On-Premise SAP License Models for IT Leaders

On-premise SAP licensing is complex and critical for IT leaders to master. SAP offers different on-premise license models – from perpetual licenses with upfront costs to user-based models, each with cost and compliance implications.

Understanding these models, optimizing license types, and negotiating contracts wisely can save millions and reduce audit risks.

On-Premise SAP Licensing

On-Premise vs. Cloud:

In on-premise SAP deployments, the software runs on your servers, and you manage it internally.

Unlike cloud subscriptions (where infrastructure and support are bundled), an on-premise license means you buy the software and run it in-house.

This provides enterprises with full control over systems and data, but also requires a substantial investment in licenses, hardware, and internal support.

IT leaders must carefully choose a licensing model that aligns with their budget, control needs, and long-term strategy.

Core License Components: On-premise SAP licensing typically involves purchasing:

- SAP software licenses: the rights to use SAP ERP or specific modules (e.g., S/4HANA Enterprise Management).

- Named user licenses: licenses for each person accessing the system, categorized by role.

- Engine or package licenses: for certain functionality or add-ons measured by usage (like number of orders or revenue).

- Database licenses: if using SAP’s databases (e.g., SAP HANA) or others on-premise.

Each component adds to the overall cost. Licenses are complex – SAP’s price list contains dozens of user types and 100+ metrics. Selecting the right combination is key to cost-effectiveness.

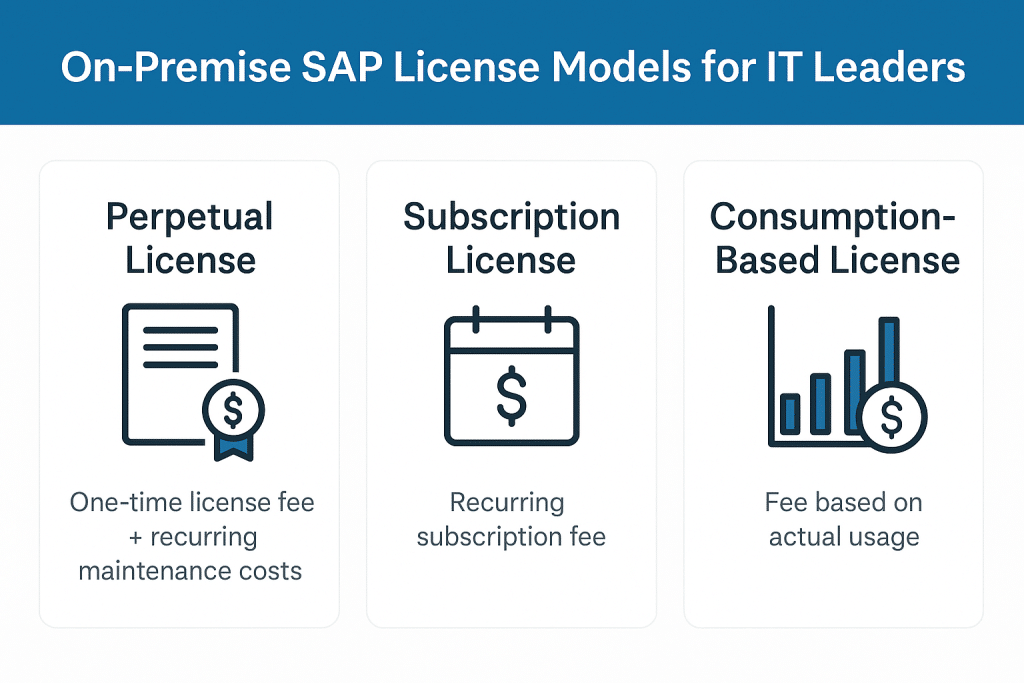

Perpetual vs. Subscription License Models

On-premise SAP software can be licensed in two main commercial models: perpetual and subscription.

Most on-premises customers use the perpetual model, but SAP has offered subscription options for on-premises solutions in some cases (though subscriptions are more common in cloud deals).

The table below compares the two:

| Aspect | Perpetual License (On-Premise) | Subscription License (On-Premise) |

|---|---|---|

| Upfront Cost | High one-time purchase of licenses | Low upfront – pay periodically (annual or monthly fee) |

| Ownership | You own the software license indefinitely | Right to use is temporary (only valid while paying) |

| Maintenance & Support | Annual maintenance ~15–22% of license cost for support/upgrades | Often included in subscription fee (or smaller separate fee) |

| Flexibility | Fixed asset – scaling down doesn’t reduce cost | More flexibility – can adjust user counts or modules with renewals |

| Long-Term Cost | Cheaper over many years if usage is stable | Potentially higher if used long-term (recurring fees accumulate) |

| Budget Impact | Large CAPEX investment, then yearly OPEX for maintenance | OPEX model – spread out as regular operating expense |

Perpetual Licensing:

You pay a one-time, significant fee to purchase the software. For example, an enterprise might pay $1 million upfront for SAP ERP licenses to cover their users and modules. This allows indefinite use. However, each year they pay maintenance (typically 20% of the license price, so $ 200,000 per year on a $1 million license) for support and updates.

The benefit is ownership – the company can use the software as long as needed without repaying license fees, making it cost-effective if SAP is a decades-long platform. The drawback is the high initial cost and commitment to ongoing maintenance fees.

Subscription Licensing:

Instead of a big upfront payment, you pay annual or monthly subscription fees to use SAP on-premise. This is essentially “leasing” the software.

Upfront costs are significantly lower (just the first period’s fee), which can be particularly beneficial for mid-size firms or those with tight capital budgets. Subscriptions also allow easier adjustment – you might increase or reduce users at renewal.

The downside is a higher total cost over time if you use SAP for an extended period.

Over 5-7 years, subscriptions often end up costing more than a one-time perpetual purchase. Additionally, if you stop paying, you will lose the rights to use the software (whereas perpetual licenses are one-time purchases).

Real-World Example:

A mid-sized company could opt for a subscription model, which would cost $200 per user per month, totaling approximately $240,000 per year, rather than paying $600,000 upfront plus $120,000 in annual maintenance for a perpetual license.

The subscription eases short-term budget strain but would exceed the perpetual cost if the system is used for more than a few years. IT leaders should model the 5-10 year TCO (total cost of ownership) of each model.

SAP Named User License Types and Costs

SAP on-premise licenses are heavily user-based. Every individual accessing SAP requires a named user license, which comes in various categories with different levels of access and associated costs.

Common SAP named user types (and approximate costs) include:

| User License Type | Typical List Price (USD) | Access Level |

|---|---|---|

| Professional User | ~$3,000 per user (perpetual license)** | Full access to all SAP modules and functionality (for power users, SAP experts). |

| Limited/Functional User | ~$1,500 per user (perpetual)** | Limited access to specific modules or roles (for example, a user restricted to HR or sales tasks). |

| Employee Self-Service (ESS) | ~$100 per user (perpetual)** | Very restricted self-service access (e.g. employees entering timesheets, expenses, or viewing their HR info). |

Note: List prices are one-time per-user costs for perpetual licensing. Annual maintenance (15–22%) is an additional cost. Actual prices vary, and large enterprises negotiate significant discounts off the list.

Professional Users are the most expensive and have unrestricted use, typical for SAP administrators, developers, or key functional experts who use many parts of the system. Limited Professional (Functional) Users have a narrower scope (for instance, only using the finance module or HR self-service).

They cost roughly half of a Professional license. ESS Users (or similar employee licenses) are for casual use by a broad base of employees (like submitting leave requests or viewing pay stubs); these are very cheap (a few hundred dollars or less) because they only perform self-service tasks.

SAP historically offered dozens of user categories – including legacy types like “Worker” or industry-specific roles – but the trend is consolidating toward simpler tiers in S/4HANA.

IT leaders should right-size user licenses to actual needs. For example, not every user should be classified as a Professional if they only perform limited tasks.

A common optimization is to review all named users: many companies find that 20-30% of users assigned Professional licenses could be downgraded to a cheaper license type. This can result in significant cost savings in both license fees and annual maintenance.

Be mindful of any contract rules (older SAP agreements sometimes required a certain ratio of Professional to Limited users), but SAP is moving away from rigid ratios.

Negotiating the freedom to allocate user types based on usage (without artificial limits) is a best practice.

Package and Engine Licensing (Modular Add-Ons)

In addition to named users, SAP on-premise licensing includes package or engine licenses for specific software components.

These are licenses for distinct SAP modules or technical components, priced by metrics other than the number of users.

Key points:

- Module Packages: If you deploy a particular SAP module or industry solution (e.g., SAP Advanced Planning, SAP Payroll, or an industry-specific add-on), SAP often charges based on a business metric. Examples of metrics include the number of employees (for an HR or payroll module), annual sales revenue (for a CRM or sales module), the number of orders processed (for supply chain or e-commerce components), or database size and transactions. The metric acts as the usage measure for licensing that package. For instance, SAP Payroll might be licensed for a specific number of employees paid; if you grow beyond that, you need to true-up the license. These metrics require forecasting – an inaccurate metric (too low) can lead to compliance issues, while an overly high one can result in overpaying. Always align package metrics with realistic growth projections and include a buffer where needed.

- SAP HANA and Databases: On-premise SAP S/4HANA implementations require the SAP HANA database. SAP offers a HANA Runtime License (a discounted DB license only for use with SAP applications), typically priced by memory size or a percentage of your application value. For example, a company might license 256 GB of HANA memory to support their SAP system; if more memory is needed later, additional licenses must be purchased. Alternatively, a full-use HANA license (allowing non-SAP use) costs more. If you use a different database (such as Oracle or IBM DB2) with SAP, those licenses are purchased from the respective vendor rather than SAP. In either case, database licensing is a significant cost component of on-prem SAP. Plan capacity carefully to avoid surprises – e.g., if you double your data volume, ensure your licenses (SAP or third-party) cover the new usage.

- Engine Licenses: Some technical components (like SAP NetWeaver engines or integrations) might be licensed by metrics such as the number of cores, processor power, or users. For instance, an SAP enterprise portal or a SAP solution manager could require separate licensing. SAP’s price list contains over 100 different engine metrics, which can be overwhelming. Key advice is to focus on the big-ticket items – identify which engines or modules your implementation truly needs and understand their metric definitions. Clarify metrics in the contract (what exactly counts as a “order” or “employee” for licensing purposes) to avoid ambiguity later.

Real-World Example: A manufacturing company might license SAP Extended Warehouse Management as an add-on, priced by “number of warehouse workers” or “number of distribution centers.” If they have three warehouses and 200 workers, the license might be, say, $50,000 per warehouse plus $500 per worker, totaling $ 100,000.

As operations grow to 5 warehouses and 300 workers, costs would increase proportionally.

Being aware of these metric-based costs helps IT leaders factor them into project ROI and negotiate volume breaks (e.g., tiered pricing if warehouses increase).

Compliance and Indirect Access Challenges

SAP’s on-premise licenses come with strict compliance obligations, and indirect access is a notorious area of risk.

IT leaders must manage these to avoid surprise bills or audit penalties.

License Audits: SAP regularly audits its customers (often annually or biannually) through measurement programs, such as the SAP License Administration Workbench (LAW).

They check the number of users in the system and the activities they perform, comparing them against your entitlements.

If you’ve exceeded user counts or if users have access higher than their license type allows, SAP may demand reimbursement of fees and penalties. To prepare, maintain diligent records of user assignments, and regularly run internal measurements.

Clean up inactive accounts and ensure each user has the appropriate license type assigned in SAP’s system; otherwise, SAP’s default might incorrectly classify some as expensive Professional users.

Proactively review contracts for any unclear terms and consider using software asset management tools to continuously track SAP usage.

Indirect Access:

Indirect access refers to using SAP data without a named user directly logging in, typically through third-party applications or interfaces.

For example, if a sales portal or mobile app pulls data from your SAP ERP in the background, or if employees input data through a non-SAP system that then updates SAP, these interactions may not be covered by standard named user licenses.

In the past, SAP famously charged customers hefty fees for such indirect use.

This is a major compliance risk: companies have been caught off guard by license liability for e-commerce sites or reporting tools accessing SAP in the backend.

- Example: A company had a customer web portal that queried SAP inventory data. SAP deemed each portal user as requiring an SAP license due to indirect access, resulting in a multi-million dollar compliance claim.

Digital Access License:

In response to the confusion, SAP introduced a Digital Access model.

Instead of licensing each indirect user, Digital Access charges for the documents created in SAP by external systems (e.g., an order created via a non-SAP storefront).

This model defines specific document types (sales orders, invoices, etc.) and charges per document volume packs. Companies can opt into Digital Access as an alternative method for licensing indirect usage.

There was even a time-bound Digital Access Adoption Program (DAAP) offering discounts to encourage switching. If your SAP landscape has numerous interfaces, evaluate whether Digital Access licensing would simplify compliance compared to the traditional named-user approach for indirect use.

Managing Indirect Use:

The best practice is to identify all third-party systems that connect to SAP.

Ensure that either an appropriate license covers the external users or that you have a Digital Access agreement in place covering the documents exchanged.

Negotiate clarity in your contract about specific scenarios. SAP’s indirect access policy has evolved, but do not assume it’s free – always discuss potential indirect usage with SAP during contract negotiations to avoid later surprises.

Optimizing Costs and Contract Negotiation

SAP licensing is renowned for being expensive, but savvy negotiation and proactive management can help mitigate costs.

As an SAP licensing and contract negotiation expert, here are strategies for IT leaders:

- Rightsize Your License Mix: Before negotiating or renewing, conduct a thorough internal audit of usage (as noted earlier). Identify how many users truly need full Professional access versus cheaper license types. It’s common to find a significant portion of users over-licensed. For instance, if 500 Professional licenses are assigned but only 300 users require that level, you have the leverage to reduce the other 200 to lower tiers. Quantify these findings – e.g., “Downgrading 200 users to Limited saves $300k in license fees plus $60k/year maintenance.” This data is powerful in negotiations.

- Negotiate Volume Discounts: SAP license list prices are high; however, large enterprises typically pay less than the list price. Everything is negotiable. Aim for substantial discounts, especially if purchasing in bulk or making a significant new investment (like a S/4HANA migration). Discounts of 30-50% off list price for large deals are not uncommon. If you’re committing to a significant expenditure or a multi-year agreement, negotiate for aggressive price breaks. Benchmark against peers or use third-party advisors to gauge a reasonable discount. Also, consider negotiating price protections (cap on future price increases) if you plan phased user growth over the years.

- Bundling and Incentives: SAP often has sales incentives at quarter-end or fiscal year-end. Timing your deal in sync with SAP’s sales cycles can yield extra discounts or freebies. Bundling additional products or cloud services can sometimes unlock better terms (e.g., SAP may offer a better deal if you include some SAP cloud licenses or sign up for RISE with SAP in the future). However, be cautious with bundles – only include things you genuinely plan to use, otherwise you’re buying shelfware.

- Contract Flexibility: A good contract is not just about price, but also terms that give you flexibility. Negotiate clauses to swap or reallocate licenses as needs change. For example, ensure you can convert some Professional user licenses to two Limited user licenses later if your workforce mix changes, without new fees. Try to eliminate any rigid user tier ratios or restrictions. If you’re still using older SAP products and planning a move to S/4HANA, consider including conversion credits to ensure your existing investment carries forward. Large enterprises may negotiate an Enterprise License Agreement or a tailored license pool that allows for internal cross-charging or flexible deployment across subsidiaries – explore these options if your SAP footprint is extensive.

- Plan for Shelfware and Growth: Don’t buy more licenses than you need. SAP sales reps may push “banking” extra users for future growth, but excess licenses will incur maintenance yearly while possibly never being used (shelfware). It’s often better to buy what you need now (with a small buffer) and include an agreed discount rate for future purchases. Conversely, if you expect significant growth or a merger, negotiate upfront to secure pricing for additional licenses and avoid paying a premium later. Regularly revisit license allocations; SAP environments are dynamic as employees join/leave or business processes change.

- Leverage Competition Carefully: While SAP is likely a long-term commitment once implemented, leverage any alternative (like considering third-party support providers for maintenance, or even the possibility of switching certain modules to other software) as a bargaining chip. SAP values customer retention – if they sense a risk, you might reduce footprint or delay S/4HANA adoption, and they may come back with better offers.

By combining these strategies, enterprises have saved 15-30% on SAP licensing costs.

Always approach SAP negotiations armed with data (usage analysis, benchmarks) and a clear must-have list of terms. It’s a partnership, but a well-managed one should align licensing costs to the actual business value received.

Read Hybrid Licensing Models.

Recommendations

- Audit Your SAP Usage Annually: Regularly review how each license is used. Identify inactive users and mismatched license types to optimize your license allocation before SAP audits do.

- Right-Size License Types: Match users to the correct license tier (Professional, Limited, or ESS). Downgrade where appropriate to avoid paying for needless functionality. Document any changes to stay compliant.

- Negotiate Before Renewal: Never auto-renew SAP agreements without negotiation. Use the upcoming contract renewal or expansion as a leverage point to secure discounts, better terms, or product credits.

- Leverage SAP’s Timing: Engage SAP at quarter-end or fiscal year-end when they are more likely to offer discounts to close deals. Consider multi-year commitments only if the pricing and terms provide clear savings or flexibility.

- Clarify Indirect Access in Contracts: Proactively address indirect usage. If using non-SAP front-ends or integrations, ensure your contract has clear terms (or use Digital Access licenses) to cover this and avoid unexpected fees later.

- Include Future-Proof Clauses: If you plan to migrate to S/4HANA or SAP cloud offerings later, consider negotiating conversion credits or locking in pricing now. Ensure you can adapt your license mix (swap license types or relocate licenses globally) as your business evolves.

- Monitor and Govern Continuously: Treat SAP license management as an ongoing process. Assign a team or owner to track license consumption, stay updated on SAP policy changes, and optimize the contract over time. Small adjustments every year can prevent expensive true-ups or compliance issues.

- Consider Expert Help: SAP licensing is a complex matter. Don’t hesitate to use third-party licensing advisors or tools to analyze your usage and contracts. Their insights on benchmarking and audit defense can pay for themselves via the savings uncovered.

Read SAP Digital Access Licensing.

FAQ

Q1: What are the main types of on-premise SAP license models?

A: The two primary on-premise licensing models are perpetual licenses (a one-time purchase to use the software indefinitely, with annual maintenance fees) and subscription licenses (pay-as-you-go, where you pay yearly or monthly for the right to use the software). Within those, SAP licenses are also based on named users and package metrics, meaning you purchase licenses per user and may also require additional licenses for specific modules or hardware metrics. Most enterprises use a combination, such as a perpetual license for the core ERP and named user licenses for each employee.

Q2: What is the difference between a Professional User and a Limited User in SAP licensing?

A: A Professional User license is the most comprehensive (and expensive) SAP user license. It grants full access to all or most SAP modules and capabilities, intended for power users, system administrators, or anyone who requires broad functionality. A Limited Professional (Functional) User license costs roughly half as much and limits the user to certain modules or tasks. For example, someone in HR who only uses HR and payroll transactions might only need a Limited User license, not access to the entire system. Using the correct license type for each person is crucial – it ensures you’re not overpaying (by giving a user a costly Professional license when they only needed limited access) and also not under-licensing (each user must have a license covering all the activities they perform).

Q3: How much do SAP on-premise licenses cost per user?

A: Ballpark figures (list prices) for perpetual SAP named users are about $3,000 for a Professional User, $1,500 for a Limited/Functional User, and under $100 for an Employee Self-Service user. These are one-time costs per user license; in addition, an annual maintenance fee of ~20% is paid for support. However, real prices vary widely – SAP offers discounts, and large enterprises often pay significantly less per user after negotiations (sometimes 30-50% off the list price). Subscription pricing would break these costs into annual or monthly fees (for example, a Professional user might be roughly $100–$200 per month on a subscription plan). Always engage with SAP or a reseller for a quote specific to your scenario, and use these figures only as a starting reference.

Q4: What is SAP “Indirect Access” and why is it important?

A: Indirect access refers to scenarios where people or systems use SAP’s data without directly logging into the SAP system. For example, if a sales order is created in SAP through an integration from a non-SAP web portal, or if a third-party reporting tool retrieves data from SAP, that’s indirect usage. Historically, SAP required a license for such usage (either for the external users or by charging for the interface activity). This is important because you could be compliant with direct users but still owe fees for indirect ones. It’s a common pitfall discovered during audits. SAP introduced a Digital Access licensing option that charges for documents (e.g., number of orders) created indirectly. It’s critical to identify all external touchpoints to your SAP system and ensure you’re licensed appropriately, either via named user licenses or a digital access agreement, to avoid surprise liabilities.

Q5: How does SAP license auditing work, and how can we prepare?

A: SAP typically requires customers to perform an annual measurement (using SAP’s audit programs) and reserves the right to audit formally. During an audit, SAP will look at your user list, license assignments, and usage of package metrics. They compare actual usage to what you’ve purchased. If you have more users or have used more of a metric than licensed, they will ask you to purchase the difference (often at list price, possibly with back-maintenance, which can be costly). To prepare: keep your user list clean (remove ex-employees, consolidate duplicate user IDs), assign the correct license types to each user (SAP’s tools default any unclassified user to Professional, which can inflate compliance gaps), and monitor your engine metrics (e.g., if your contract says up to X employees or Y transactions, track those and be aware of growth). It’s wise to do an internal “self-audit” before SAP’s audit, sometimes with the help of license management tools or consultants, so you can address issues or at least know your exposure. If an audit finds issues, negotiate a resolution – SAP might allow remediation or offer an expanded agreement instead of a straight penalty buy if approached proactively.

Q6: Can we negotiate the pricing and terms of the SAP license?

A: Yes. SAP licensing isn’t take-it-or-leave-it – there’s substantial room to negotiate, especially for large enterprises or significant deals. Pricing: Always negotiate the price. SAP list prices are high, but discounts of 30% or more are common. Use competitive bidding (if working through resellers) or benchmark data to justify a lower price. Terms: You can also negotiate contractual terms: for example, the ability to swap license types (trade some Professional licenses for Limited later), or to phase purchases over time at locked-in discounts. Multi-year commitments or purchasing additional SAP products (like cloud services) can be leveraged for better terms across the board. The key is to enter negotiations with a clear understanding of what you need and data to back up your requests. Don’t be afraid to push for clauses that protect you, such as price caps on future increases, audit resolution procedures, or flexibility to adjust licenses as your business changes.

Q7: What happens to our on-premise licenses if we migrate to S/4HANA or SAP Cloud?

A: If you’re moving from an older SAP ERP (like ECC 6.0) to SAP S/4HANA on-premise, SAP offers conversion programs. Typically, your existing user licenses can be converted to equivalent S/4HANA licenses by exchanging your license credits or dollar value. You’ll need to purchase S/4HANA product licenses (e.g., S/4HANA Enterprise Management), but SAP often provides credit for the legacy licenses you already paid for. It’s essential to negotiate that conversion to avoid paying twice for similar functionality. When moving to SAP Cloud (RISE with SAP or SaaS products), the model changes to a subscription, and infrastructure is included. In those cases, your on-premise perpetual licenses might be put into “shelf” status or terminated in favor of the new subscription. Sometimes SAP will incentivize a move to the cloud by offering a discount or transfer program (e.g., crediting unused maintenance fees towards the cloud subscription). Always evaluate the financial trade-offs: on-prem licenses you own can be used as long as needed (with maintenance), while cloud is a new recurring cost. Ensure you get fair credit for past investments when transitioning. This should be a key part of any migration discussion with SAP – they have programs in place to prevent customers from feeling penalized for switching models.

Q8: How can we avoid paying for unused SAP licenses (“shelfware”)?

A: Unused SAP licenses – often referred to as “shelfware” – typically result from overestimating needs or changes in business that leave licenses idle. To avoid this, adopt a proactive license management practice:

- Start small and scale: Instead of buying 1000 users because you might need them in 3 years, buy 700 now and include a clause to buy an additional 300 at the same discount when needed. This way, you’re not paying maintenance on 300 extra licenses sitting unused.

- Regular true-ups: Internally reallocate licenses. If one division isn’t using all its licenses, you can assign them to another rather than buying more. Some organizations maintain a central license pool to redistribute as needed.

- Contractual protections: Negotiate the right to return or exchange a portion of the licenses. While SAP typically doesn’t refund, in large agreements, you might negotiate the ability to swap some unused licenses for other products or services of equivalent value.

- Monitor usage: Use SAP’s tools or third-party solutions to track login frequency and module use per user. If certain licenses (like engines) are well below capacity, consider scaling down at renewal (if your contract structure allows it). The goal is to continually align what you pay for with what you use. This requires ongoing attention, but can save significant costs in maintenance fees on shelfware.

Q9: Are there alternatives to SAP’s named user licensing?

A: SAP’s standard for on-premise licensing is named user licenses – every person needs their license. Unlike some software, SAP does not offer concurrent user licenses for its main ERP (you cannot just buy 50 concurrent-use licenses for 100 possible users; you must license all 100 named individuals who may access the system). There are a few alternatives in specific scenarios: for example, if you have a large number of occasional users, SAP has offered solutions like SAP Professional Worker or Industry user licenses that might cover shop floor workers more economically, or enterprise metric licensing where a metric like revenue or employees licenses the entire system (this is less common and usually part of a custom agreement). Additionally, for external or indirect users, the Digital Access document-based model serves as an alternative to named users. But for internal users, the named user model is the norm. Enterprises typically negotiate within that framework by optimizing user types and counts, rather than avoiding it entirely.

Q10: What should we consider when budgeting for an on-premise SAP implementation?

A: When budgeting for on-premise SAP, include several elements:

- Software licenses: This includes the core SAP product (e.g., S/4HANA), named user licenses, and any required module or engine licenses. Obtain a detailed quote that covers all components.

- Annual maintenance: Remember that each year you’ll pay ~20% of the license fees for support. This is essentially a mandatory cost to get updates and support from SAP.

- Hardware and infrastructure: As an on-prem deployment, you need to invest in servers, storage, network equipment, backup systems, and possibly disaster recovery setups. This can sometimes rival the software cost, depending on scale.

- Implementation and consulting: SAP projects require configuration, customization, and integration work by experts (internal or external). It’s common for implementation services to cost 1-2x the software license cost (or more for complex projects). Include partner or consultant fees, training for your team, and data migration costs.

- Internal support staff: After implementation, you may require additional IT staff or SAP BASIS administrators to manage the system. Their salaries should be factored into the TCO.

- Contingency: It’s wise to set aside a budget for contingencies, such as additional licenses if the scope increases, or unexpected needs (e.g., an extra test system, or specialist consulting if issues arise).

By accounting for all these areas, you’ll have a realistic view of the total cost of owning an on-premise SAP system. It helps prevent unpleasant surprises and ensures the project’s ROI is evaluated against the full investment, not just the initial license fee.

Read more about our SAP Licensing Services.