAP licensing. For example, they should be aware that creating a new user isn’t just a technical step; it also has licensing implications. This awareness will help avoid inadvertent compliance issues (like spinning up a test system with duplicate users counted).

- Plan for the Future – Cloud vs On-Prem: Develop a roadmap that aligns your licensing with your IT strategy. If you intend to stick with on-premise for now but maybe move to the cloud later, don’t over-invest in perpetual licenses you can’t use after migration – negotiate contract clauses that allow conversion to cloud subscriptions. Conversely, if you commit to the cloud, ensure you have clear exit options or a clear understanding of costs after the initial term.

- Engage Independent Experts if Needed: If your organization lacks internal licensing expertise, consider bringing in third-party SAP licensing advisors for a one-time assessment or to provide support during a major negotiation or audit. Their insights on SAP’s tricks and industry best practices can pay for themselves in cost savings or risk avoidance.

- Maintain Excellent Documentation: Keep a living document (or SAM tool) that tracks your SAP entitlements (what you purchased), your current deployments (what’s installed/used), and your assignments (which user has which license type). This documentation should be updated with every change (new contract, user changes, etc.) and is your evidence and guide in any compliance discussion.

By following these recommendations, organizations can transform SAP licensing from a source of uncertainty and cost overruns into a manageable and strategic part of IT operations.

Read more about our SAP Licensing Services.