RISE with SAP Sovereign Edition

RISE with SAP Sovereign Edition is SAP’s cloud offering tailored for organizations that need strict data residency and compliance controls.

In simple business terms, it’s a version of RISE with SAP (the all-in-one S/4HANA cloud subscription bundle) designed to run in a sovereign cloud environment, meaning the data centers, support staff, and processes are confined to a specific country or region to meet regulatory demands.

It exists because in 2025, companies in highly regulated sectors (public sector, defense, financial services, healthcare, critical infrastructure) face intense regulatory pressure around data privacy and sovereignty. Read our guide to SAP Sovereign Cloud.

High-profile rulings like the Schrems II case in the EU have invalidated easy data transfers and forced businesses to ensure sensitive data stays under local jurisdiction.

Sector-specific laws and cybersecurity mandates also require local control over data and systems.

In this context, SAP introduced the Sovereign Edition to give customers cloud benefits without violating data residency rules.

This is not just a technical hosting choice; it’s a strategic 3–5 year licensing and financial decision. Opting for RISE with SAP Sovereign Edition means committing to a long-term contract that affects budgets, compliance posture, and operational flexibility.

CIOs and CFOs must evaluate it as a comprehensive package – one that bundles software licenses, infrastructure, and managed services under stricter controls.

The Sovereign Edition differs from the standard RISE primarily in how and where the service is delivered (locally, with enhanced security) and in the contractual terms that ensure local control.

Understanding those differences up front will help you avoid surprises. In short, Sovereign Edition trades some of the cost-efficiency and global support flexibility of standard cloud for the assurance of local data residency and compliance.

As you consider this option, keep in mind why it exists: regulators and government customers have made it clear that cloud providers must bend to sovereignty requirements, not the other way around.

SAP’s Sovereign Edition is its answer. Now, your task as a buyer is to ensure it’s delivered on your terms and at a fair price.

The following guide lays out a negotiation playbook to protect your interests, covering licensing uplifts, contract riders, exit strategies, and more.

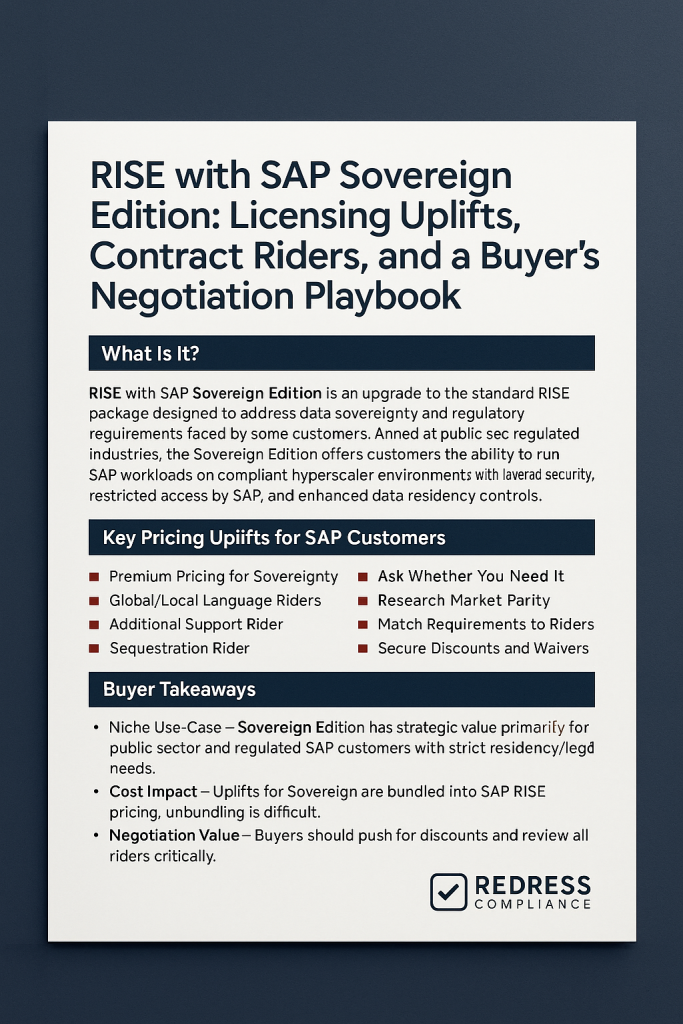

Understanding Sovereign SKUs & Pricing Uplifts

One of the first things to grasp is how sovereign SKUs work and how they’re priced. In SAP’s price list, a “SKU” (stock keeping unit) is essentially a product code for a service. Sovereign SKUs refer to cloud services sold explicitly for sovereign cloud deployment.

They differ from global or standard SKUs by including the additional controls and restrictions required for compliance (for example, limiting data processing to country X only, or using a specific certified data center).

In practice, that means if you choose RISE in a sovereign cloud, SAP will use a different line item in your contract for, say, “S/4HANA Cloud (Sovereign Edition)” instead of the normal one.

These special SKUs come with pricing uplifts – an added percentage on top of the regular RISE subscription fee.

How much more expensive is the Sovereign Edition?

It depends, but typically we see uplifts in the 10–25% range versus the standard RISE pricing for the same scope. In other words, if standard RISE would cost $1M annually, the sovereign version might be $1.1M to $1.25M.

This premium is ostensibly designed to cover items such as restricted data center locations, dedicated support teams, additional encryption and compliance measures, and lower economies of scale.

However, the actual markup varies widely. In some cases, especially for highly sensitive government deployments, the uplift could be significantly higher (there have been niche deals with premiums of 50% or more).

Benchmarking sovereign premiums is thus critical. Try to determine how much of the uplift is true “compliance cost” vs. vendor margin.

For example, suppose SAP is hosting on a local cloud provider that charges them 15% more than a global provider.

In that case, a 15% uplift might be justifiable cost recovery – but anything beyond that could be an

Buyer leverage:

You can negotiate sovereign uplifts. Don’t accept the first quote as a fixed add-on. If SAP proposes a 20% sovereign surcharge, treat it as a negotiable component.

Key levers include:

- Uplift caps: Negotiate a cap so that the sovereignty surcharge cannot exceed a certain percentage throughout the term. This protects you from future cost spikes. For instance, cap the uplift at 15% even if list prices or circumstances change.

- Volume-based discounts: If you’re a large enterprise with significant volume (users or revenue), push for a lower uplift percentage at higher volumes. Perhaps 15% extra for the first 1000 users, dropping to 10% for the next 1000, etc. The more you buy, the less you pay per unit.

- Cross-service offsets: Often, you’ll be purchasing multiple SAP cloud services (ERP, SuccessFactors, Analytics, etc.) in a sovereign model. Ensure you’re not being charged separate uplifts on each as pure additive costs. Negotiate the overall deal so that, for example, if you pay a premium on the core S/4HANA, you get a break on add-on services. Another tactic is bundling global services with sovereign ones – if some SAP services you use remain in standard cloud, leverage that total spend to get a better rate on the sovereign part.

In essence, treat the sovereignty requirement as one element in the deal to manage. While SAP knows you have compliance constraints, remember, they also want marquee customers on this new Sovereign Edition.

Use that to your advantage to limit the premium. Smart procurement teams will acknowledge that sovereign cloud may cost a bit more.

Still, they will diligently identify and eliminate any unjustified surcharges, ensuring the pricing reflects real value, not opportunism.

Also read SAP BTP in Sovereign Cloud: Service Catalog Gaps, Indirect Access Traps, and Architecture Guardrails.

Licensing Conversions & BYOL Scenarios

A major consideration when moving to RISE with SAP (sovereign or not) is what happens to your existing SAP licenses. Many SAP customers have invested in perpetual licenses for SAP ERP and other products for years, paying annual maintenance fees.

RISE is a subscription model – essentially a “new” contract that includes software usage rights. So how do you transition? And can you bring your own licenses (BYOL) to a sovereign cloud environment?

Conversion of perpetual licenses:

Typically, SAP offers programs to convert your on-premise licenses and maintenance into a RISE subscription credit.

Instead of paying full price for RISE while your old licenses sit unused, you negotiate a conversion where the value of your existing licenses is recognized. For example, suppose you have a license for 3,000 users of SAP ECC with an active maintenance contract.

In that case, you might negotiate that the money you’ve already paid (or the maintenance fees you would have paid over the next year or two) is factored in as a discount or credit against the new RISE Sovereign subscription.

This is crucial to avoid “double paying” – one of the worst feelings is to realize you bought software permanently and now you’re renting it anew without compensation. Insist on BYOL credits or conversion credits in your deal.

SAP often has formal conversion offers, especially if you’re migrating to S/4HANA; use them to reduce your cost.

However, note that in a strict RISE with SAP Sovereign Edition scenario, BYOL is usually not allowed in the pure sense.

RISE, by definition, bundles the software license in the subscription – you cannot simply take your old perpetual license and run it on SAP’s cloud. BYOL (bring your own license) typically applies if you self-manage on cloud infrastructure (for example, running SAP on a sovereign AWS/Azure region yourself).

With RISE, you’re buying a new subscription, so any use of existing licenses must be through a negotiated conversion program rather than a literal reuse.

An exception might be if SAP allows a “customer data center” deployment under RISE, where you supply hardware – even then, they usually still convert the license to subscription.

Bottom line: Don’t assume BYOL is automatic. If you have significant investment in SAP licenses, raise this early and push for maintenance fee waivers or credits.

A common approach is to get a first-year discount equal to one year’s maintenance (since you’ll stop paying maintenance once you move to RISE). That way, you’re not paying maintenance and subscription in parallel.

Shelfware cleanup:

Moving to the cloud is an opportunity to shed excess. Most SAP shops have some “shelfware” – unused licenses or overprovisioned users/modules that sit idle.

When converting to RISE Sovereign, conduct an audit of what you truly need going forward. Perhaps you bought licenses for 5000 users, but only 3000 are actively used – then don’t convert all 5000 into the subscription.

Negotiate to eliminate or credit the unused portion.

SAP might let you terminate support on shelfware a bit early without penalty if you’re moving that spend into the new contract. The goal is to right-size your subscription so you pay only for what delivers value.

Mapping on-prem metrics to cloud metrics:

Be prepared for a change in how licensing is counted. SAP RISE utilizes a metric often referred to as Full-Use Equivalents (FUEs) or similar constructs to aggregate consumption. For instance, instead of named user types, you commit to several FUEs, which correspond to different types of users or usage.

One FUE might equal one high-level user or several low-level users. If you were licensed by modules or by CPU on-prem, those now roll into an overarching metric in RISE. Work closely with SAP (and ideally independent experts) to map your current entitlements to the new model.

Ensure that the conversion is fair – e.g., if you had a license for an 8-core HANA database, how does that translate into the memory or capacity included in RISE? If you had 100 Professional user licenses and 300 Limited Professional, how many FUEs is that? Insist on a detailed mapping and consider adding it as an exhibit to the contract for clarity.

Also, clarify the rules during migration. If there’s a transition period where your legacy system and the new cloud run in parallel (which is common for cutover), negotiate a dual-use provision so you’re not penalized.

SAP should allow you to temporarily use both environments (old on-prem and new sovereign cloud) without double licensing, for a reasonable period.

In summary, converting licenses to RISE Sovereign is like a trade-in: get a fair trade-in value, drop the unwanted extras, and make sure the new usage metrics align with your business.

Don’t let the move to cloud wipe out the equity you built in your existing licenses – carry it forward in the form of credits and optimized subscription sizing.

Contract Riders & Legal Controls

When dealing with a Sovereign Edition contract, the paperwork is as critical as the technology.

A standard SAP cloud contract typically includes a master cloud agreement, along with various schedules or annexes. For sovereign cloud, additional terms are included that address data residency and security.

To protect your interests, you’ll want to negotiate specific contract riders and legal controls that ensure SAP delivers on sovereignty promises.

Here are the essential areas to cover:

- Operator residency clauses: It’s not just where your data sits, but who can touch it. Include a clause that any personnel who operate, maintain, or support your systems are resident in your jurisdiction (and ideally, citizens or cleared personnel). For example, suppose you are using a Sovereign Cloud in France. In that case, you may require that all administrators and support engineers accessing your environment are located in France (or at least within the EU, depending on your needs) and not from offshore locations. This prevents scenarios where the data is in-country but someone remotely accesses it from another country to provide support, which could violate security mandates. SAP does have models (like in the EU, “EU Access Only” support) – make sure it’s explicitly written that remote access by non-local staff is prohibited without your approval.

- Data location guarantees: The contract should spell out exactly where all your data and its copies reside. Don’t settle for vague assurances; it should state the primary and backup data centers (e.g., “Primary in Country X, Disaster Recovery in Country X as well” if that’s needed). Crucially, no carve-outs for telemetry, logs, or backups leaving the country. Sometimes, cloud providers might send certain monitoring data or backups to global locations. Your agreement must prohibit any customer data or personal data from being transferred or accessed outside the defined sovereign boundary. Define “customer data” broadly to include things like support dump files, logs, and metadata. And require notification/consent if SAP ever thinks an exception is needed (for example, if a specific expert outside the country needs to assist, you should approve it on a case-by-case basis).

- Encryption and customer-managed keys: One of the strongest ways to enforce sovereignty is via encryption control. Insist on the right to use customer-managed encryption keys (CMK) or “hold your own key” for your data in the cloud. This means that even if data resides in SAP’s data center, you supply the encryption key (via a key management service you control), and SAP cannot decrypt the data without your key. The contract should ensure you have the right to encrypt all sensitive data at rest and that encryption keys remain under your sole control (with no backdoor for SAP or others). If SAP’s standard offering doesn’t easily allow this, push for a commitment that they will support a solution (some SAP services support bring-your-own-key options – get it in writing if you need it).

- Compliance reporting and audit logs: In a regulated environment, you may need proof that SAP is living up to the contract. Include obligations for regular compliance reporting. This could include quarterly attestations that confirm data residency and security measures, reports of any support access (including who accessed your systems, from where, and what was done), and any reported incidents. Essentially, build in a transparency mechanism: SAP should provide you with access logs or summaries so you can demonstrate to your auditors that no unauthorized access or transfer occurred. Also consider a right-to-audit clause for you (or an independent third party) to verify compliance with the sovereign controls. While SAP might not allow routine customer audits of their data centers, you can negotiate for audit rights in specific areas, or at least audit certifications that they must maintain (e.g., they must maintain ISO, government clearance, etc., and provide certificates).

- Tightened SAP audit terms: Separately, think about SAP’s right to audit you for license compliance. In a cloud subscription, direct audits are less frequent, but SAP might still have clauses to ensure you aren’t misusing the service. For a sovereign cloud, ensure any such audits (if they exist) are limited in scope and local in jurisdiction. For example, if SAP wants to verify you’re not exceeding user counts, the process should be defined, and any data shared for audit should remain within sovereign boundaries. Avoid overly broad audit clauses that could let SAP collect or transfer data out under the guise of auditing. In cloud deals, SAP often uses system usage reports instead of on-site audits, but verify this area.

- Data processing and privacy addenda: You will certainly have a Data Processing Agreement (DPA) as part of the contract (critical for GDPR and similar laws). Ensure the DPA accurately reflects the sovereign setup: list the allowed sub-processors and their locations (all should be local or as agreed), and include strong commitments on breach notifications, data access requests handling, and other relevant aspects. If your regulators require additional terms (some public sector entities have specific security requirements or clauses around liability for data breaches), negotiate those into a sovereignty annex or special terms. Don’t assume SAP’s standard documents cover everything – they are a starting point. You may need a custom rider for, say, classified data handling if you’re in the defense sector, or for financial data retention rules in banking.

In summary, get it in writing, and get it specific. Many vendors will verbally assure you of sovereignty measures, but if it’s not contractual, it’s not enforceable.

Every element that can access systems, where data lives, how it’s encrypted, and what happens in an investigation should be clearly defined.

This may result in a thicker contract, but that’s a small price for avoiding a compliance nightmare later. Your legal and security teams should work together here to cover all bases.

Remember, the goal of the Sovereign Edition is to mitigate risk; solid contract controls ensure that the risk remains truly mitigated throughout the relationship.

Commercial Levers: Step-Downs, Ramps & Exit Rights

Beyond pricing and legal terms, negotiating commercial flexibility into your sovereign RISE contract is key to protecting your organization’s long-term interests.

Cloud needs can change over a 3–5 year span, and a sovereign cloud deal can feel especially sticky once signed.

Use the following levers to maintain agility and avoid getting trapped:

- Ramp-up (phased volume) pricing: Don’t pay for your peak capacity on Day 1 if you won’t use it on Day 1. Many RISE deployments, especially in large enterprises or government organizations, will be phased – perhaps starting with a pilot, followed by waves of migration. Negotiate a ramp schedule where your subscription volume (and cost) starts lower and increases as you actually go-live with more users or modules. For example, Year 1 you pay for 1,000 users, Year 2 for 2,000 users, and only by Year 3 you reach the full 3,000 users. This avoids a situation where you’re paying full price while only a portion of your organization is on the new system. SAP often prefers a flat commitment, but you can argue that the practical deployment plan necessitates a ramp. If they resist a pure pay-as-you-go model, at least offer some credits or discounts for the initial period when usage is known to be lower.

- Step-down rights (downsize flexibility): Equally important, build in rights to reduce usage in later years if needed. Business conditions change – divestitures, efficiency gains, or shifting priorities might mean you need fewer users or less capacity. Standard cloud contracts often lock you into a fixed or growing spend, but savvy buyers negotiate a step-down clause allowing, say, up to 10-15% reduction in subscription volume year-over-year. Even if you never use it, having that option can save your bacon if budgets are slashed. It also puts some onus on SAP to keep you satisfied (so you don’t invoke the reduction). Be specific: e.g., “Customer may reduce the number of subscribed FUEs by up to 10% in any renewal term or after year 3 with 60 days’ notice, with pricing adjusted accordingly.” Naturally, SAP will want a commitment, but you can trade this for other concessions (perhaps agree not to reduce in the first 2 years if they give you the right in later years).

- Exit rights for regulatory change: One nightmare scenario is you sign a 5-year deal. Then laws or policies change such that the solution no longer meets requirements (or your agency is mandated to use a different approach). For instance, what if a new law in 2026 disallows any foreign vendor for certain data, or requires an on-site only solution? To avoid being stuck, negotiate a termination for a regulatory cause clause. This would allow you to exit the contract (without hefty penalties) if a defined regulatory or legal change renders the service non-compliant or illegal for you to use. It’s a tough ask – vendors want lock-in – but given sovereign cloud is all about compliance, it’s a fair protection to seek. At minimum, have a conversation: “If external factors beyond our control prohibit us from using the service, we need a clean way to disengage.” Perhaps you won’t get a full termination right, but you might get the right to suspend and renegotiate, or migrate to an alternative SAP offering.

- Data export and deletion assistance: Plan the divorce at the wedding, so to speak. An exit might happen at the end of the contract or earlier – in all cases, ensure there are provisions for data export. Specifically, you will want SAP to provide you with your entire database and documents in a usable format upon departure, without additional charges (or at most, minimal professional service fees). Additionally, include a clause that SAP will delete all your data from their systems and certify its deletion (often called a data deletion attestation) within a certain timeframe after termination. The certification is important for compliance – you may need to prove that data is no longer lingering on some server after you’ve left.

- Off-boarding support: If you have a complex landscape, consider negotiating some off-boarding assistance from SAP or a partner. This might be optimistic, but even a few workshops or technical support hours to help transition to whatever’s next (be it on-premise or another cloud) can be valuable. If SAP is confident you won’t leave, they might not agree, but if leaving is a real possibility, having that safety net is good.

- Leverage sovereign complexity to your favor: Implementing and running a sovereign cloud is complex and relatively new for SAP. This means you have leverage when things don’t go perfectly. For example, if certain services aren’t yet available in the sovereign environment (perhaps some SAP cloud service is not offered in-country initially), use that as a bargaining chip: “Since we can’t get Service X in the sovereign cloud yet, we expect a Y% discount or flexibility to add it later without cost.” Or set service credits for missed commitments (if they fail to meet a certain sovereignty requirement or SLA, you get a credit). Basically, if SAP is asking you to be a pioneer in a new offering, ask for pioneer perks – extra flexibility, better pricing, or easy outs if they can’t fulfill a promise. Get these on paper.

By baking these commercial levers into your contract, you convert a potentially rigid 5-year deal into a more nimble partnership.

The goal is to avoid paying for unused capacity, have options in case things change, and ensure SAP has a vested interest in keeping you compliant and happy. You’ll sleep much better at night knowing you’re not handcuffed to a one-sided deal.

Benchmarking & Discount Strategy

Negotiating any SAP deal comes down to numbers, and a sovereign cloud deal is no different. In fact, because list prices for sovereign offerings are often obscured, custom, benchmarking, and a smart discount strategy are absolutely vital.

Here’s how to approach it:

Understand the baseline and set target discounts:

First, establish what the equivalent standard RISE deal would cost. If you know that, say, globally SAP might price your scenario at $5 million/year before discounts, and you expect an X% sovereign uplift, you have a baseline.

Then look at typical discount ranges. Enterprise deals for SAP cloud can often achieve significant discounts off list (50% or more off list price is not unheard of for large commitments).

However, since the Sovereign Edition is a premium service, SAP might initially offer a smaller discount. Don’t accept that at face value. Realistic discount ranges for sovereign deals might still be, for example, 30-40% off the combined list price (including the uplift) if you’re a sizeable client.

The key is to negotiate the total cost down to a level that aligns with your budget and market norms.

Benchmark against global RISE and peers: If possible, gather insight into other similar organizations’ deals. How much more are others paying for sovereignty?

While exact numbers are confidential, industry analysts or consultants might give ballpark figures (e.g., “Most public sector RISE deals get around 20% off list and then sovereign adds 15% but they negotiated down to 5% net effect”).

Use any available data to sanity-check SAP’s proposal. If SAP claims “no one gets more than 10% off in sovereign cloud,” be skeptical – that’s likely a sales line.

Also, compare to what it would cost to do it yourself: what’s the price of licensing S/4HANA traditionally and running it on a self-managed sovereign cloud (like a local provider or private data center)? If that hypothetical TCO is much lower, you have a strong argument for a better price from SAP.

Leverage enterprise volume and bundling:

SAP loves big strategic deals. If your sovereign cloud move is part of a larger digital transformation, consider bundling negotiations across SAP products. For instance, you might be buying RISE (S/4HANA) plus SuccessFactors, plus Analytics Cloud, all at once.

Rather than negotiate each in isolation, use the total spend as leverage: “We are investing $X million across SAP, we expect an aggressive overall discount.” You can ask SAP for bundle discounts or a larger incentive if you bring more business their way.

Likewise, if you have global operations and only part of it needs sovereign hosting, you might commit the rest to standard RISE or other SAP services – in exchange, you want the sovereign part discounted more.

Consider alternative providers as a BATNA: In negotiation, your BATNA (Best Alternative to a Negotiated Agreement) strengthens your position. Alternatives to RISE Sovereign might include:

- Staying on-premise a bit longer (not ideal, but a fallback).

- Moving to a self-managed sovereign cloud: for example, using a hyperscaler’s government region or a local cloud provider, and having a partner manage SAP there.

- Competing solutions or delaying certain moves.

Even if you prefer the SAP-managed route, make it clear you have options. For instance: “We could deploy on Azure [Government] with our existing licenses if this doesn’t work out.” If SAP believes it’s RISE Sovereign or nothing, you lose power. If they know you have a credible alternative, they will be more flexible on price and terms. In some regions, local cloud providers or government-run data centers might be pushing their own offerings – you can cite those as comparisons (“Provider X offered to host our SAP with full sovereignty at Y cost – can you match that level of cost efficiency, SAP?”).

Timing and fiscal year considerations:

SAP (like most software vendors) has quotas and sales targets, typically set on a quarterly and annual basis. Aligning your negotiation towards the end of the quarter or the fiscal year can improve your discount.

SAP’s fiscal year ends in December, so Q4 is usually a hot time for deals. If your project timeline allows, try to get final offers around late Q3 or Q4 when sales leaders are eager to close.

Additionally, suppose SAP has recently launched the Sovereign Edition in your region. In that case, they might be hungry for a flagship customer reference – that’s the perfect time to press for a better price and extras. Conversely, don’t let them rush you into a suboptimal deal just for timing – use it to your advantage.

Aim for price predictability:

Beyond the initial discount, negotiate caps on increases at renewal. For example, a clause that says the per-unit price won’t increase by more than 3% per year or that the sovereign uplift percentage will not increase at renewal. You don’t want a bait-and-switch where year 1 is fine but year 4 becomes unaffordable.

In essence, treat this like any big IT procurement – gather data, compare options, play vendors (or scenarios) against each other politely, and push SAP to demonstrate the value of their offering in financial terms.

A sovereign cloud might be a premium service, but as the buyer, you have the right (and responsibility) to ensure that the premium is competitive and justified.

With solid benchmarking and negotiation, you can close a deal that satisfies compliance requirements and your CFO’s expectations.

Negotiation Scenarios

To illustrate how negotiation can improve outcomes, here are a few scenarios comparing a baseline proposal versus a better negotiated result:

| Scenario | Baseline Proposal | Negotiated Outcome | Savings | Risk Reduced |

|---|---|---|---|---|

| 3,000 S/4 users in Sovereign RISE | 20% uplift, no reductions allowed | 10% capped uplift, 5% annual step-down flexibility | $2.5M | Flexibility on downsizing usage |

| BYOL conversion for legacy ECC licenses | No credit for perpetual licenses | Maintenance fee credit in Year 1 + removal of shelfware | $1M | Eliminated double-paying for licenses |

| 5-year fixed sovereign RISE term | Locked 5-year term, no exit options | 3+2 year model with mid-term opt-out for regulatory change | 15%* | Avoided lock-in if laws change |

*Savings in the table are illustrative estimates over the contract term (for example, a 15% cost avoidance if the contract could be exited early or re-scoped in year 4–5 in case of regulatory change).

Each scenario illustrates how a challenging initial offer can be enhanced. For instance, capping the uplift and adding step-down rights saved millions and gave the customer room to adjust. Negotiating a BYOL credit turned sunk costs into real value.

And restructuring a rigid term into a more flexible “3+2” arrangement provided an escape hatch that significantly reduced compliance risk (worth far more than just the dollar savings). Use these ideas as inspiration for your own negotiation playbook.

Common Pitfalls to Avoid

Even savvy buyers can stumble during sovereign cloud negotiations.

Watch out for these common pitfalls and actively guard against them:

- Accepting uplift pricing without transparency: Don’t just accept a “sovereign surcharge” line item without a thorough explanation. Blindly paying an extra 20% because it’s sovereign is a mistake. Always dig into why and push back if it seems inflated.

- Assuming BYOL automatically applies: Many think they can simply bring their existing licenses into RISE Sovereign and instantly save money. Not so – without negotiation, you could end up paying for subscriptions while your old licenses go unused. Clarify conversion terms in writing; nothing happens automatically.

- Ignoring exit and renewal mechanics: A huge pitfall is signing a deal without a clear exit strategy or renewal protections, then finding yourself stuck or at SAP’s mercy for renewal pricing. Avoid this by planning exits and renewal caps from the start rather than as an afterthought.

- Overcommitting capacity “to be safe”: It’s easy to over-size the contract (e.g., user counts, storage) to ensure compliance or performance, but that leads to overspend on capacity you don’t use. Right-size the deal based on realistic needs and growth, not fear. You can always scale up if needed, but scaling down is hard unless pre-negotiated.

- Leaving audit scope vague: If your contract doesn’t explicitly detail how audits (license audits or compliance audits) will work, you risk invasive or disruptive scrutiny later. An unclear audit clause can also result in unexpected costs or requirements. Pin down the scope, frequency, and process of any audits in the contract to avoid “gotchas.”

Five Best Practices for RISE Sovereign Negotiations

To wrap up, here are five best-practice tips that every CIO, CFO, or procurement lead should keep in mind when negotiating a RISE with SAP Sovereign Edition deal:

- Unbundle and cap sovereignty premiums: Treat the sovereignty-related costs as their own element. Get SAP to quantify them, then negotiate to cap the uplift or even separate it so you can clearly track it. This prevents stealth increases and ensures you only pay what’s necessary for compliance.

- Convert smartly – shed the dead weight: Use the move to negotiate a fair conversion of existing licenses. Insist on credits for maintenance and don’t carry over idle licenses (“shelfware”). This is a chance to clean house: only subscribe to what you actually need in the new environment.

- Embed sovereignty in the contract, not in promises: Sales presentations and brochures about “secure local cloud” mean nothing if not backed by contractual terms. Bake all sovereignty controls into the contract language. That includes data residency, support access limits, encryption rights, etc. Never rely on verbal assurances or marketing slides – get it in the master agreement or an addendum.

- Build in flexibility (ramps, step-downs, triggers): Structure your commercial terms to expect change. Start with what you need now and ramp up, negotiate the right to reduce if needed, and include exit triggers for things like regulatory upheaval. Flexibility clauses today will save headaches (and money) tomorrow.

- Benchmark and use alternatives as leverage: Do your homework on pricing – know roughly what the “normal” cloud deal looks like and how much extra sovereign typically adds. Compare SAP’s offer to alternatives, whether that’s a different deployment model or another provider. Even if you’re committed to SAP, having a benchmark empowers you to push for a competitive deal. Don’t be shy about mentioning that you have other options – it often encourages SAP to sharpen their pencil.

Following these best practices will help ensure your sovereign cloud journey with SAP starts on a solid, customer-friendly footing. Remember, regardless of how unique your compliance needs may be, you, as the customer, still deserve transparency, fair pricing, and control over your destiny.

FAQs

Finally, here are some frequently asked questions around RISE with SAP Sovereign Edition, with quick answers:

- What’s a typical sovereign uplift? → Generally around 10–25% over standard cloud pricing, but it’s highly negotiable. Very dependent on region and deal size.

- Can I BYOL (bring my own license) into RISE Sovereign? → Usually no. RISE is a subscription bundle, so you can’t just apply your old license. You must convert licenses via negotiation (e.g., get credit for what you own).

- Do I need a 5-year term for Sovereign RISE? → Not necessarily. While SAP may push for 5 years, you can negotiate structures like a 3+2 year (3 firm years + 2 optional) or other flexible term lengths. Shorter initial terms or break options are possible.

- How do I avoid paying twice for shelfware I don’t use? → Audit your licenses before moving. Identify unused licenses and either drop them or get a maintenance fee credit for them in the RISE deal. Don’t carry unnecessary users/modules into the new contract.

- Can SAP audit me in a sovereign cloud environment? → Yes, SAP can still ensure you’re compliant with the subscription terms, but you should tighten the audit clause. Make sure any audit or usage verification stays within the agreed jurisdiction and that SAP can’t access your data beyond what’s needed for compliance checks.

By approaching RISE with SAP Sovereign Edition with a clear strategy, understanding the unique costs, converting your licenses wisely, locking in strong legal protections, and insisting on flexibility, you can achieve the benefits of cloud innovation without compromising on compliance or budget control.

This playbook equips you to be firmly on the buyer’s side, ensuring that SAP’s sovereign cloud works for you, not the other way around. Good luck with your negotiations!

Read about our SAP Advisory Services.