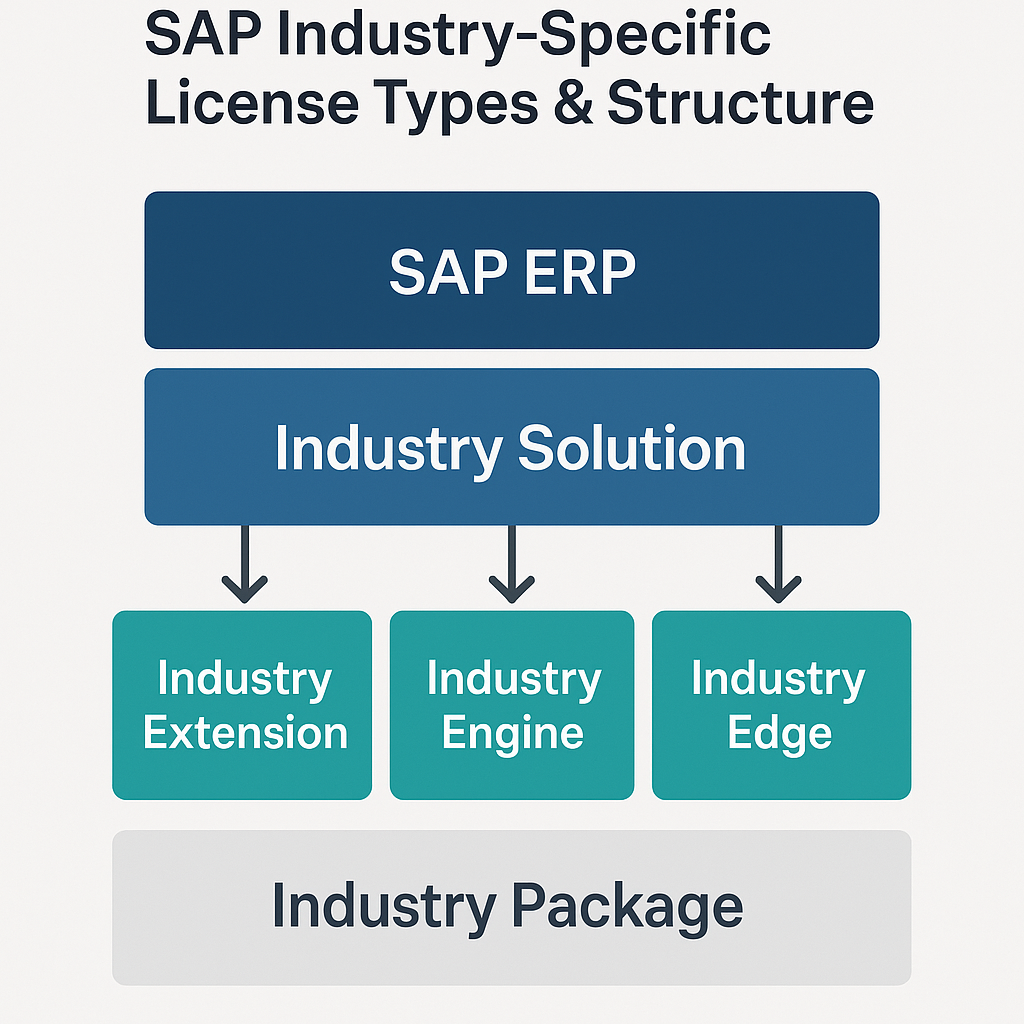

SAP Industry-Specific License Types & Structure

SAP’s licensing model is complex, especially for industry-specific solutions that go beyond standard ERP. IT leaders must navigate a mix of named user licenses and package (engine) licenses tied to business metrics.

By understanding SAP’s license structure and its variations by industry and deployment model, organizations can optimize costs, remain compliant, and negotiate more effective contracts.

SAP’s License Model Structure

SAP software licensing typically consists of two layers: named user licenses (for individuals accessing the system) and package or engine licenses (for specific functional modules, measured by usage).

In practice, this means that every individual user requires a license, and many advanced modules – particularly industry-specific solutions – necessitate additional licenses based on metrics such as transactions, revenue, or other units.

- Named Users: Each human user of SAP must be assigned to a specific license type. These range from high-level Professional users with broad access to limited or employee users with restricted use. Every user is a “named user” (tied to a unique ID), and a single license cannot be shared among multiple people.

- Package/Engine Licenses: Beyond user access, SAP offers add-on modules (engines) that provide extra capabilities or industry-specific solutions. These are priced by metrics relevant to their use. For example, a utility billing module might be licensed based on the number of customer accounts or meter readings processed. In contrast, a manufacturing planning engine might be licensed based on the number of plants or production orders per year. Unlike user licenses, which are fixed counts, engine licenses tie cost directly to business volume – as your usage grows, you may need to move up to the next tier or purchase additional capacity.

Notably, these two layers work in tandem. To use an SAP industry solution, you must have enough named users for your staff and the appropriate engine licenses for the industry-specific components.

The structure is not one-size-fits-all; it’s tailored to how the software is used in your business. This dual licensing model introduces complexity, but it enables flexibility in scaling for both users and workloads.

Read SAP Employee Licensing.

On-Premise vs. Cloud:

Traditionally, SAP sold perpetual licenses (a one-time purchase per user or engine metric, plus annual maintenance). Now, many offerings are available via subscription (cloud SaaS or RISE with SAP bundle), where you pay recurring fees for users and usage. In a perpetual model, you might buy 500 user licenses and a specific engine capacity upfront.

In a cloud subscription, you might pay monthly for a package that includes a certain number of users or transactions, with the vendor hosting the system.

The move to the cloud can simplify some metrics (SAP may bundle more features under one subscription). Still, it introduces its metrics, such as Full User Equivalents (FUEs), which are essentially weighted user counts used in RISE contracts.

The key for IT leaders is to align license entitlements with actual usage and choose a model (CapEx perpetual vs. OpEx subscription) that fits the organization’s financial and operational strategy.

SAP Named User License Types

SAP offers multiple user license categories to reflect different usage levels. Choosing the right type for each user is vital to control costs.

The main license types (for on-premise SAP ERP like ECC or S/4HANA) include:

- Professional User: Full access to SAP functionality. These are power users or heavy users (e.g., finance managers posting journals, supply chain planners, and system admins). Professional licenses are the most expensive per user because they allow unrestricted use across modules.

- Limited Professional (Functional) User: A restricted license for users who need significant access but only in certain areas. For example, a procurement clerk working solely in purchasing or an HR specialist utilizing HR modules might fall under this category. Limited/Functional users are cheaper (~30–50% lower cost than Professionals) because their scope is limited.

- Employee (Productivity) User: A low-cost license for light or self-service users. This covers employees who perform basic tasks, such as entering timesheets, creating expense reports, or viewing pay stubs in SAP. They have no broad system capabilities beyond their data. Employee licenses often cost a small fraction of a Professional license.

- Developer User: A license for technical staff who develop or maintain the SAP system but don’t execute business transactions. Developers get access to development tools and coding environments. This license is usually priced similarly to a Professional user (since developers need deep access). Only users actively engaged in development or system support should have this – normal business users do not require a Developer license.

To illustrate the cost impact, a Professional user license typically has a list price of around $3,000, whereas a basic Employee user license is roughly $300.

This 10:1 cost ratio means that misclassifying even a handful of casual users as professionals can result in thousands of dollars being wasted.

For example, if 100 light users are mistakenly given Professional licenses, the annual maintenance alone on those unnecessary licenses would be significant (since SAP’s support is ~22% of the license price each year). Always match the license type to the user’s actual needs.

Many organizations find they can downgrade 10-20% of users to cheaper categories with careful analysis without affecting productivity. Simple governance steps, such as regular user audits and the use of SAP’s monitoring tools (to track the transactions users execute), can help identify mismatches.

When negotiating contracts, try to include flexibility to swap or reassign licenses as needs change (e.g., trade some Professional licenses for more Limited licenses if you find you have purchased too many heavy-user licenses).

Table: Example SAP User License Types and Relative Costs

| License Type | Typical Use Case | Relative Cost (List Price) |

|---|---|---|

| Professional User | Broad, unrestricted use (power users, admins, key functional experts) | High (e.g. ~$3,000 one-time per user) |

| Limited/Functional | Significant use but limited to certain modules or tasks (department specialists) | Medium (around 50% of Professional) |

| Employee Self-Service | Very limited use for personal tasks (time entry, HR self-service) | Low (10–20% of Professional) |

| Developer | Technical development and support roles (non-production usage) | High (similar to Professional) |

Note: These are illustrative list price ratios. In practice, discounts vary – enterprise agreements often reduce effective prices by 30-60%.

The crucial point is to avoid giving a high-cost license to a user who doesn’t need that level of access.

Read SAP Package Licensing.

Package Licenses and Industry Metrics

In addition to users, SAP licenses many software components based on business metrics, especially in industry solutions.

These packages or engine licenses cover specific functionality (sometimes entire industry applications) and use measurements aligned with the value or usage of that module.

Common metric categories include:

- Transaction or Document Volume: For example, SAP’s Digital Access licensing counts documents (like the number of sales orders, invoices, etc., generated by non-SAP systems). Similarly, a procurement module might be licensed by the number of Purchase Orders processed annually.

- Revenue or Financial Volume: In some industries, add-ons (e.g., in the insurance or retail sectors) are priced by a revenue band. An insurance claims system might charge per $1 billion of premiums processed; a retail solution could scale with annual sales revenue. As your company’s revenue grows, you might cross into higher license tiers.

- Employee or Headcount: HR and talent management solutions often use the number of employees as the metric (e.g., SAP payroll engine per 1,000 employees on the system). If your workforce increases, you’d need to true-up the license.

- Technical Capacity (CPU/Memory): For databases and middleware, metrics such as CPU cores or memory size in gigabytes may be applicable. For instance, if you run SAP HANA on-premise, you might license it per 64GB of memory. Upgrading your hardware or allocating more memory may result in a higher license requirement.

- Other Industry-Specific Units: Many SAP industry solutions have unique metrics specific to their respective domains. Examples: “barrels of oil per day” for an oil & gas upstream module, “occupied hospital beds” for a healthcare solution, “utility meter connections” or “number of customers” for a utility billing system. SAP chooses metrics that reflect the scale of activity – the idea is that a larger operation derives more value and thus pays more for the software.

These engine metrics often come in predefined tiers or blocks. You may purchase a license that covers up to a certain amount of the metric, and if you exceed that limit, you will need to purchase additional blocks or upgrade to the next tier. It’s critical to forecast your usage of these metrics.

Underestimating can lead to compliance issues or unbudgeted costs if you outgrow your license mid-contract; overestimating means you’ve paid for capacity (often referred to as shelfware) that you’re not using.

For instance, if a utility company licenses SAP for 500,000 customer accounts but only has 300,000 active customers, the extra 200,000 accounts are wasted expenditure (yet you’re still paying maintenance on them).

Conversely, if they grow to 600,000 customers without updating the contract, an audit could find them out of compliance.

Monitoring and flexibility are key. IT leaders should ensure they have processes in place to track these metrics (e.g., how many orders are we processing versus what we have licensed?) and include provisions in contracts for reasonable growth.

When negotiating, consider adding clauses for threshold adjustments or temporary bursts so that normal business growth doesn’t immediately trigger a huge new purchase.

Also, be aware that SAP periodically changes metric definitions or offers new licensing models – for example, some customers negotiate a “flat” metric license (unlimited usage in one area for a premium price) if that simplifies things.

Always evaluate whether metric-based licensing aligns with your usage patterns or if an alternative model (such as a more comprehensive user license or enterprise license) might be more cost-effective for your scenario.

Industry-Specific Licensing Examples

SAP offers tailored solutions for various industries, each of which often comes with its unique mix of user and engine licenses.

Here are a few examples of how licensing can differ by industry:

- Manufacturing: A manufacturer typically utilizes a core ERP system supplemented by manufacturing execution or planning modules. They might license 50 Professional Users for engineers and planners, 200 Limited Users for plant floor operators, and an engine for up to 100,000 production orders per year. If the company ramps up to 120,000 orders, it will need to purchase additional capacity. Integration with shop-floor systems (e.g., IoT sensors automatically creating production orders) is common. This indirect usage needs to be licensed, too (often via SAP’s Digital Access document counts or by assigning a generic user license to the interface). The goal is to align license counts with roles – e.g., Forklift drivers or machine operators may only require an inexpensive limited license, not a full Professional License.

- Utilities: Utility providers (such as electric, water, etc.) leverage SAP for Utilities solutions to manage billing, metering, and customer service. Engine licenses here are typically based on the scale of operations, such as the number of active customer contracts or meter points. A city power utility might pay for up to 1 million meter connections. They also have a large number of users across call centers and field services. Those user licenses need to be right-sized (a call center agent looking up accounts might just need an Employee or Limited license, while a billing manager needs a Professional license). Also, because customers interact via web portals or mobile apps, a lot of consumption happens indirectly (customers triggering SAP transactions). That means the utility must account for those indirect uses (either by named user licenses for external users or, more practically, by the Digital Access document model for items such as service orders and payments originating from outside).

- Retail: Retail companies utilize SAP for merchandising, supply chain management, and often point-of-sale integration. They tend to have a very large number of end users (store staff, planners, warehouse clerks). Most of these users only need limited functionality (e.g., a store clerk might just review stock or enter a goods receipt). Retailers optimize costs by using lower-tier user licenses for these roles at scale. On the engine side, a retail solution like SAP Customer Activity Repository (CAR) can be licensed by transaction volume or number of stores. For example, a retailer could license CAR for data from up to 500 stores and a certain number of POS transactions per day. If they add more stores via expansion, the license must scale up. Additionally, retail has heavy integration with e-commerce and third-party systems, making Digital Access considerations vital (e.g,. each online order creates a sales order in SAP – without proper licensing of those documents, the retailer could be out of compliance).

- Healthcare and Life Sciences: Hospitals using SAP may license modules based on the number of patients or beds. For instance, an SAP healthcare solution could charge per occupied bed or hospital admission processed. Pharmaceutical companies may use SAP Advanced Track & Trace for Pharmaceuticals (ATTP), which can be licensed based on the number of serial numbers tracked or transactions in the serialization system. Compliance is critical in this sector, so they must ensure that all systems (often validated for regulatory purposes) are fully licensed and documented. User licenses in these environments typically cover lab technicians, pharmacists, and other professionals, often under Professional or Functional categories due to the critical nature of their work. Still, there may also be many casual users (such as doctors viewing data) who only need limited access.

- Oil & Gas: SAP’s industry solutions for oil and gas might measure usage by production volume or assets. An upstream operations module might charge based on the “barrels of oil per day” capacity or the number of wells it manages. If an oil producer’s output grows or they drill new wells, licensing costs will rise accordingly. These companies also utilize standard SAP ERP; for example, maintenance workers and project managers will require appropriate user licenses. Given volatile commodity production levels, oil & gas firms often negotiate flexibility to scale engine licenses up or down to match production without incurring full new purchases each time.

Across industries, the pattern is consistent: user licenses for each person interacting with SAP, plus engine licenses reflecting the business scale or processes in that industry.

IT leaders should work closely with functional departments to forecast usage metrics (such as the number of stores, patients, or barrels) and avoid both under-licensing and over-licensing.

Real-world contract negotiations for industry solutions often revolve around these metrics – for example, ensuring the metric definitions are crystal clear and perhaps setting a baseline now with options to expand later at a predefined price.

Always examine whether SAP offers industry bundles or special programs (sometimes SAP has industry-specific bundles that package common components for a fixed price, which can simplify licensing if it fits your needs).

On-Premises vs. Cloud Subscription Considerations

SAP licensing structure is also influenced by the deployment model: on-premises (perpetual) vs. cloud (subscription). The core concepts of user and engine licenses still apply, but the payment and scaling methods differ.

With perpetual on-premise licenses, you pay a large one-time fee for each license (user or engine) and then pay annual maintenance (usually 20-22% of the license cost) for support and updates. You own the usage rights indefinitely.

This model often makes sense if you plan to use it for a long term (7-10+ years) and want full control. However, it requires upfront capital, and you must manage the infrastructure (hardware, hosting) or pay someone to host your licensed software.

In a cloud subscription model, such as SAP S/4HANA Cloud or RISE with SAP, you pay a recurring subscription fee (monthly or yearly) that typically includes the software license, support, and cloud infrastructure in a single bundle.

This is more like renting the software – if you stop paying, you lose access. Subscription licensing converts the cost into an operating expense, avoiding a significant upfront investment.

It also allows for more elasticity: you may be able to adjust the number of users or capacity at renewal cycles rather than purchasing fixed licenses that sit idle.

For example, instead of $5M upfront for perpetual licenses, a company might pay approximately $150,000 per month for a similar scope in the cloud over three years, which equates to $450,000, spread out slightly more evenly and with all hosting included.

Cloud contracts often use simplified metrics. One common approach in RISE with SAP is the Full User Equivalent (FUE) model, where different user types are assigned weights (e.g., a Professional user = 1.0 FUE, a functional user = 0.5, a self-service user = 0.1, etc.). The subscription is priced based on the total number of FUEs.

The organization can mix and match roles as long as the sum stays within the purchased FUEs. This can be convenient but requires understanding those weights – e.g., adding more heavy users might consume FUEs faster than expected.

Cloud solutions may also include some engine functionality by default or utilize different metrics (for example, SAP’s cloud procurement might charge based on spending managed through the system rather than distinct engines).

Key differences to manage:

- Contract Term: On-prem is indefinite use; the cloud is time-bound (commonly 3-5 year contracts). Ensure you can renew on favorable terms and understand any annual price escalators in subscriptions.

- Scaling Up or Down: On-premises requires purchasing new licenses for growth (or shedding maintenance for reduction, which can be challenging once purchased). Cloud often allows you to scale at renewal or sometimes mid-term (with additional fees); however, scaling down is challenging – you usually commit to a minimum term until the contract ends.

- Cost Over Time: Subscriptions can end up costing more if used over a long term, but they provide flexibility and offload infrastructure costs. Always do a total cost of ownership (TCO) comparison. A perpetual license might pay off in year 5 or 6 compared to the cloud, but only if you’re confident you’ll use the system at stable capacity that long.

- Customization: On-prem allows extensive customization of SAP software. Cloud SaaS (especially public cloud editions) may limit the extent to which you can tailor the system. If your industry solution requires heavy customization, a private cloud or on-premises solution may be preferable, despite licensing differences. RISE with SAP (private cloud) aims to give more flexibility while still being subscribed.

- Audit and Compliance: Regardless of the model, SAP will conduct audits of usage. In on-prem, audits ensure you haven’t exceeded user counts or metric limits. In the cloud, audits and checks ensure that you aren’t using more than your subscription entitles you to (e.g., exceeding the number of users or transactions allowed by the contract). In both cases, you must manage usage, but the cloud might automatically meter and charge overages, whereas on-prem might result in a formal audit finding and a surprise bill.

For IT leaders, the takeaway is to align the license model with organizational priorities. If you value control and long-term cost certainty (and have the capital budget), perpetual licenses could make sense.

Suppose flexibility, quicker startup, and cloud benefits are priorities. In that case, subscription might be better, but plan for the long-term implications and negotiate caps on price increases or clear definitions of how growth will be charged.

Common Pitfalls and Compliance Risks

Navigating SAP’s licensing without careful management can lead to expensive pitfalls. Here are some common issues and how to mitigate them:

- Indirect Access (Digital Access): This occurs when third-party applications or external users utilize SAP data or functions indirectly (e.g., an e-commerce site creating orders in SAP or sensors updating inventory). SAP requires licensing for this usage, which has historically been a grey area that has led to high-profile audit penalties. Now, SAP offers a Digital Access Document model to license these interactions by document counts. Risk: If indirect use isn’t licensed, an audit could impose back-charges for every document or user that accessed SAP indirectly. Mitigation: Identify all non-SAP systems that interface with SAP. Either assign properly named user licenses for external systems (which may not always be practical) or adopt the Digital Access licenses. Negotiate a reasonable package for digital access upfront – SAP has offered discounted bundles for this to existing customers. Monitor those document counts annually to stay compliant.

- Misclassified Users: As discussed, giving everyone a Professional license “just in case” is costly. Risk: Overspending on license fees and maintenance for capabilities many users don’t need, or conversely, the compliance risk if a user with only an Employee license is performing tasks requiring a higher license (audit finding). Mitigation: Conduct periodic license reviews. Use analysis tools to right-size user licenses based on actual usage. Implement a governance process when onboarding new SAP users – assign the lowest appropriate license first and only upgrade if their role truly demands it. Keep documentation of how each user type is determined in case of audit questions.

- Exceeding Engine Metrics: It’s easy to outgrow the licensed metric as the business scales (e.g., more sales, more employees). Risk: If you exceed a licensed limit (e.g., you are licensed for 1 million orders/year but process 1.2 million), you are technically unlicensed for the excess – audits will catch this and could demand true-up fees and back maintenance. Mitigation: Proactively track your usage. Many SAP engines have measurement tools or reports; run them quarterly to identify trends. If you’re nearing a limit, engage with SAP early about expanding the license or explore ways to optimize usage to stay within bounds. Also, consider negotiating buffer capacity in the contract (e.g., a slight overage allowance or a discounted rate for extra units if needed). This avoids punitive costs after the fact.

- Shelfware (Underuse of Licenses): Enterprises often purchase more licenses or SAP products than they end up using (sometimes due to bundle deals or overestimation). Risk: Money tied up in unused software and paid maintenance on it annually (~22% of license cost) with no value in return. Mitigation: Only buy what you need for the near-to mid-term. It’s better to add licenses later than over-buy upfront “just in case” (SAP sales might push bundle incentives, but weigh them carefully). If you already have shelfware, you may be able to terminate maintenance on unused licenses to stop the bleeding. SAP typically allows dropping certain licenses at contract renewal anniversaries if you provide notice. Also, explore whether SAP’s license exchange programs (like swapping unused licenses for credit toward new products) apply – sometimes, under a new S/4HANA contract, SAP gives credit for old licenses you won’t use.

- Unclear Contract Definitions: SAP agreements often contain jargon and specialized definitions. If terms like “Indirect access” or specific metrics aren’t clearly defined, you could get caught out. Risk: Misinterpretation of what’s allowed (e.g., you thought a third-party system was covered, but SAP later claims it wasn’t) or scope creep (SAP introduces a new product and claims you need additional licenses). Mitigation: Scrutinize contract language. Ensure every metric and license type is explicitly defined. Include examples in the contract if possible. Maintain a good dialogue with SAP or an independent licensing advisor to clarify any uncertainties before you sign. For large or complex deals, involve legal and licensing experts to negotiate terms that are fair and clear.

By staying vigilant about these areas, IT leaders can avoid the most common and costly licensing mistakes. Remember that SAP’s licensing policies evolve – for example, the move towards cloud subscriptions and digital access arose from prior pitfalls.

Keep updated on SAP’s licensing changes (SAP regularly publishes notes or guides on licensing updates) and ensure your team and contracts adapt accordingly.

Recommendations

- Map Roles to License Types: Thoroughly map your user roles to appropriate SAP license types. Don’t over-provision Professional licenses to users who can suffice with a Limited or Employee license. This alignment can quickly cut costs and should be revisited periodically.

- Monitor Usage Metrics: Implement regular monitoring for engine metrics (transactions, users, revenue, etc.). Use SAP’s measurement tools to track consumption against what you’re entitled to. Early detection of a growth trend lets you plan for additional licenses or optimize usage before an audit forces the issue.

- Negotiate with Headroom: When contracting with SAP, consider negotiating some headroom or flexible terms to accommodate future growth. For example, include an option to add 10% more users at the same discount or agree on fixed pricing for the next tier of engine metrics. This avoids paying a premium later under pressure.

- Leverage SAP Programs: Stay informed about SAP’s licensing programs, such as RISE, cloud conversion offers, or product bundling relevant to your industry. Sometimes, SAP offers incentive pricing to move to a new platform (like S/4HANA or cloud). These can be advantageous, but ensure the new model truly suits your usage before making the switch.

- Audit Your Licenses Annually: Don’t Wait for SAP’s Official Audit. Do your internal license audit at least once a year. Check user counts, license classifications, and engine usage. This proactive approach helps you resolve issues (reassign licenses, drop unused ones, and purchase additional ones where needed) on your terms, rather than scrambling during a vendor audit.

- Optimize and Recycle Licenses: Treat SAP licenses as a strategic asset. If someone leaves the company, reassign their license to a new user instead of automatically buying a new one. If a project ends and a module is no longer in use, consider sunsetting those engine licenses to save on maintenance costs. Regularly evaluate if you can redistribute or reduce licenses to eliminate waste.

- Engage Experts for Negotiation: SAP licensing and contracts are intricate. Consider involving a licensing specialist or third-party advisor when negotiating large contracts or renewals. They can identify negotiation levers (like global discount benchmarks, favorable contract clauses, or knowledge of typical SAP flexibility in your industry) that result in better terms and cost savings.

- Understand Cloud vs. On-Prem Trade-offs: Before committing to RISE or any cloud subscription, do a long-term cost and flexibility analysis. For some, the cloud’s simplicity and lower upfront costs are worth it; for others, the long-term expense and reduced control might be a downside. Make an informed decision aligned with your IT strategy, and don’t be afraid to push SAP for a hybrid model if that suits you (e.g., keep some systems on-prem and some in the cloud).

- Clarify Indirect Usage Early: If your SAP system connects with many external systems, address indirect usage in your contract. Negotiate a fair model (document-based or a blanket third-party access license) upfront. This way, you have budget certainty and compliance for those interactions, and you avoid surprise claims that third-party systems caused a license breach.

- Plan for Future Needs: Review your business roadmap (including M&A plans, expansion into new markets, and introduction of new product lines) and anticipate how these initiatives may impact SAP usage. If you acquire a company, you’ll inherit new users and possibly different SAP contracts – plan how to consolidate and ensure enough licenses. If you aim to implement new SAP modules (e.g., advanced analytics or an Industry 4.0 solution), factor those into your license plan and negotiate bundle pricing when possible, rather than purchasing one-offs later.

- Maintain Executive Oversight: Finally, treat SAP license management as an ongoing governance issue, not a one-time procurement. Regularly brief CIO/CFO executives on license posture and costs. This maintains high awareness, ensures a budget for proper licensing, and prevents the scenario of a sudden audit revealing millions in unplanned liability. With informed leadership support, you can approach SAP licensing strategically rather than reactively.

FAQ

Q1: What are the main SAP license types I need to know?

A1: The primary SAP license types are Named User licenses (assigned to individuals) and Package/Engine licenses (for specific modules or functions measured by usage). Named users come in various flavors, including Professional (full access), Limited/Functional (restricted to specific tasks), Employee (self-service/light usage), and others. Package licenses cover items such as industry solutions or add-ons, measured by specific metrics (e.g., transactions, revenue, number of assets). In short, every user needs a named user license, and certain SAP functionalities (especially industry-specific ones) require additional metric-based licenses.

Q2: How do industry-specific solutions affect SAP licensing?

A2: Industry solutions typically introduce specialized engine licenses. SAP tailors modules for industries (retail, utilities, healthcare, etc.) and often charges based on an industry-relevant metric. For example, a utility company licenses based on the number of customer accounts or meter readings, whereas a hospital might license based on the number of beds or patients. The core named user licenses still apply to your employees using the system, but you’ll add these industry engine licenses on top. It’s essential to identify these metrics and incorporate them into your license planning if you utilize an industry solution, as they can significantly impact cost and compliance.

Q3: What’s the difference between on-premises licensing and SAP’s RISE or cloud licensing?

A3: On-premises (perpetual) licensing means you buy the software licenses outright and typically run SAP on your infrastructure (or hosted environment). You pay maintenance annually for support. Cloud licensing (such as RISE with SAP or SAP S/4HANA Cloud) is a subscription-based model – you pay a recurring fee that includes the software, as well as often the cloud infrastructure and support. The difference lies in the payment model (CapEx vs OpEx) and flexibility. On-premises, you incur high upfront costs but own the rights indefinitely; on the cloud, you spread costs over time but must continue to pay to use them. Cloud contracts often use concepts like Full User Equivalents or simplified bundle metrics instead of a la carte user and engine licenses. Deciding between them involves evaluating the total cost over your expected timeline, your need for customization or control, and your organization’s preference for capital versus operational spending.

Q4: How can we reduce our SAP licensing costs without risking compliance?

A4: There are several strategies. First, ensure optimal license assignment – don’t give an expensive license to someone who only needs basic access. Audit user roles and utilize tools to determine if some users can be downgraded to lower-cost license types. Second, actively manage engine usage – if you are licensed for more volume than you use, consider adjusting down at renewal to avoid paying maintenance on unused capacity. Conversely, avoid compliance issues by monitoring usage so you can purchase additional licenses before exceeding limits (you’re then negotiating proactively, not paying audit penalties). Third, negotiate better terms: if you’re a large customer or undertaking a significant upgrade (such as migrating to S/4HANA or the cloud), use this as leverage to secure discounts or value-added benefits (e.g., complimentary training or bundling an additional module at a reduced cost).

Q5: What is SAP “indirect access,” and why is it such a big deal?

A5: “Indirect access” refers to any scenario where SAP is used by something other than a human directly logging into SAP. For example, if an e-commerce website or a mobile app pulls data from SAP or pushes transactions into SAP, those interactions are indirect. Historically, SAP’s stance has been that if SAP is being used (even indirectly), it still requires a license. This became a significant issue because some companies were integrating multiple systems and believed that only direct users required licenses. However, after audits were conducted, SAP claimed fees for all indirect usage. SAP’s newer solution is the Digital Access Document model, which tracks certain document types created indirectly (such as sales orders and invoices) and requires a license for a bundle of those documents. It’s a significant issue because indirect usage is prevalent in modern IT landscapes and can represent a hidden licensing cost. IT leaders should inventory all external systems interfacing with SAP and ensure they have a licensing approach in place for them, whether it involves covering them under the document model named user licenses for external parties or a special agreement with SAP. Proactively addressing indirect access in your contract prevents nasty surprises later.

Q6: How do SAP license audits work, and what should we do to prepare?

A6: SAP license audits (often referred to as “license reviews”) typically occur annually or biennially. SAP will ask you to run measurement programs (like SAP’s USMM and LAW tools) that count your users and usage of various engines against what you have purchased. They’ll compare the counts to your entitlements and identify any shortfalls. To prepare, conduct your measurements first to ensure everything aligns. Clean up any obsolete user accounts (ensure you’re not licensing users who left the company, etc.), correct any wrong license assignments, and double-check engine metrics usage. Have documentation ready for your license counts and any assignment rationale (e.g., why certain users are categorized as limited). If an audit finds you under-licensed, you’ll be asked to purchase the deficit (and back-maintenance for the period you were under-licensed). It’s better to find and fix those issues proactively. Also, during audits, maintain a collaborative yet careful approach – provide the requested data, but also review the results SAP provides. If something looks off (say, they counted a technical user as a real user or counted documents that shouldn’t count), you can contest it with proper justification. The best defense is to manage licenses continuously, so the audit is just a formality.

Q7: We plan to move to S/4HANA or RISE – how will that impact our license structure?

A7: Moving to SAP S/4HANA can impact licensing in a few ways. If you stay on-premise S/4HANA, the named user types are broadly similar (SAP has streamlined some definitions, but you’ll still have Professional, Functional, etc.). Many of your existing licenses can be carried over through conversion programs. However, S/4HANA introduced the Full Usage Equivalent (FUE) model for cloud deployment. If you opt for RISE with SAP (essentially S/4HANA as a cloud subscription, plus infrastructure, and some platform services), your licensing may shift to the FUE metric or other subscription terms. Essentially, you would stop paying maintenance on old licenses and start a subscription contract. It can simplify things (one contract for software+infrastructure), but note that RISE bundles can include only the core — some satellite products (SuccessFactors, Ariba, industry-specific cloud apps) might still be separate subscriptions. It’s essential to collaborate with SAP and potentially an independent advisor to align your current entitlements with the new model. Sometimes, SAP offers credit for your existing licenses if you convert them to cloud subscriptions. Expect differences, such as no direct hardware costs (since these are included in the subscription), possibly a minimum contract term (e.g., 3 years), and a different method of counting users. In summary, a move to S/4 or RISE is an opportunity to restructure your licenses – ideally to your benefit by eliminating shelfware and getting a modernized contract – but ensure you understand the new rules and don’t lose any usage rights you need in the transition.

Q8: Can we negotiate SAP pricing? Or are license fees fixed?

A8: Absolutely, SAP pricing is negotiable, especially for large enterprises or significant deals. The official price list (which outlines list prices for each user type or engine) is just a starting point. In reality, discounts in SAP deals can be substantial (30%, 50%, and sometimes even more off-list prices), depending on factors such as deal size, the strategic importance of your account, end-of-quarter timing, and the quantity you’re purchasing. Key negotiation tactics include bundling purchases (licensing multiple products together for a better overall discount), leveraging competition (if SAP knows you’re considering a competitor or alternative, they might be more flexible), and aligning with SAP’s sales incentives (for example, if SAP is pushing cloud adoption, they might give extra discount or free add-ons if you sign a cloud deal now). It’s also possible to negotiate price protections (caps on maintenance increases or future price locks for additional users) and favorable payment terms. The main point is to treat SAP licensing like any other major procurement – do your homework (know your needs and the fair market value), engage in back-and-forth discussions, and don’t be afraid to push for concessions. Often, bringing in an experienced negotiator or consultant who knows SAP’s playbook can help uncover where you can save. SAP wants your business in the long term, so they often come to mutually agreeable terms if you have a solid rationale and alternatives.

Q9: What should we include in an SAP contract to protect our interests (from a licensing perspective)?

A9: Besides the obvious, like pricing and quantities, there are a few clauses and conditions to consider:

- Clear Definitions: Ensure that every license metric and user type is clearly defined to prevent ambiguity. If you expect to use a system in a certain way (such as accessing third-party systems), describe it and confirm that it’s allowed or licensed.

- Audit Process: Some customers negotiate audit notice periods or dispute resolution steps (so an audit can’t be used punitively without giving you a chance to respond).

- Flexibility Clauses: As mentioned, try to include the ability to swap license types, drop a percentage of licenses from maintenance annually, or carry over unused cloud subscriptions to the next period – any flexibility that prevents waste.

- Price Locks & Escalators: If on-premises, lock in discount percentages for future purchases (e.g., if you buy more users next year, they receive the same discount). In cloud deals, watch for annual price escalators (the standard might be 5% per year – you can attempt to negotiate it lower or flat for a certain term).

- Termination/Exit: If you’re going cloud, ensure you have clarity on what happens if you don’t renew – data extraction, transition assistance, etc., so you’re not locked in forever.

- Indirect Use Clause: If possible, get language that clarifies how indirect access is handled (some customers have gotten clauses stating that certain interfaces are covered without additional license – though SAP’s general stance is the digital access model now).

In summary, a well-negotiated SAP contract will not just state what you’re buying now but set guardrails for future situations (growth, audits, changes). Involving your procurement and legal teams will help ensure these protections are included. It could save a lot of money and headaches down the road.

Q10: How do I keep up with changes in SAP licensing?

A10: SAP licensing policies and offerings do evolve – for example, the introduction of digital access documents, new cloud bundles, renamed user categories, etc. To stay updated, leverage a few approaches: maintain contact with your SAP account manager and ask to be briefed on any changes affecting licenses; follow SAP’s official updates (they sometimes publish notes or blog posts on the SAP Community about licensing changes or new models); and engage with the wider user community. There are SAP user groups (like ASUG in the Americas or DSAG in Germany) that often discuss licensing issues and share knowledge. Consider attending SAP webinars or conferences where roadmap and licensing might be discussed. Additionally, working with independent SAP licensing advisors or consulting analyses from firms specializing in software asset management can provide you with early insight into potential changes. By staying informed, you can adapt your license strategy proactively – for instance, if SAP is phasing out a certain license type or offering a limited-time conversion deal, you can take advantage of it rather than react late. In short, make licensing an ongoing topic in your SAP governance, rather than something you only consider during purchase or audit time.

Read more about our SAP Licensing Services.