SAP License Migration Strategies for ECC, S/4HANA, and RISE Transitions

SAP license migration is the process of transitioning your existing SAP ERP software licenses (such as SAP ECC) to new license models required for SAP S/4HANA or cloud solutions.

For IT leaders, this is not just a technical upgrade but a critical contract and cost transformation.

A well-planned SAP license migration protects your prior investments and prevents duplicate payments for the same capabilities.

It requires early planning, careful mapping of old to new licenses, and strategic negotiation to secure maximum value and flexibility for your organization’s future.

The Push to Migrate SAP Licenses

SAP will end mainstream support for its legacy ERP (SAP ECC) in 2027, pressuring organizations to move to SAP S/4HANA, the next-generation ERP. Beyond the technical migration, this shift forces a licensing transition.

S/4HANA is considered a new product line with a different license structure and metrics, so you cannot simply carry over your old ECC licenses. IT leaders who invested millions in SAP licenses are understandably concerned about not paying twice.

SAP has publicly assured customers that they won’t be double-charged for equivalent functionality, but to realize this promise, you must execute a license migration or conversion with SAP’s involvement.

SAP offers programs to credit the value of your existing licenses toward new S/4HANA licenses or subscriptions. However, these incentives diminish over time. Early adopters enjoyed very generous credits (historically up to ~90% of the new license value could be offset by turning in old licenses).

In recent years, the credit percentages have decreased (roughly 70–80% credit as of 2024–2025), and SAP has signaled they will drop further each year, approaching 2027.

In practice, if you wait until the last minute, you might get only around 50–60% credit for your legacy investment.

This creates urgency: delaying too long can mean leaving substantial money on the table. In short, migrating licenses sooner can preserve more of your sunk costs, while procrastinating can lead to higher net new spending.

Read SAP Business One License Types.

SAP License Migration Options

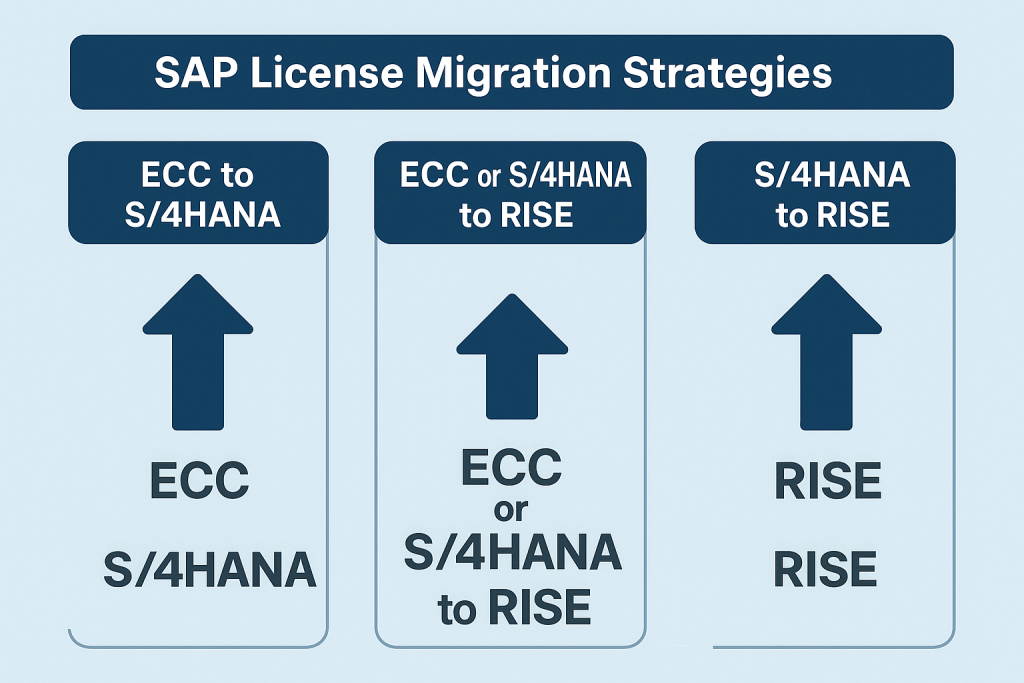

When moving to S/4HANA or SAP’s cloud offerings, there are a few paths for transitioning your licenses.

The main license migration options include:

- Product Conversion: Historically, SAP allowed customers to swap specific on-premise ERP licenses for their S/4HANA equivalents on a one-to-one basis. You keep your existing contract and simply replace (convert) old products with new S/4 products. All your previously negotiated discounts and terms stay intact. This approach enabled a phased migration – you could convert licenses module by module or department by department, and even run ECC and S/4HANA in parallel under “dual use” rights during the transition. Pros: Preserves legacy contract benefits, minimizes immediate costs, and has low disruption by maintaining contract terms. Cons: limited flexibility (you can only get S/4 products equivalent to what you already had); cannot eliminate unused licenses easily. ⚠️ Note: As of 2023, SAP has retired most product conversion options for those who didn’t already start. The special conversion SKUs were removed from SAP’s price list, meaning that new S/4 licenses can generally no longer be acquired via simple product swaps. If you haven’t locked this in earlier, you will likely need to pursue contract conversion or a new subscription deal.

- Contract Conversion: This is a “rip-and-replace” of your SAP agreement. You terminate your old ECC license contract and sign an entirely new S/4HANA license contract (under SAP’s updated S/4HANA pricing and terms). SAP gives you credit for the unused value of your existing licenses to offset the cost of new licenses. For example, if you had $10 worth of ECC licenses, SAP might credit a percentage of that toward your S/4 licenses purchase. Initially, the credit was very high (nearly 90%), but it has since been reduced (e.g., to 70–80% in recent deals, with further reductions expected annually). With contract conversion, you effectively have the opportunity to restructure your entire license portfolio. This means you can drop shelfware (unused licenses or modules) and acquire a different mix of products that better fit your current needs. You also immediately move to SAP’s latest licensing model (including new user definitions and metrics like Digital Access for indirect use). Pros: maximum flexibility to realign licenses; opportunity to eliminate waste and simplify your contract; ensures you’re on the latest terms (which cover innovations). Cons: It’s an “all-in” commitment up front – you start paying for the full S/4HANA contract right away, even if your technical migration is phased. It requires careful negotiation of a new agreement from scratch. Additionally, any favorable terms in your old contract must be renegotiated; otherwise, they may be lost. Contract conversion can yield long-term value but might increase costs in the short term if not managed well.

- Cloud Subscription (RISE with SAP): SAP’s strategic push is toward the cloud. RISE with SAP is an offering where, instead of owning licenses, you purchase a subscription that bundles the S/4HANA software, underlying infrastructure (cloud hosting), and services into one package. Essentially, you migrate to S/4HANA Cloud (in a private or public cloud edition) under a subscription model. This shifts your licensing from a perpetual license + maintenance model to a term subscription (OpEx instead of CapEx). When moving to RISE, you don’t do a line-by-line license swap; instead, SAP will factor in your existing license investments when setting the subscription price or incentives. For example, they may offer discounted subscription fees for the initial years or other credits, acknowledging your past investment. Pros: Simplifies the landscape by incorporating cloud infrastructure and SaaS benefits, reducing internal IT overhead, converting large upfront costs into predictable yearly expenses, and often includes the latest features and updates automatically. Cons: You effectively start a new contract, which can result in less flexibility in certain areas (standard cloud terms, limited customization). You also forego perpetual ownership of licenses in favor of “renting” the software. Over a long horizon, subscription can be more expensive if not right-sized, and you are dependent on SAP for ongoing services. Additionally, moving to RISE means relinquishing your on-premises license entitlements (which may be terminated or placed in shelf status) and trusting SAP’s cloud delivery; switching away later could be complex.

Each migration path has its place, and some enterprises even use a hybrid approach (e.g. a partial product conversion to buy time, followed by a full contract conversion or a move to RISE later).

Choosing the right option depends on your organization’s strategy: Do you want to stick with on-premise and gradually evolve, or jump fully into SAP’s new world?

Factors include how quickly you plan to implement S/4HANA, the amount of unused licensing you have, your appetite for cloud solutions, and your financial preferences (upfront spend versus subscription).

In today’s environment, contract conversion and RISE are the primary options for most, since SAP’s policy changes have curtailed the phased product swap route for new conversions.

Read Hybrid Licensing Models.

Key Challenges and Risks in License Migration

Migrating SAP licenses can be almost as challenging as the technical migration.

CIOs should be aware of several risks and pitfalls:

- Valuing Existing Licenses: A key challenge is receiving fair credit for the licenses you have already paid for. As noted, SAP’s credit policies are changing over time. If you migrate too late, you risk getting a much smaller offset, effectively “losing” a chunk of the money you spent on legacy licenses. For instance, a company that waits until 2027 might only receive credit for about half of its original license value, whereas migrating now might offset 70% or more. This timing aspect introduces a financial risk – delay can cost millions in lost credits.

- Functional Coverage Gaps: S/4HANA’s product modules and user definitions don’t line up one-for-one with the old ECC structure. Some ECC modules have been merged, renamed, or retired in S/4, while new modules have also been introduced. There is a risk that something essential might be left out during the conversion process. For example, you might convert your core ERP packages to S/4HANA Enterprise licenses; however, a niche component (such as a specific HR or supply chain feature) may have been separately licensed in ECC and isn’t automatically included in the new package. If overlooked, this could result in a functionality gap, necessitating an unplanned purchase later. To mitigate this, you must do a meticulous mapping of old licenses to new ones, involving functional experts from each department to verify that all critical capabilities are covered in the S/4 license lineup.

- Dual Environment Licensing: During the migration project, many organizations run ECC and S/4HANA in parallel for a period, allowing for testing, data migration, training, or phased rollouts by business unit. You need to ensure your contract allows this without incurring double payment. Typically, SAP provides “dual use” rights or a grace period, allowing you to continue operating the old system alongside the new one. However, these terms must be negotiated and documented. If you don’t secure explicit transition rights, you could technically be out of compliance (or be charged extra) for using both systems. Also consider fallback provisions – e.g., if your S/4HANA go-live is delayed, can you extend your use of ECC for a bit longer under support? Clarify what happens if timelines slip so you’re not caught needing emergency extensions (which SAP could charge for if not agreed upfront). Bottom line: ensure the migration plan is built into the license agreement with enough breathing room for parallel usage.

- Shelfware and Unused Licenses: Over the years, many companies, including those using SAP, accumulate shelfware – licenses for users or modules that are not fully utilized. A big risk in a naive migration is converting everything “as is,” including those unused licenses, which means you’d be paying maintenance or subscription on capabilities you don’t need. This is a wasted cost. The migration is a prime opportunity to clean house: identify what you’re not using and either retire or trade it in, rather than carrying it forward. However, identifying true usage versus what can be dropped is tricky and requires solid data (usage reports, stakeholder input) and possibly some reimagining of future needs. Failing to complete this homework could result in an oversized contract (and higher costs) after migration.

- Internal Alignment and Budget Impact: License migration isn’t just an IT exercise; it has accounting and procurement implications. Swapping perpetual licenses for subscriptions, for example, shifts spend from capital expenditure to operating expense, which may require CFO approval and budget planning. Additionally, if you write off old licenses, there may be financial statement considerations (those licenses might be assets on the books). Internally, different teams (IT, procurement, finance, and business units) need to be on the same page. There may be a political or incentive misalignment – e.g., a business unit might resist giving up licenses it “owns” even if they are unused, or procurement might be measured on cost savings while IT focuses on acquiring new capabilities. Effective coordination is needed to execute the migration smoothly. Lack of alignment can delay decisions or result in suboptimal outcomes (like converting unnecessary licenses due to internal pressure).

- Negotiation Pressure and Timeline: SAP account executives are eager to close S/4HANA deals and may impose pressure through incentive deadlines or a year-end push. Many CIOs report feeling rushed by SAP’s sales tactics (“This discount is only valid if you sign by Q4” or “Product conversion won’t be available next year, act now!”). While some of these pressures reflect real policy changes, others are sales strategies. The risk is signing a hurried deal that locks you into unfavorable terms or costs. Yes, there is a ticking clock (2027 end-of-support and diminishing credits), but don’t let that force a poorly planned migration. Rushing can lead to mistakes in license scope or missed opportunities in the contract. It’s important to negotiate at your own pace, armed with data and a clear strategy. If necessary, consult experts or obtain benchmarks from peer companies to ensure you’re receiving a fair offer. Remember that any new S/4 contract will likely span many years – it’s worth taking the time to get it right.

- New Licensing Metrics (Indirect/Digital Access): SAP’s licensing for indirect access changed with S/4HANA. Rather than charging by named users for third-party systems, SAP introduced Digital Access. This model charges based on documents created (such as sales orders and invoices) by non-SAP systems interacting with SAP. This can be a cost trap if not addressed. During migration, evaluate how your integrations (such as Salesforce and e-commerce platforms) will be licensed. SAP has offered a Digital Access Adoption Program in the past to help customers transition to document-based licensing with some credits. Ensure you factor this into your license migration plan so you’re not hit with surprise indirect usage fees later. In new S/4 contracts, clarify how digital access will be handled – you might need to purchase a document license bundle or ensure sufficient rights are included. Neglecting this could pose a compliance risk and additional cost post-migration.

By anticipating these challenges, CIOs can plan mitigations. Next, we look at how to approach the migration proactively to minimize risks and costs.

Best Practices for a Smooth License Migration

Successful SAP license migration requires treating it as a project in its own right.

Below are several best practices and strategies to help ensure a smooth transition:

- Start with a License Audit and Usage Analysis: Begin by inventorying all your current SAP licenses. Catalog how many of each user type and engine/module licenses you have, and how much you pay in annual maintenance. More importantly, assess actual usage – which licenses are actively in use and which are sitting idle. Tools like SAP’s License Administration Workbench (LAW) and user activity logs can help, but also gather input from application owners. Identify any obvious shelfware (e.g., 200 HR self-service user licenses purchased but only 50 used) as well as areas where usage is high. This data forms the foundation of your migration plan. It tells you what you need going forward versus what can be dropped or re-purposed.

- Align Licensing with Future Architecture and Business Needs: Don’t just carry forward what you had – think about what you will need in the S/4HANA era. For example, if you plan to implement new S/4HANA modules, such as embedded analytics or extended supply chain, consider including those in your conversion so you can use your credits to obtain them now (rather than purchasing them later with no credits). Conversely, if certain legacy modules are being replaced (maybe you’ll use a third-party cloud solution for some function instead of the SAP module), you might not need to license that in S/4. Map out your target S/4HANA solution footprint in collaboration with your enterprise architects and SAP functional consultants. This ensures the license migration covers the right products. It also prevents a scenario where you convert everything and later find out you’re missing a new capability, or you converted something that turned out to be redundant. Cover your future bases under the conversion deal, leveraging your existing investment to pay for as much of the new landscape as possible.

- Obtain SAP’s Proposal Early: Engage with SAP early in your planning. You can request a formal license conversion proposal or evaluation from SAP. Essentially, ask: “If we were to migrate our licenses now, what would our S/4HANA license entitlements look like and what credit or pricing can you offer?” SAP can generate a draft conversion quote that maps your current licenses to S/4 equivalents, including prices. Getting this baseline quote early is incredibly useful. Firstly, it helps you understand SAP’s starting point – perhaps they propose a contract conversion where your $5M in licenses becomes $6M in S/4 licenses with an $4M credit, meaning $2M net new spend (just as an example). If that offer isn’t favorable, you now have time to refine your approach (perhaps by reducing scope, negotiating discounts, or considering other options like RISE). Secondly, this early quote gives you concrete data to compare options – you could also ask for a RISE subscription quote in parallel. Having numbers on paper well ahead of deadlines enables rational decision-making, rather than last-minute scrambling. Don’t be afraid to go back and forth with SAP – often the first offer can be improved through negotiation or by demonstrating more precise license usage data.

- Migrate Licenses Sooner Rather than Later (if S/4 is Inevitable): Given the declining credit incentives, there is a strong financial case to convert licenses sooner once your organization is committed to S/4HANA. Some enterprises are even executing the license migration before their technical migration is fully done. In other words, they sign the S/4 contract and secure the credits and pricing now, while continuing to run ECC for a while longer. This can make sense if you want to lock in a good deal at 75% credit, rather than waiting two years and possibly only getting 50%. If you do this, coordinate closely with SAP on how maintenance fees will work during the interim. (Typically, once you convert, you start paying maintenance on the new S/4 licenses, and your old maintenance may be reduced or folded in. You shouldn’t be paying double maintenance – it usually transitions to the new contract – but ensure that’s agreed.) The key point is that if S/4HANA is in your roadmap, delaying the license conversion can cost you real money without much benefit, especially if the technical migration will occur anyway. Of course, don’t convert too early if your plans are uncertain, but waiting until 2026–2027 to decide will almost guarantee a higher price.

- Plan for Dual-Use and Transition Periods: As discussed in the risks, ensure that you negotiate transition rights into your agreement. Explicitly get SAP’s approval in writing that you can run legacy systems and S/4HANA in parallel for a reasonable duration (often 12–24 months, sometimes more depending on project length). Confirm how long you have and whether any extensions are possible. Also, clarify if any additional “temporary” license keys or documentation are needed to keep ECC running after conversion. SAP’s standard practice for contract conversions typically includes dual usage provisions, but you should verify the exact terms and duration. If you anticipate a multi-year phased rollout, request a longer dual-use period or, at the very least, a clearly defined process for extending it if needed. Having this nailed down avoids panic later if the project takes longer than expected. Similarly, include a clause for fallback: for example, if you encounter a critical issue and need to roll back from S/4 to ECC for a period, you won’t be out of compliance. It’s about ensuring continuity and avoiding unplanned costs if things don’t go perfectly.

- Maximize the Value of What You Turn In: When negotiating a conversion, you want the highest possible credit for your existing licenses. You can influence this. One tactic is to remove truly unused licenses from your entitlement before performing the conversion (if you’re in a position to terminate some licenses or let them lapse due to maintenance expiration). For instance, if you have 1,000 professional user licenses on paper but only 700 active users, you might negotiate with SAP to exclude the 300 unused licenses from your support before conversion, so that you’re not paying to convert them. Those could then potentially be counted as retired and some value given (or at least you’re not carrying them forward). Additionally, document your license usage and highlight the areas of high value to SAP – e.g., if you have a large number of certain engine licenses, ensure SAP’s credit calculation fully accounts for those. Essentially, come to the table with a clear view of what your legacy portfolio is “worth” and push to get as much credit as policy allows. If SAP’s current policy maxes at, say, 75%, aim for that. Every extra percentage point of credit on a multi-million dollar deal is significant. Also,Be mindful of netting: if you’re buying some net-new licenses as part of S/4 (for new modules or more users), see if the credit can apply broadly, such that you minimize net new spend.

- Negotiate Maintenance and Support Terms Wisely: In a contract conversion, your new S/4 licenses will come with an annual maintenance fee (typically 22% of the net license price). If you negotiate a deep discount on the S/4 license list prices, ensure that the maintenance is calculated based on the discounted price (net), not the original list price; otherwise, you will pay an inflated support cost every year. This is standard, but double-check it in the contract drafts. Also, compare the total maintenance cost after conversion with the cost before. If you ended up with more licenses or higher value (on paper) in the new contract, your 22% maintenance might increase your annual spend – factor that into TCO. You might negotiate a cap on maintenance increase for the first year or two, or some credits to ease the transition. Additionally, clarify support levels: S/4HANA might come with new support programs or require HANA database support, etc., so ensure you understand any changes in support fees.

- Build Flexibility into the New Agreement: Locking in a big new contract can be risky if your business changes. Try to include flexible terms. Examples: if your company divests a division or sells off a business unit, can you transfer or reallocate licenses that were tied to that entity (so you’re not stuck over-licensed after an organizational change)? Another example: if you are doing a phased migration, perhaps negotiate the ability to reduce (true-down) certain license counts after each phase if you find you don’t need as many in the new system. SAP contracts are not usually known for allowing downsizing, but some customers negotiate one-time adjustment rights or pool-based licensing to allow flexibility. At minimum, ensure the contract doesn’t forbid reallocating licenses across affiliates or geographies as your organization evolves. The more flexibility you have, the less likely you’ll end up with future shelfware or the need to buy additional licenses due to a scenario you didn’t foresee.

- Consider External Expertise and Benchmarking: Navigating SAP’s licensing programs and negotiation tactics can be daunting, especially if your team doesn’t frequently engage in such activities. Consider engaging an independent SAP licensing advisor or using benchmarks from user groups (like ASUG or SUGEN) to strengthen your position. Third-party experts have seen many deals and can identify if SAP’s proposal has hidden pitfalls or if there’s room for better discounts. They can also help script negotiation strategies (for example, using the option of delaying migration or using third-party support as leverage, if credible for your situation). Peer companies might share anonymously what kind of discount or credit they received. This information is gold when negotiating, as SAP’s pricing is often opaque and varies on a case-by-case basis. Even a brief consultation could save a significant amount in the final deal. At the very least, do your homework: read industry research, talk to your SAP user community, and go into negotiations with a clear view of what a “good deal” looks like.

By following these practices – auditing your licenses, planning, engaging early, and negotiating effectively- you can transform SAP license migration from a daunting cost into an opportunity.

Companies that manage this transition well often end up with cleaner contracts, more appropriate licenses for their needs, and cost predictability as they enter the S/4HANA era.

Negotiating an SAP License Migration Deal

Negotiation is a critical aspect of license migration. Here are some targeted negotiation tips to ensure you get the best outcome:

- Leverage Timing to Your Advantage: SAP sellers have quarterly and yearly targets. If possible, time your negotiations to align with SAP’s end-of-quarter or fiscal year-end, when they may be more likely to be more generous in closing a deal. Be careful, though – don’t let their timeline force you into an unprepared agreement, but use it to push for extra concessions (for example, ask for an additional discount or free extended support if you agree to sign by that quarter’s end).

- Explore All Options (and make it known): Even if you strongly lean towards one path (say contract conversion on-prem), it’s wise to evaluate multiple options – and let SAP know you are doing so. Solicit a cloud/RISE offer, look at third-party support costs, or consider sticking with ECC a bit longer. Showing SAP that you have alternatives or a willingness to delay can increase your bargaining power. If SAP believes you might choose a competitor or postpone migration, they often become more flexible in pricing to secure your commitment now. Use this as a negotiation lever, but be genuine – an empty bluff can backfire. If you are truly open to RISE vs. on-prem, play those proposals against each other to see where SAP will offer the better deal.

- Bundle and Save: If your company is also considering purchasing other SAP products or services (like Ariba, SuccessFactors, or SAP cloud platform services), bring them into the negotiation as a bundle. Larger deals give you more leverage to negotiate enterprise-wide discounts. You may secure a better overall price by signing a broader agreement that encompasses S/4HANA alone. However, be cautious not to get sold things you don’t need; only bundle what aligns with your roadmap.

- Get Every Promise in Writing: In complex negotiations, SAP representatives might make verbal promises – e.g., “We’ll allow you 24 months of dual use, no problem” or “If you need a few extra user licenses later, we’ll throw them in.” Do not rely on verbal assurances. Ensure all negotiated terms are documented in the contract or an official SAP quote. This includes transition periods, special discount renewals, future price protections, and other benefits. If it’s not in writing, it effectively doesn’t exist once the deal is signed.

- Understand Future Cost Commitments: Clarify how costs might change over time. For instance, if you sign a 3-year RISE subscription, what is the renewal rate cap for years 4 and beyond? If you’re currently receiving a certain credit, will additional conversions later (if you didn’t convert 100% this time) be at a worse rate? Nail down any multi-year pricing terms to avoid surprises. SAP often locks initial subscription terms, but can increase later; try to negotiate limits on those increases.

- Address Indirect Use Upfront: Use the negotiation to settle the indirect access/digital access issue. If you haven’t adopted SAP’s Digital Access document licensing yet, consider doing it as part of this contract, ideally with a discount or free document count to cover your needs. This can prevent a nasty audit surprise later. Negotiate a clause that states your new licensing covers known interfaces and that SAP won’t pursue additional license fees for those connections (to the extent possible). Some customers achieve contractual clarity that their specific third-party systems (by name) are covered under the agreed licensing metrics.

- Be Willing to Say No (or Walk Away): If SAP’s proposal isn’t acceptable, be prepared to pause or walk away from the table to regroup. Given the 2027 deadline, you likely can’t walk away forever, but showing that you won’t sign a bad deal is important. You may need to escalate within SAP or involve an executive sponsor from your side to negotiate a better offer. Sometimes, waiting another quarter or exploring interim solutions can result in a significantly improved proposal. For example, a company might decide to pay for one year of extended ECC maintenance (or third-party support) to avoid an overpriced conversion deal, then revisit negotiations the following year when SAP may be more receptive. Use the time you have smartly; don’t let fear of the deadline make you accept unfavorable terms.

- Keep Stakeholders Informed: During negotiations, keep your C-level executives and budget holders informed. If you can show the CEO/CFO that you’re saving X million via a savvy conversion deal, it’s easier to get quick approvals when needed. Conversely, if negotiations hit a snag, having executive backing for a hardline stance (e.g., “we’ll delay rather than overpay”) can strengthen your position. SAP sales often tries to engage your executives directly – ensure those leaders are armed with the facts and strategy so they don’t inadvertently undermine the negotiation (for instance, by expressing too much eagerness).

By negotiating wisely, you can significantly reduce the cost and improve the terms of your SAP license migration.

Many organizations have not only carried over their prior investments but also achieved incremental discounts or added value through skillful negotiation.

Remember, this is likely a multi-million dollar, multi-year commitment – investing time and effort into negotiation is well worth the payoff.

Recommendations

- Begin License Planning Early: Start an SAP license audit immediately to understand your current entitlements and usage. Early planning gives you time to explore options and avoid last-minute pressure.

- Evaluate All Migration Paths: Compare the financial and operational implications of contract conversion, cloud subscription, and any phased approaches. Solicit proposals for each and review them side by side.

- Maximize Credit for Legacy Licenses: Negotiate aggressively to get the highest possible credit for your existing licenses. Consider dropping or selling back unused licenses now to avoid carrying them forward into the next period. Migrate sooner to lock in better credit percentages before they diminish further.

- Secure Transition Rights in Writing: Ensure your new agreement includes dual-use rights to run ECC and S/4HANA in parallel, along with any necessary extensions or fallback provisions. This guarantees continuity and compliance during the migration period.

- Align Licenses with Future Needs: Use the migration as an opportunity to right-size and modernize your SAP portfolio. Only convert what adds value, and include new S/4HANA functionalities you plan to use so that you purchase them with credits.

- Involve Cross-Functional Stakeholders: Engage procurement, finance, and department heads in the process. Their input can validate which licenses are truly needed and support the internal budget approvals for the new contract.

- Consider Expert Help: Don’t hesitate to consult SAP licensing experts or peer benchmarks before finalizing the deal. An outside perspective can identify hidden risks or savings opportunities, thereby strengthening your negotiation position.

- Plan for the Long Term: Treat the S/4HANA contract as a long-term commitment. Negotiate flexibility (for business changes, growth, or downsizing) and clarity on future costs (subscription renewals, maintenance rates) so you’re not caught off guard a few years down the line.

FAQ

Q1: What is SAP license migration?

A1: It’s the process of transitioning your existing SAP software licenses (usually from SAP ECC or Business Suite) to the new licensing model required for SAP S/4HANA or SAP’s cloud offerings. This involves modifying your contract and entitlements to ensure you’re licensed correctly for the new S/4HANA system without incurring additional costs.

Q2: Why can’t we reuse our old ECC licenses for S/4HANA?

A2: SAP S/4HANA is technically a new product line with its own license metrics and product codes. Your ECC licenses cover SAP Business Suite software, which differs from S/4HANA software. SAP requires customers to convert or migrate licenses to ensure they have the right licenses for S/4HANA’s functionality. Essentially, S/4 is sold under new licenses, but SAP offers credit for your old ones so you don’t pay full price again.

Q3: What are my options for migrating licenses to S/4HANA?

A3: The main options are a Product Conversion (swapping individual licenses for S/4 equivalents under your existing contract – though this option is largely phased out now), a Contract Conversion (signing a brand new S/4HANA license contract and getting credit for retiring your old licenses), or migrating via RISE with SAP (cloud subscription), where you move to a SaaS model for S/4HANA. Each approach has pros and cons in terms of cost, flexibility, and risk.

Q4: How does SAP calculate credit for my existing licenses?

A4: In a contract conversion, SAP assesses the “license value” of what you own (often based on the license list price and your maintenance payments) and then offers a credit percentage against your purchase of new S/4HANA licenses. For example, if you need $5 million in S/4 licenses and SAP’s credit policy is 75%, they would use $3.75M worth of your old licenses to cover that, and you’d pay $1.25M net. The exact credit percentage is set by SAP policy (and negotiation) – it has been decreasing over time, so earlier conversions receive higher credits, while later ones receive lower credits.

Q5: What is RISE with SAP, and is it different from a license conversion?

A5: RISE with SAP is a subscription-based offering where SAP provides S/4HANA as a cloud service (including infrastructure). It’s not a license purchase per se, but rather an annual subscription fee. If you choose RISE, you aren’t doing a traditional “license swap” – instead, you negotiate a subscription contract. SAP will consider your existing licenses by giving you incentives (like reduced fees initially or credits) so that your prior investment is acknowledged. It’s a way to migrate to S/4HANA and the cloud in one step, moving from owning licenses to a cloud subscription model.

Q6: How can I make sure I’m not wasting money on unused licenses during migration?

A6: The key is to identify shelfware before you convert. Perform a thorough usage analysis of your current SAP environment. Any user licenses or modules that are not actively used should be questioned. When you migrate, you can drop these unused licenses (so you don’t pay maintenance on them or include them in the conversion). During contract conversion, you can also try to “trade in” shelfware for something more useful. Essentially, don’t convert what you don’t need – it’s an opportunity to cleanse and optimize your license portfolio.

Q7: What negotiation tips can help save costs on SAP license migration?

A7: Some tips: Start negotiations early and get a proposal from SAP to understand the baseline. Compare multiple options (on-prem vs RISE) to create competition. Use timing – SAP’s quarter/year-end can be leveraged for discounts. Negotiate the total package – obtain pricing for licenses, support, and any relevant cloud infrastructure together to see the full picture. Also, insist on contract terms that provide flexibility (such as dual use and the ability to adjust licenses, etc.). And of course, get all promises in writing. If you’re unsure, consider involving a licensing expert to assist with the negotiation.

Q8: How do we handle running ECC and S/4 in parallel – will we pay twice?

A8: You should negotiate dual-use rights as part of your migration. SAP typically allows customers to continue using the old system for a defined period while S/4 is implemented, without requiring extra licenses. This needs to be documented in your agreement. For example, your contract might state you can use ECC for 18 months after the S/4 contract start for transition purposes. During that time, you shouldn’t be charged additional license fees for ECC. The key is to have that clause included so you have legal permission to run both environments until you have fully migrated to S/4HANA.

Q9: What is SAP Digital Access, and do I need to be concerned about it during a migration?

A9: Digital Access is SAP’s licensing model for indirect use, when non-SAP systems or bots access SAP data. Instead of requiring a user license for those scenarios, SAP now charges based on the number of documents (such as orders or invoices) created. When migrating to S/4HANA, you’ll be asked to adopt the digital access model for those indirect scenarios. It’s essential to determine the number of documents your interfaces generate, as this will help you decide whether to purchase a “digital access license”. Many customers convert some of their old user licenses into a document license via SAP’s adoption program. So yes, include this in migration discussions to ensure you’re compliant and optimally licensed for third-party interactions with SAP.

Q10: What if we aren’t ready to move by 2027 – do we have alternatives?

A10: If you choose to stay on SAP ECC past 2027, SAP offers extended maintenance support until 2030 for an extra fee (typically an additional premium on your annual maintenance). Alternatively, some companies consider switching to third-party support providers for their SAP ECC (which can be cheaper but means you won’t get new updates). However, delaying migration has downsides: your ECC system will become outdated, and SAP’s incentives for conversion will dwindle. Also, if you leave SAP support, you might lose the ability to easily convert licenses later. In short, you can delay if necessary, but you’ll pay more for support and likely get a worse deal when you eventually migrate. Most IT leaders advise planning the move sooner to avoid being in a last-minute scramble or paying a premium later.

Read more about our SAP Licensing Services.